Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Martin Bowles is 63 years old and is employed by, Dominion Brass, a large public company. During 2019, his Net Income and Taxable Income

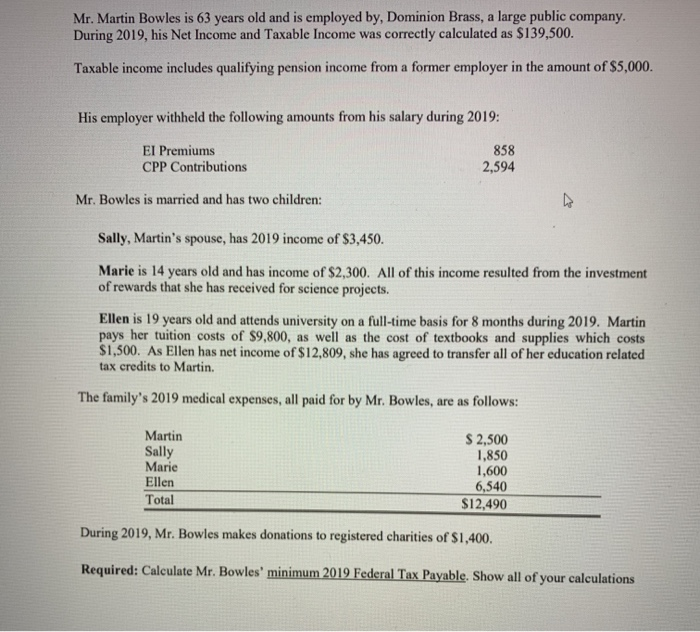

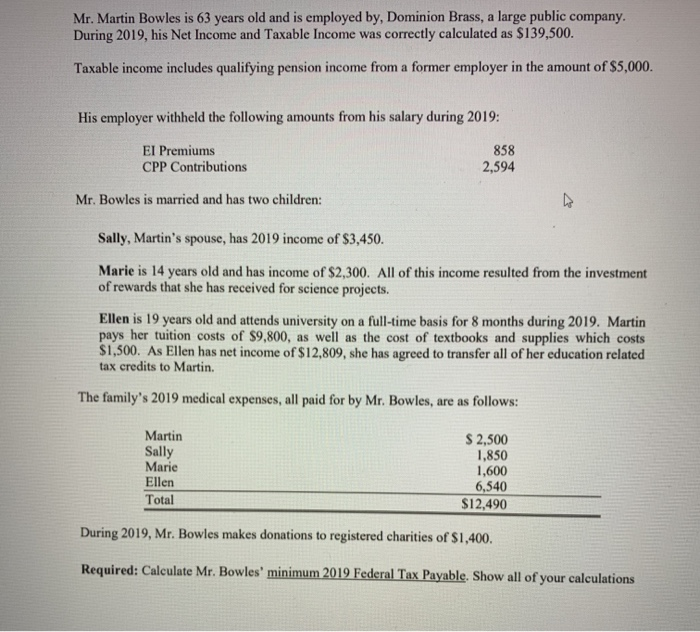

Mr. Martin Bowles is 63 years old and is employed by, Dominion Brass, a large public company. During 2019, his Net Income and Taxable Income was correctly calculated as $139,500. Taxable income includes qualifying pension income from a former employer in the amount of $5,000. His employer withheld the following amounts from his salary during 2019: EI Premiums CPP Contributions 858 2,594 Mr. Bowles is married and has two children: Sally, Martin's spouse, has 2019 income of $3,450. Marie is 14 years old and has income of $2,300. All of this income resulted from the investment of rewards that she has received for science projects. Ellen is 19 years old and attends university on a full-time basis for 8 months during 2019. Martin pays her tuition costs of $9,800, as well as the cost of textbooks and supplies which costs $1,500. As Ellen has net income of $12,809, she has agreed to transfer all of her education related tax credits to Martin The family's 2019 medical expenses, all paid for by Mr. Bowles, are as follows: Martin Sally Marie Ellen Total $ 2,500 1,850 1,600 6,540 $12,490 During 2019, Mr. Bowles makes donations to registered charities of $1,400. Required: Calculate Mr. Bowles' minimum 2019 Federal Tax Payable. Show all of your calculations Mr. Martin Bowles is 63 years old and is employed by, Dominion Brass, a large public company. During 2019, his Net Income and Taxable Income was correctly calculated as $139,500. Taxable income includes qualifying pension income from a former employer in the amount of $5,000. His employer withheld the following amounts from his salary during 2019: EI Premiums CPP Contributions 858 2,594 Mr. Bowles is married and has two children: Sally, Martin's spouse, has 2019 income of $3,450. Marie is 14 years old and has income of $2,300. All of this income resulted from the investment of rewards that she has received for science projects. Ellen is 19 years old and attends university on a full-time basis for 8 months during 2019. Martin pays her tuition costs of $9,800, as well as the cost of textbooks and supplies which costs $1,500. As Ellen has net income of $12,809, she has agreed to transfer all of her education related tax credits to Martin The family's 2019 medical expenses, all paid for by Mr. Bowles, are as follows: Martin Sally Marie Ellen Total $ 2,500 1,850 1,600 6,540 $12,490 During 2019, Mr. Bowles makes donations to registered charities of $1,400. Required: Calculate Mr. Bowles' minimum 2019 Federal Tax Payable. Show all of your calculations

Mr. Martin Bowles is 63 years old and is employed by, Dominion Brass, a large public company. During 2019, his Net Income and Taxable Income was correctly calculated as $139,500. Taxable income includes qualifying pension income from a former employer in the amount of $5,000. His employer withheld the following amounts from his salary during 2019: EI Premiums CPP Contributions 858 2,594 Mr. Bowles is married and has two children: Sally, Martin's spouse, has 2019 income of $3,450. Marie is 14 years old and has income of $2,300. All of this income resulted from the investment of rewards that she has received for science projects. Ellen is 19 years old and attends university on a full-time basis for 8 months during 2019. Martin pays her tuition costs of $9,800, as well as the cost of textbooks and supplies which costs $1,500. As Ellen has net income of $12,809, she has agreed to transfer all of her education related tax credits to Martin The family's 2019 medical expenses, all paid for by Mr. Bowles, are as follows: Martin Sally Marie Ellen Total $ 2,500 1,850 1,600 6,540 $12,490 During 2019, Mr. Bowles makes donations to registered charities of $1,400. Required: Calculate Mr. Bowles' minimum 2019 Federal Tax Payable. Show all of your calculations Mr. Martin Bowles is 63 years old and is employed by, Dominion Brass, a large public company. During 2019, his Net Income and Taxable Income was correctly calculated as $139,500. Taxable income includes qualifying pension income from a former employer in the amount of $5,000. His employer withheld the following amounts from his salary during 2019: EI Premiums CPP Contributions 858 2,594 Mr. Bowles is married and has two children: Sally, Martin's spouse, has 2019 income of $3,450. Marie is 14 years old and has income of $2,300. All of this income resulted from the investment of rewards that she has received for science projects. Ellen is 19 years old and attends university on a full-time basis for 8 months during 2019. Martin pays her tuition costs of $9,800, as well as the cost of textbooks and supplies which costs $1,500. As Ellen has net income of $12,809, she has agreed to transfer all of her education related tax credits to Martin The family's 2019 medical expenses, all paid for by Mr. Bowles, are as follows: Martin Sally Marie Ellen Total $ 2,500 1,850 1,600 6,540 $12,490 During 2019, Mr. Bowles makes donations to registered charities of $1,400. Required: Calculate Mr. Bowles' minimum 2019 Federal Tax Payable. Show all of your calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started