Question

Mr de Minaur is the sole owner of Roger & Rafa, a retail store that sells tennis equipment. Roger & Rafa is currently hiring for

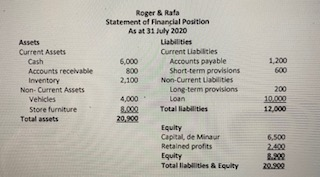

Mr de Minaur is the sole owner of Roger & Rafa, a retail store that sells tennis equipment. Roger & Rafa is currently hiring for a part-time bookkeeping position. You applied for the job and were interviewed by Mr de Minaur on 16 August 2020. On this occasion, you were asked to prepare the accounting record for business events that took place in the month at Roger & Raga as a competency test. You received the following information: Business Events in August

1 August Paid $3,600 rent for the shopfront, covering a four-week period from 2 August to 29 August.

2 August A corporate customer, Novak Inc., placed an order for tennis equipment to be delivered to a local tennis club in 10 days. The equipment is sold at $1,800 and was out of stock at the time of the order. Novak Inc. paid $400 as a deposit for the order.

3 August Purchased tennis equipment for $1,600. Paid $600 in cash. The remaining amount was payable in 30 days. 6 August Roger & Rafa purchased store furniture for $150 in cash. 8 August Paid $1,200 for credit purchases, included in the payment was the full amount owing in relation to the purchase on 3 August.

9 August Made $220 credit sales of tennis equipment (cost: $160).

12 August Repaid $2,500 loan.

13 August Completed Novak Inc.s order on 2 August (sold at $1,800) by delivering all tennis equipment purchased on 3 August (cost: $1,600) to the local tennis club. No payment was received upon delivery (Hint: note the advanced payment $400 on 2 August).

15 August Recognised two weeks rental use of the shopfront. Paid an electricity bill of $200.

16 August Mr de Minaur gave his van to the business. The van had a market value of $8,000 at the time of the event.

REQUIRED: Record the business eventsin August (up until 16 August) in the Assignment Answer Worksheet to show how each event affects the accounts shown in the worksheet. (Note: ignore depreciation)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started