Mr. Rivera and Mrs. Lopez are married, and they have 50 and 66 years respectively years old. Their income consisted of the following sources

They have Salaries: Mr. Rivera $45,000 and Mr. Lopez $ 35,000 Interest received in Federal Bonds $1,000 Interest received in Private Banks Accounts $2,000

Jury Duty Compensation $3,000

Inheritance (Herencia recibida por Mrs. Lpez) $10,000 Interest in Milwaukee city bonds 1,500

Withholding Tax payment $2,000 and 3,000

Please present computation items.

Make the follows calculations:

- Gross Income:

- Adjusted Gross Income:

- Standard Deduction

- Additional Standard Deduction:

- The taxable income is:

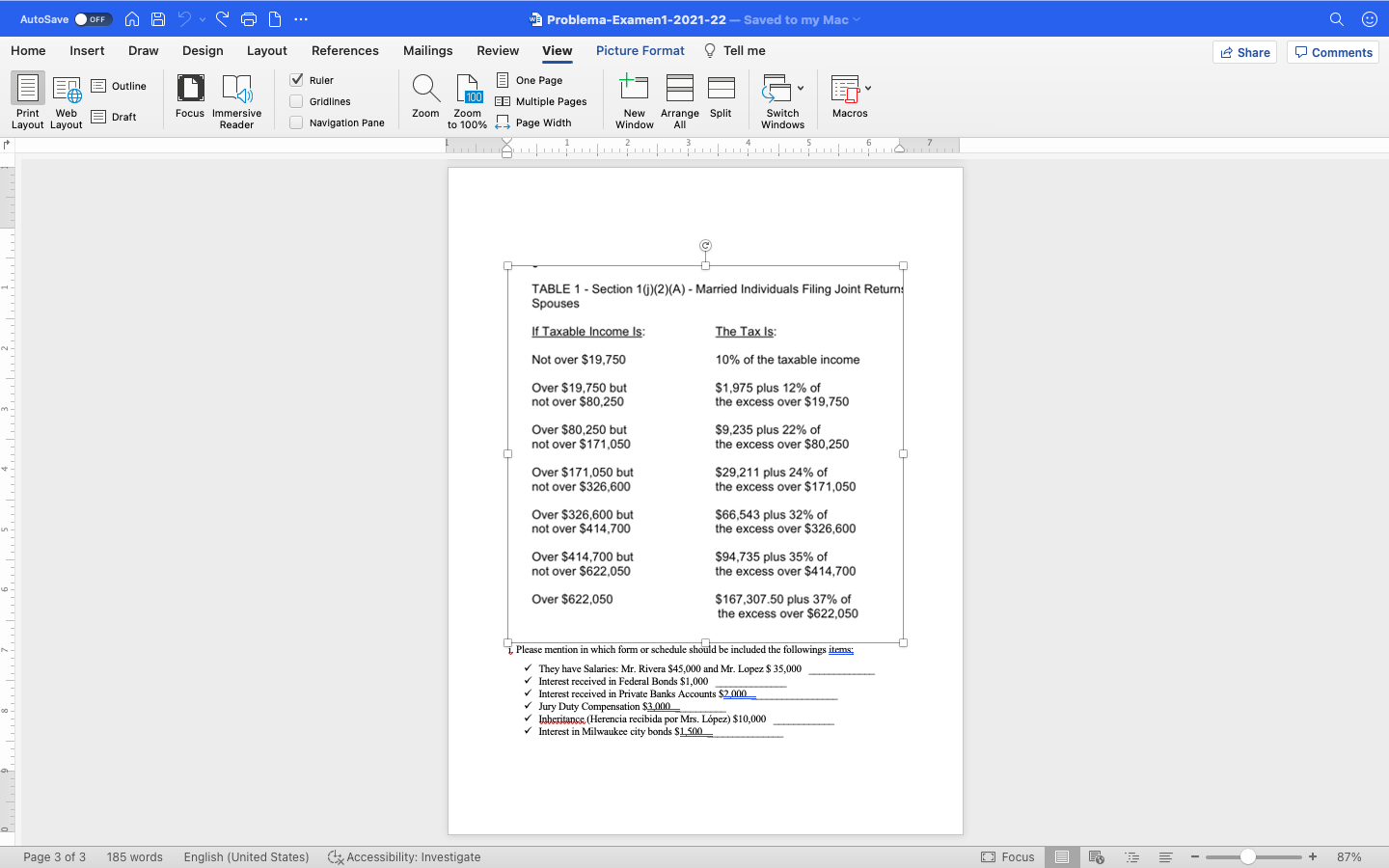

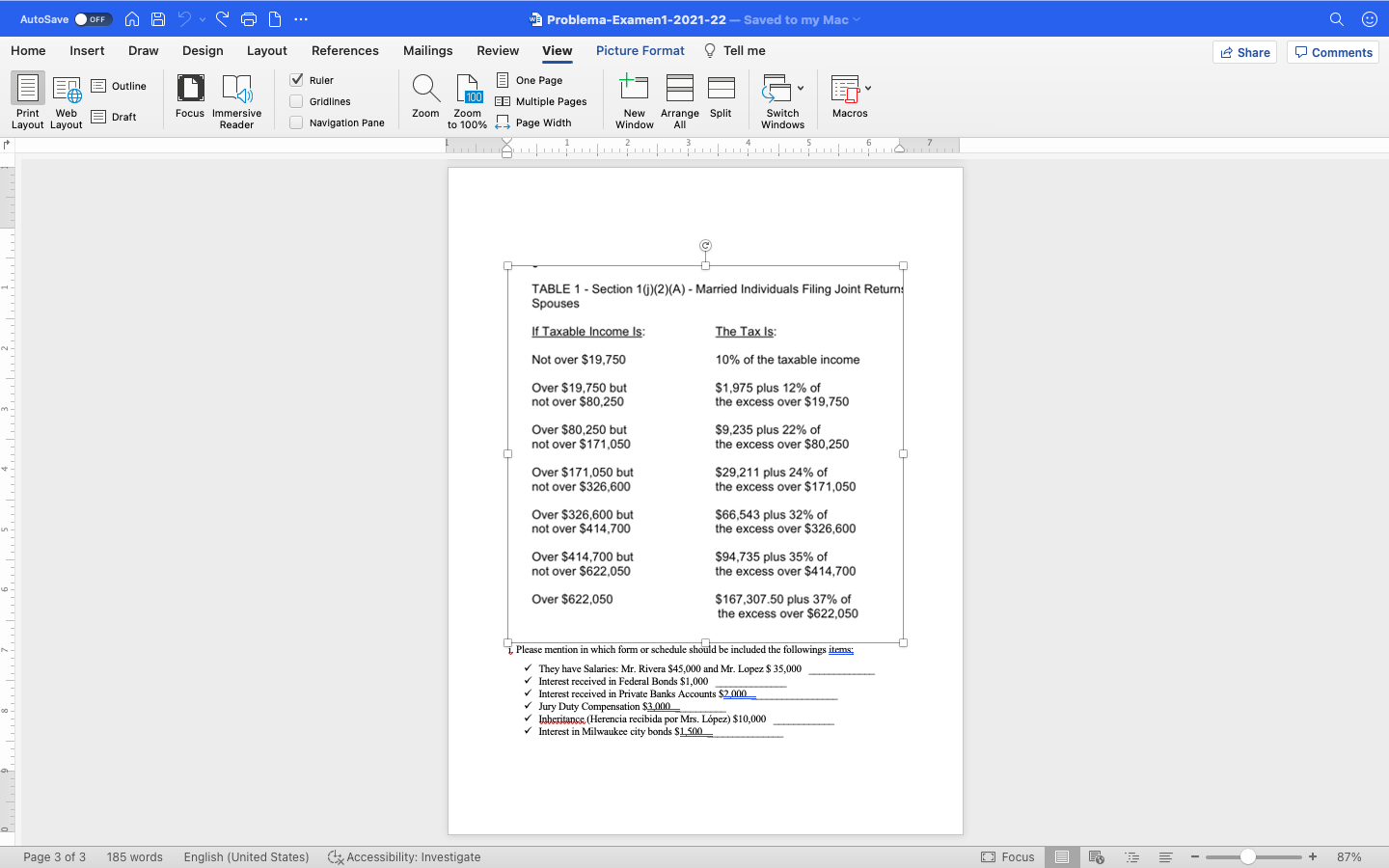

- The Total tax liability: (Please, use the table at the end of the problem)

- The Payment or Refund:

i. Please mention in which form or schedule should be included the followings items;

- They have Salaries: Mr. Rivera $45,000 and Mr. Lopez $ 35,000 _____________

- Interest received in Federal Bonds $1,000 ______________

- Interest received in Private Banks Accounts $2,000 _________________

- Jury Duty Compensation $3,000 __________

- Inheritance (Herencia recibida por Mrs. Lpez) $10,000 ____________

- Interest in Milwaukee city bonds $1,500 _______________

AutoSave OFF w Problema-Examen1-2021-22 - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Picture Format Tell me Share 0 Comments Ruler E Outline . Gridlines One Page EE Multiple Pages Zoom Zoom to 100% Page Width Print Web Layout Layout 3 Draft Focus Immersive Reader Macros Navigation Pane New Arrange Split Window All Switch Windows TABLE 1 - Section 16)(2)(A) - Married Individuals Filing Joint Return Spouses If Taxable income is: The Tax is: Not over $19.750 10% of the taxable income Over $19,750 but not over $80,250 $1,975 plus 12% of the excess over $19.750 Over $80,250 but not over $171,050 $9,235 plus 22% of the excess over $80,250 Over $171,050 but not over $326,600 $29,211 plus 24% of the excess over $171,050 Over $326,600 but not over $414,700 $66,543 plus 32% of the excess over $326,600 Over $414,700 but not over $622,050 $94,735 plus 35% of the excess over $414.700 Over $622,050 $167,307.50 plus 37% of the excess over $622,050 1. Please mention in which form or schedule should be included the followings items: They have Salaries: Mr. Rivera $45,000 and Mr. Lopez $ 35,000 Interest received in Federal Bonds $1,000 Interest received in Private Banks Accounts $2.000 Jury Duty Compensation $3.000 Inheritance (Herencia recibida por Mrs. Lpez) $10,000 Interest in Milwaukee city bonds $1.500_ Page 3 of 3 185 words English (United States) Accessibility: Investigate O Focus + 87% AutoSave OFF w Problema-Examen1-2021-22 - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Picture Format Tell me Share 0 Comments Ruler E Outline . Gridlines One Page EE Multiple Pages Zoom Zoom to 100% Page Width Print Web Layout Layout 3 Draft Focus Immersive Reader Macros Navigation Pane New Arrange Split Window All Switch Windows TABLE 1 - Section 16)(2)(A) - Married Individuals Filing Joint Return Spouses If Taxable income is: The Tax is: Not over $19.750 10% of the taxable income Over $19,750 but not over $80,250 $1,975 plus 12% of the excess over $19.750 Over $80,250 but not over $171,050 $9,235 plus 22% of the excess over $80,250 Over $171,050 but not over $326,600 $29,211 plus 24% of the excess over $171,050 Over $326,600 but not over $414,700 $66,543 plus 32% of the excess over $326,600 Over $414,700 but not over $622,050 $94,735 plus 35% of the excess over $414.700 Over $622,050 $167,307.50 plus 37% of the excess over $622,050 1. Please mention in which form or schedule should be included the followings items: They have Salaries: Mr. Rivera $45,000 and Mr. Lopez $ 35,000 Interest received in Federal Bonds $1,000 Interest received in Private Banks Accounts $2.000 Jury Duty Compensation $3.000 Inheritance (Herencia recibida por Mrs. Lpez) $10,000 Interest in Milwaukee city bonds $1.500_ Page 3 of 3 185 words English (United States) Accessibility: Investigate O Focus + 87%