Answered step by step

Verified Expert Solution

Question

1 Approved Answer

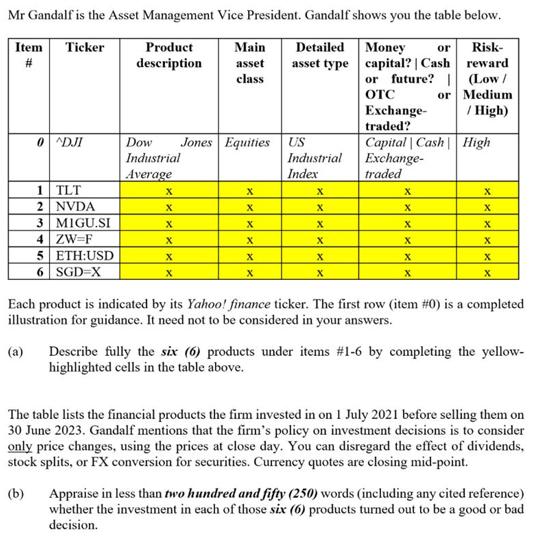

Mr Gandalf is the Asset Management Vice President. Gandalf shows you the table below. Product Main Detailed description asset asset type class Item Ticker

Mr Gandalf is the Asset Management Vice President. Gandalf shows you the table below. Product Main Detailed description asset asset type class Item Ticker # 0 ^DJI 1 TLT 2 NVDA 3 MIGU.SI 4 ZW=F 5 ETH:USD 6 SGD=X Dow Jones Equities Industrial Average X X X X X X X X X X X X US Industrial Index X X X X X X Money or capital? | Cash or future? OTC Exchange- traded? Capital Cash High Exchange- traded X X X X X Risk- reward (Low/ or Medium / High) X X X X X X X Each product is indicated by its Yahoo! finance ticker. The first row (item #0) is a completed illustration for guidance. It need not to be considered in your answers. Describe fully the six (6) products under items #1-6 by completing the yellow- highlighted cells in the table above. The table lists the financial products the firm invested in on 1 July 2021 before selling them on 30 June 2023. Gandalf mentions that the firm's policy on investment decisions is to consider only price changes, using the prices at close day. You can disregard the effect of dividends, stock splits, or FX conversion for securities. Currency quotes are closing mid-point. (b) Appraise in less than two hundred and fifty (250) words (including any cited reference) whether the investment in each of those six (6) products turned out to be a good or bad decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To complete the description of the six products under items 16 we can use the information provided 1 TLT iShares 20 Year Treasury Bond ETF Main Asse...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started