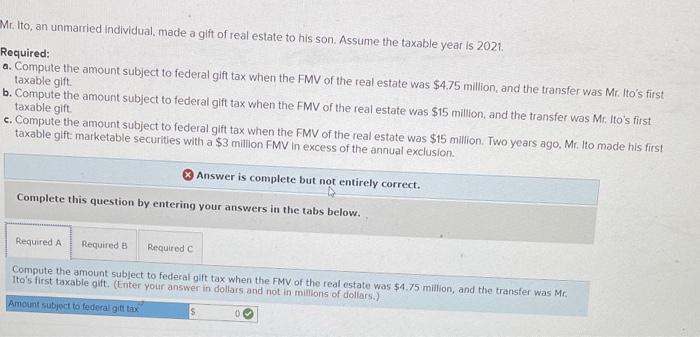

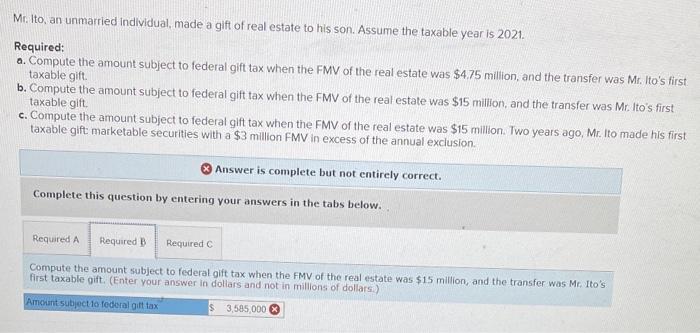

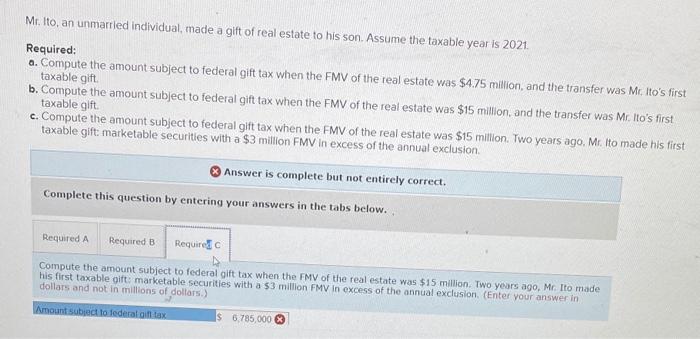

Mr. Ito, an unmarried individual, made a gift of real estate to his son. Assume the taxable year is 2021. Required: a. Compute the amount subject to federal gift tax when the FMV of the real estate was $4.75 million and the transfer was Mr. Ito's first taxable gift b. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million, and the transfer was Mr. Ito's first taxable gift c. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million. Two years ago, Mr. Ito made his first taxable gift: marketable securities with a $3 million FMV in excess of the annual exclusion. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required Compute the amount subject to federal gift tax when the FMV of the real estate was $4.75 million, and the transfer was Mc Ito's first taxable gift. (Enter your answer in dollars and not in millions of dollars.) Amount subject to federal gift tax Mr. Ito an unmarried individual, made a gift of real estate to his son. Assume the taxable year is 2021. Required: a. Compute the amount subject to federal gift tax when the FMV of the real estate was $4.75 million, and the transfer was Mr. Ito's first taxable gift b. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million, and the transfer was Mr. Ito's first taxable gift c. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million. Two years ago, Mr. Ito made his first taxable gift marketable securities with a $3 million FMV in excess of the annual exclusion Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million, and the transfer was Mr. Ito's first taxable gift. (Enter your answer in dollars and not in millions of dollars.) Amount subject to federal gilt tax 3,585,000 3 Mt. Ito an unmarried individual, made a gift of real estate to his son. Assume the taxable year is 2021 Required: a. Compute the amount subject to federal gift tax when the FMV of the real estate was $4.75 million, and the transfer was Mc. Ito's first taxable gift b. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million, and the transfer was Mr. Ito's first taxable gift c. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million. Two years ago, Mr. Ito made his first taxable gift marketable securities with a $3 million FMV in excess of the annual exclusion Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million. Two years ago, Mr. Ito made his first taxable gift: marketable securities with a $3 million FMV in excess of the annual exclusion (Enter your answer in dollars and not in millions of dollars.) Amount subiect to federal of tax $ 6,785.000 3