Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Nemcek has $200,000 in cash that he does not currently require for personal expenses. In his province of residence, the combined federal/provincial rate on

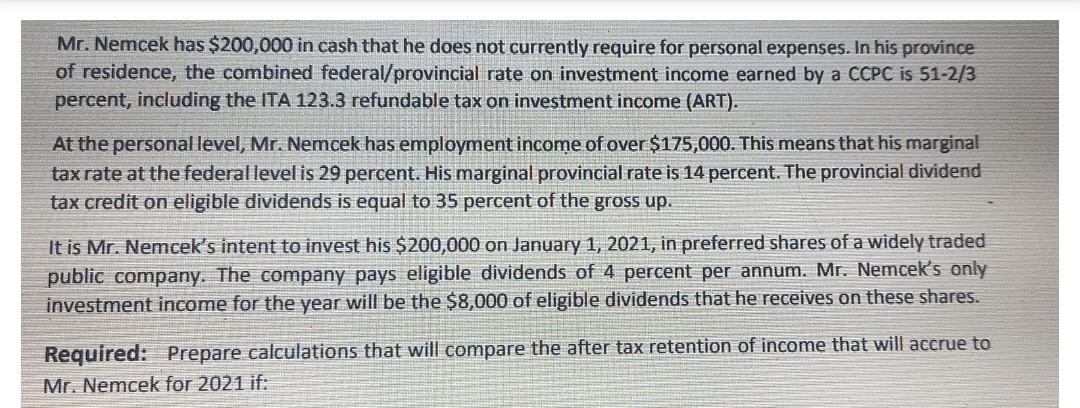

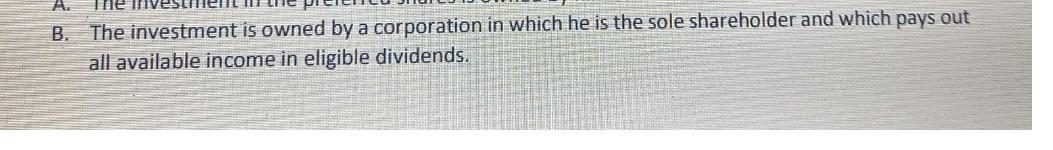

Mr. Nemcek has $200,000 in cash that he does not currently require for personal expenses. In his province of residence, the combined federal/provincial rate on investment income earned by a CCPC is 51-2/3 percent, including the ITA 123.3 refundable tax on investment income (ART). At the personal level, Mr. Nemcek has employment income of over $175,000. This means that his marginal tax rate at the federal level is 29 percent. His marginal provincial rate is 14 percent. The provincial dividend tax credit on eligible dividends is equal to 35 percent of the gross up. It is Mr. Nemcek's intent to invest his $200,000 on January 1, 2021, in preferred shares of a widely traded public company. The company pays eligible dividends of 4 percent per annum. Mr. Nemcek's only investment income for the year will be the $8,000 of eligible dividends that he receives on these shares. Required: Prepare calculations that will compare the after tax retention of income that will accrue to Mr. Nemcek for 2021 if: B. The investment is owned by a corporation in which he is the sole shareholder and which pays out all available income in eligible dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started