Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Hassan Baraka retired from employment on 1 October 2005 and was paid terminal benefits of Sh. 3,000,000 He utilized Sh. 2,500,000 in purchasing

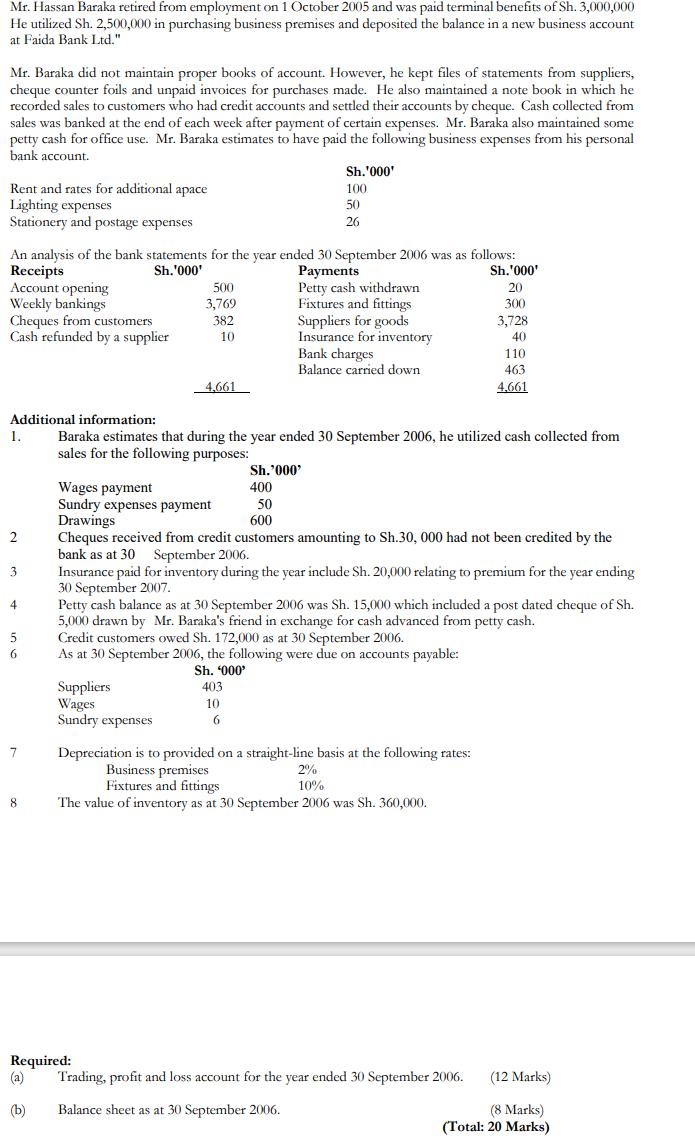

Mr. Hassan Baraka retired from employment on 1 October 2005 and was paid terminal benefits of Sh. 3,000,000 He utilized Sh. 2,500,000 in purchasing business premises and deposited the balance in a new business account at Faida Bank Ltd." Mr. Baraka did not maintain proper books of account. However, he kept files of statements from suppliers, cheque counter foils and unpaid invoices for purchases made. He also maintained a note book in which he recorded sales to customers who had credit accounts and settled their accounts by cheque. Cash collected from sales was banked at the end of each week after payment of certain expenses. Mr. Baraka also maintained some petty cash for office use. Mr. Baraka estimates to have paid the following business expenses from his personal bank account. Rent and rates for additional apace Lighting expenses Stationery and postage expenses An analysis of the bank statements for the year ended 30 September 2006 was as follows: Sh.'000' Payments Receipts Account opening Weekly bankings Cheques from customers Cash refunded by a supplier 2 3 4 5 6 7 8 Additional information: 1. Baraka estimates that during the year ended 30 September 2006, he utilized cash collected from sales for the following purposes: 500 3,769 382 10 4,661 Suppliers Wages Sundry expenses Sh.'000' 100. 50 26 Required: (a) (b) Petty cash withdrawn Fixtures and fittings Suppliers for goods Insurance for inventory Bank charges Balance carried down 6 Sh.'000' Wages payment 400 50 Sundry expenses payment Drawings 600 Cheques received from credit customers amounting to Sh.30, 000 had not been credited by the bank as at 30 September 2006. Insurance paid for inventory during the year include Sh. 20,000 relating to premium for the year ending 30 September 2007. Petty cash balance as at 30 September 2006 was Sh. 15,000 which included a post dated cheque of Sh. 5,000 drawn by Mr. Baraka's friend in exchange for cash advanced from petty cash. Credit customers owed Sh. 172,000 as at 30 September 2006. As at 30 September 2006, the following were due on accounts payable: Sh. '000' 403 10 Sh.'000' 20 300 3,728 40 Depreciation is to provided on a straight-line basis at the following rates: 2% Business premises Fixtures and fittings 10% The value of inventory as at 30 September 2006 was Sh. 360,000. 110 463 4,661 Trading, profit and loss account for the year ended 30 September 2006. Balance sheet as at 30 September 2006. (12 Marks) (8 Marks) (Total: 20 Marks)

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started