Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Smith had recently flown into Chicago on a commercial airline for a two-day business trip. While there, he learned that his company's private

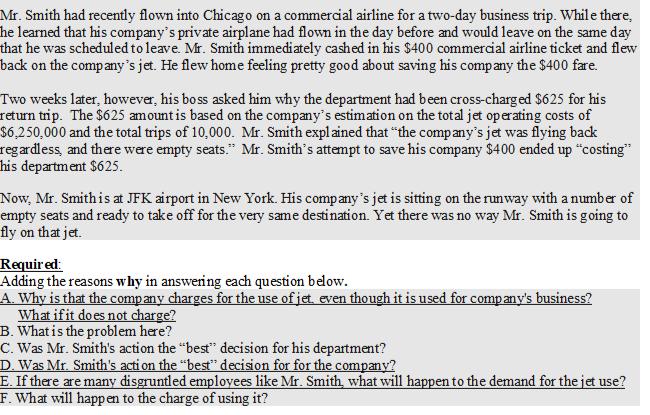

Mr. Smith had recently flown into Chicago on a commercial airline for a two-day business trip. While there, he learned that his company's private airplane had flown in the day before and would leave on the same day that he was scheduled to leave. Mr. Smith immediately cashed in his $400 commercial airline ticket and flew back on the company's jet. He flew home feeling pretty good about saving his company the $400 fare. Two weeks later, however, his boss asked him why the department had been cross-charged $625 for his return trip. The $625 amount is based on the company's estimation on the total jet operating costs of $6,250,000 and the total trips of 10,000. Mr. Smith explained that "the company's jet was flying back regardless, and there were empty seats." Mr. Smith's attempt to save his company $400 ended up "costing" This department $625. Now, Mr. Smith is at JFK airport in New York. His company's jet is sitting on the runway with a number of empty seats and ready to take off for the very same destination. Yet there was no way Mr. Smith is going to fly on that jet. Required: Adding the reasons why in answering each question below. A. Why is that the company charges for the use of jet, even though it is used for company's business? What if it does not charge? B. What is the problem here? C. Was Mr. Smith's action the "best" decision for his department? D. Was Mr. Smith's acti on the "best" decision for for the company? E. If there are many disgruntled employees like Mr. Smith, what will happen to the demand for the jet use? F. What will happen to the charge of using it?

Step by Step Solution

★★★★★

3.29 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Answer A The company charges for the use of its jet because it is a business expense If the company ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started