Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Rahman started a business selling readymade garments on 1 March 2021. After the first six months of his business, he was asked by

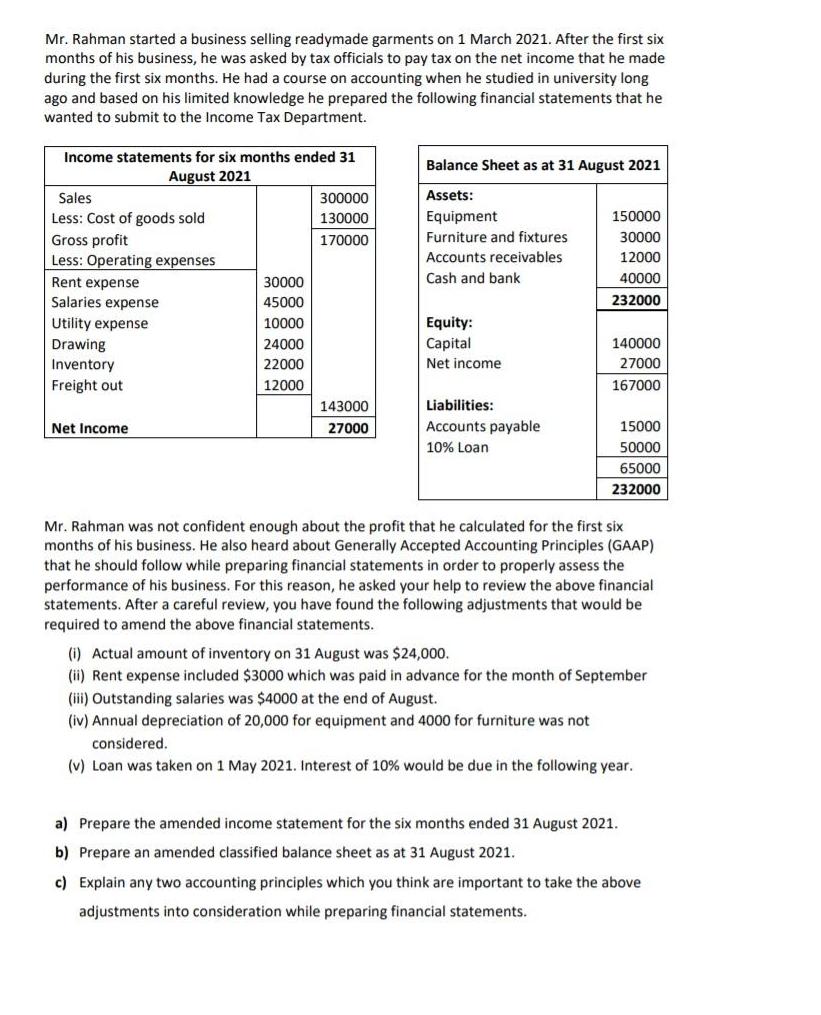

Mr. Rahman started a business selling readymade garments on 1 March 2021. After the first six months of his business, he was asked by tax officials to pay tax on the net income that he made during the first six months. He had a course on accounting when he studied in university long ago and based on his limited knowledge he prepared the following financial statements that he wanted to submit to the Income Tax Department. Income statements for six months ended 31 August 2021 Sales Less: Cost of goods sold Gross profit Less: Operating expenses Rent expense Salaries expense Utility expense Drawing Inventory Freight out Net Income 30000 45000 10000 24000 22000 12000 300000 130000 170000 143000 27000 Balance Sheet as at 31 August 2021 Assets: Equipment Furniture and fixtures Accounts receivables Cash and bank Equity: Capital Net income Liabilities: Accounts payable 10% Loan 150000 30000 12000 40000 232000 140000 27000 167000 15000 50000 65000 232000 Mr. Rahman was not confident enough about the profit that he calculated for the first six months of his business. He also heard about Generally Accepted Accounting Principles (GAAP) that he should follow while preparing financial statements in order to properly assess the performance of his business. For this reason, he asked your help to review the above financial statements. After a careful review, you have found the following adjustments that would be required to amend the above financial statements. (i) Actual amount of inventory on 31 August was $24,000. (ii) Rent expense included $3000 which was paid in advance for the month of September (iii) Outstanding salaries was $4000 at the end of August. (iv) Annual depreciation of 20,000 for equipment and 4000 for furniture was not considered. (v) Loan was taken on 1 May 2021. Interest of 10% would be due in the following year. a) Prepare the amended income statement for the six months ended 31 August 2021. b) Prepare an amended classified balance sheet as at 31 August 2021. c) Explain any two accounting principles which you think are important to take the above adjustments into consideration while preparing financial statements.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Sales Cost of Goods Sold Gross Profit Rent Expenses Salaries Expenses Utility Expen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started