Answered step by step

Verified Expert Solution

Question

1 Approved Answer

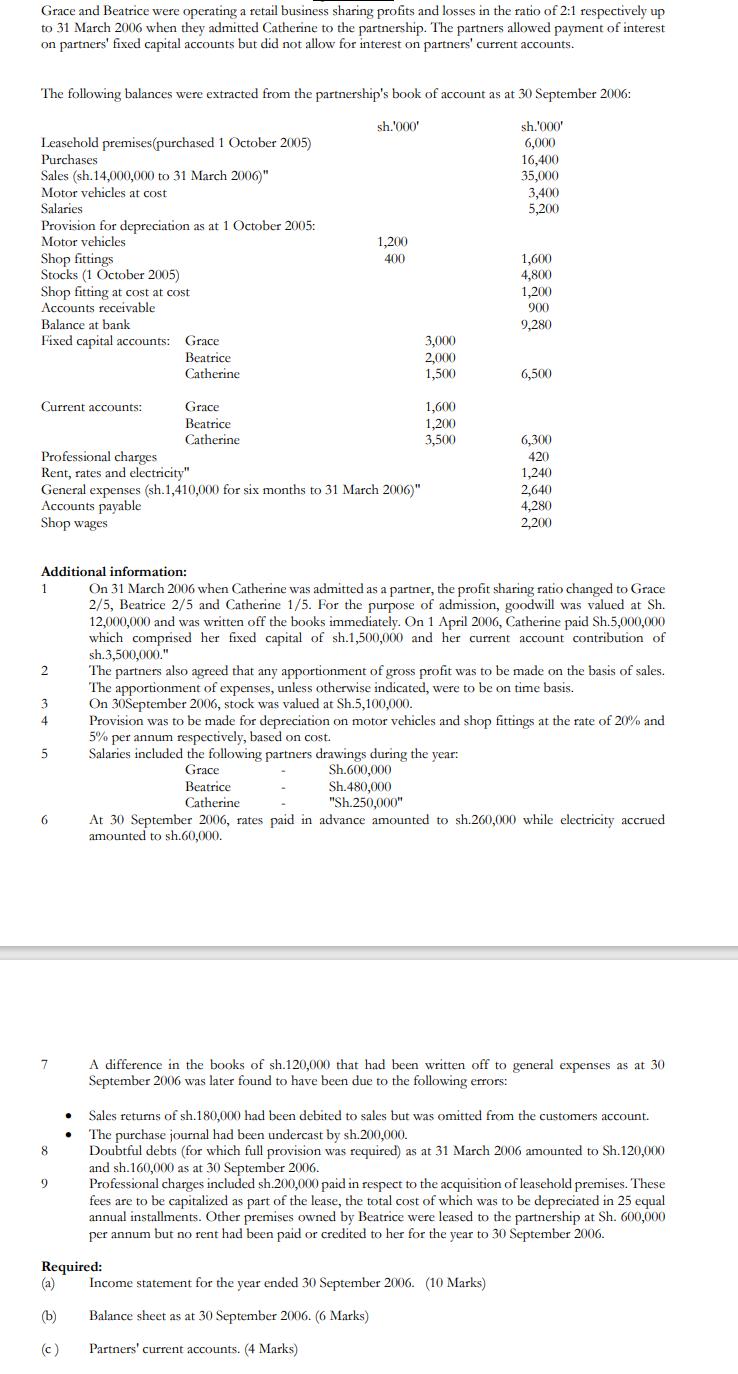

Grace and Beatrice were operating a retail business sharing profits and losses in the ratio of 2:1 respectively up to 31 March 2006 when

Grace and Beatrice were operating a retail business sharing profits and losses in the ratio of 2:1 respectively up to 31 March 2006 when they admitted Catherine to the partnership. The partners allowed payment of interest on partners' fixed capital accounts but did not allow for interest on partners' current accounts. The following balances were extracted from the partnership's book of account as at 30 September 2006: Leasehold premises (purchased 1 October 2005) Purchases Sales (sh.14,000,000 to 31 March 2006)" Motor vehicles at cost Salaries Provision for depreciation as at 1 October 2005: Motor vehicles Shop fittings Stocks (1 October 2005) Shop fitting at cost at cost Accounts receivable Balance at bank Fixed capital accounts: Current accounts: Professional charges Rent, rates and electricity". 1 2 General expenses (sh.1,410,000 for six months to 31 March 2006)" Accounts payable Shop wages 3 4 5 6 7 8 9 Grace Beatrice Catherine Grace Beatrice. Catherine . (b) (c) sh.'000' 1,200 400 Additional information: On 31 March 2006 when Catherine was admitted as a partner, the profit sharing ratio changed to Grace 2/5, Beatrice 2/5 and Catherine 1/5. For the purpose of admission, goodwill was valued at Sh. 12,000,000 and was written off the books immediately. On 1 April 2006, Catherine paid Sh.5,000,000 which comprised her fixed capital of sh.1,500,000 and her current account contribution of sh.3,500,000." Required: (a) 3,000 2,000 1,500 1,600 1,200 3,500 Sh.600,000 Sh.480,000 "Sh.250,000" sh.'000' 6,000 16,400 35,000 3,400 5,200 1,600 4,800 1,200 900 9,280 6,500 Income statement for the year ended 30 September 2006. (10 Marks) Balance sheet as at 30 September 2006. (6 Marks) Partners' current accounts. (4 Marks) 6,300 420 1,240 The partners also agreed that any apportionment of gross profit was to be made on the basis of sales. The apportionment of expenses, unless otherwise indicated, were to be on time basis. On 30September 2006, stock was valued at Sh.5,100,000. 2,640 4,280 2,200 Provision was to be made for depreciation on motor vehicles and shop fittings at the rate of 20% and 5% per annum respectively, based on cost. Salaries included the following partners drawings during the year: Grace Beatrice Catherine At 30 September 2006, rates paid in advance amounted to sh.260,000 while electricity accrued amounted to sh.60,000. A difference in the books of sh.120,000 that had been written off to general expenses as at 30 September 2006 was later found to have been due to the following errors: Sales returns of sh.180,000 had been debited to sales but was omitted from the customers account. The purchase journal had been undercast by sh.200,000. Doubtful debts (for which full provision was required) as at 31 March 2006 amounted to Sh.120,000 and sh.160,000 as at 30 September 2006. Professional charges included sh.200,000 paid in respect to the acquisition of leasehold premises. These fees are to be capitalized as part of the lease, the total cost of which was to be depreciated in 25 equal annual installments. Other premises owned by Beatrice were leased to the partnership at Sh. 600,000 per annum but no rent had been paid or credited to her for the year to 30 September 2006.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started