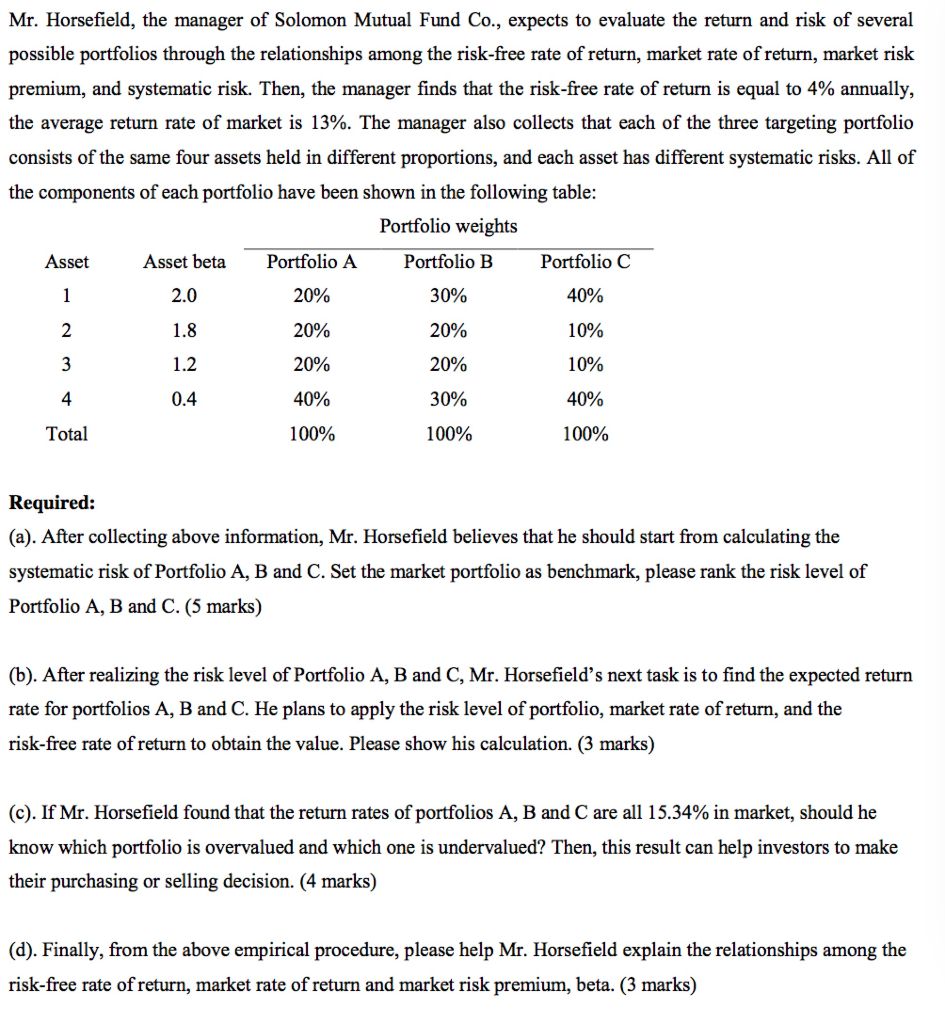

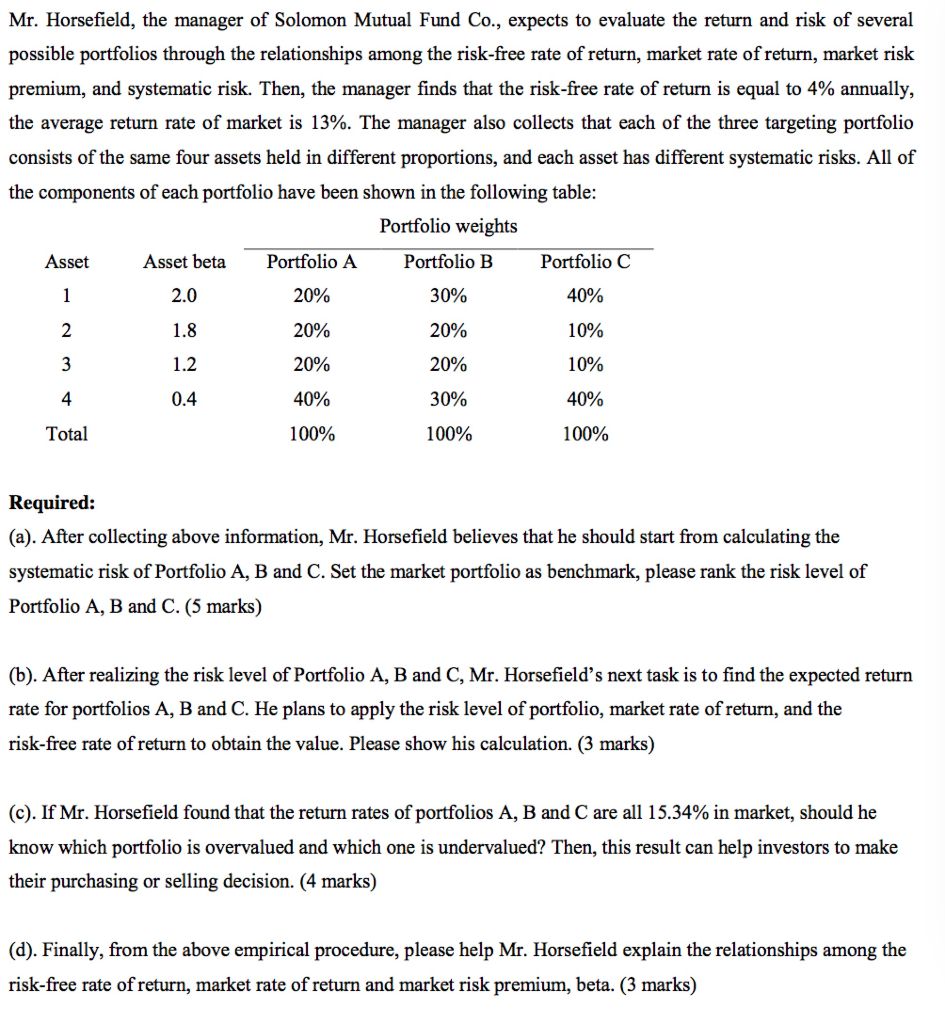

Mr. Horsefield, the manager of Solomon Mutual Fund Co., expects to evaluate the return and risk of several possible portfolios through the relationships among the risk-free rate of return, market rate of return, market risk premium, and systematic risk. Then, the manager finds that the risk-free rate of return is equal to 4% annually, the average return rate of market is 13%. The manager also collects that each of the three targeting portfolio consists of the same four assets held in different proportions, and each asset has different systematic risks. All of the components of each portfolio have been shown in the following table: Portfolio weights Asset Asset beta Portfolio A Portfolio B Portfolio C 2.0 20% 30% 40% 2 1.8 20% 20% 10% 3 1.2 20% 20% 10% 4 0.4 40% 30% 40% Total 100% 100% 100% Required: (a). After collecting above information, Mr. Horsefield believes that he should start from calculating the systematic risk of Portfolio A, B and C. Set the market portfolio as benchmark, please rank the risk level of Portfolio A, B and C. (5 marks) (b). After realizing the risk level of Portfolio A, B and C, Mr. Horsefield's next task is to find the expected return rate for portfolios A, B and C. He plans to apply the risk level of portfolio, market rate of return, and the risk-free rate of return to obtain the value. Please show his calculation. (3 marks) (c). If Mr. Horsefield found that the return rates of portfolios A, B and C are all 15.34% in market, should he know which portfolio is overvalued and which one is undervalued? Then, this result can help investors to make their purchasing or selling decision. (4 marks) (d). Finally, from the above empirical procedure, please help Mr. Horsefield explain the relationships among the risk-free rate of return, market rate of return and market risk premium, beta. (3 marks) Mr. Horsefield, the manager of Solomon Mutual Fund Co., expects to evaluate the return and risk of several possible portfolios through the relationships among the risk-free rate of return, market rate of return, market risk premium, and systematic risk. Then, the manager finds that the risk-free rate of return is equal to 4% annually, the average return rate of market is 13%. The manager also collects that each of the three targeting portfolio consists of the same four assets held in different proportions, and each asset has different systematic risks. All of the components of each portfolio have been shown in the following table: Portfolio weights Asset Asset beta Portfolio A Portfolio B Portfolio C 2.0 20% 30% 40% 2 1.8 20% 20% 10% 3 1.2 20% 20% 10% 4 0.4 40% 30% 40% Total 100% 100% 100% Required: (a). After collecting above information, Mr. Horsefield believes that he should start from calculating the systematic risk of Portfolio A, B and C. Set the market portfolio as benchmark, please rank the risk level of Portfolio A, B and C. (5 marks) (b). After realizing the risk level of Portfolio A, B and C, Mr. Horsefield's next task is to find the expected return rate for portfolios A, B and C. He plans to apply the risk level of portfolio, market rate of return, and the risk-free rate of return to obtain the value. Please show his calculation. (3 marks) (c). If Mr. Horsefield found that the return rates of portfolios A, B and C are all 15.34% in market, should he know which portfolio is overvalued and which one is undervalued? Then, this result can help investors to make their purchasing or selling decision. (4 marks) (d). Finally, from the above empirical procedure, please help Mr. Horsefield explain the relationships among the risk-free rate of return, market rate of return and market risk premium, beta