Question

Mr. Sam Conrad lives in Detroit, Michigan, and is a full-time employee of a business in Windsor, Ontario. His responsibilities with the business in

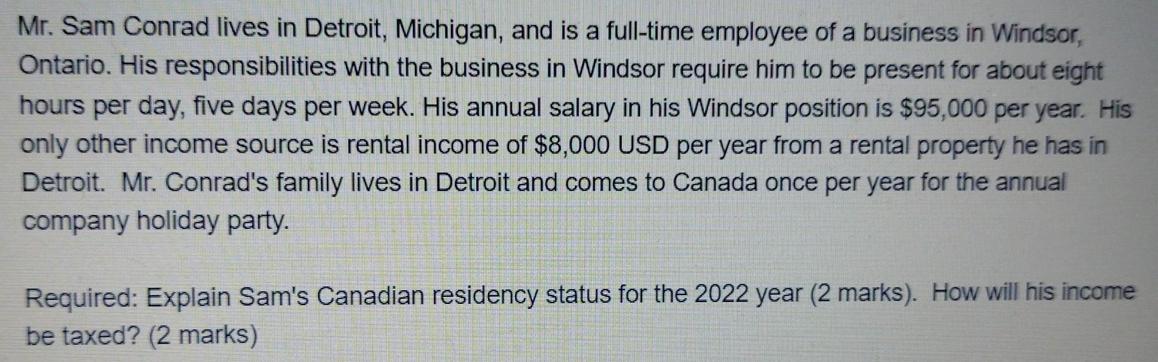

Mr. Sam Conrad lives in Detroit, Michigan, and is a full-time employee of a business in Windsor, Ontario. His responsibilities with the business in Windsor require him to be present for about eight hours per day, five days per week. His annual salary in his Windsor position is $95,000 per year. His only other income source is rental income of $8,000 USD per year from a rental property he has in Detroit. Mr. Conrad's family lives in Detroit and comes to Canada once per year for the annual company holiday party. Required: Explain Sam's Canadian residency status for the 2022 year (2 marks). How will his income be taxed? (2 marks)

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Finite Mathematics and Its Applications

Authors: Larry J. Goldstein, David I. Schneider, Martha J. Siegel, Steven Hair

12th edition

978-0134768588, 9780134437767, 134768582, 134437764, 978-0134768632

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App