Question

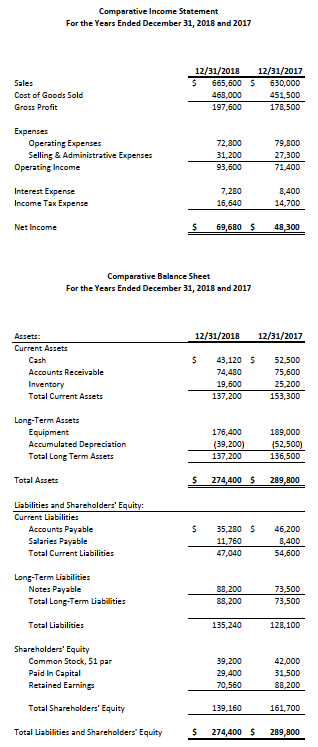

Mr. Smith has brought you a set of financial statements of a company that he is considering investing in as a long-term investment. He is

Mr. Smith has brought you a set of financial statements of a company that he is considering investing in as a long-term investment. He is asking for your help in determining if the company would be a good investment for him.

Using the attached financial statements, you need to create a vertical analysis as percentage of Total Assets for the Balance Sheet and as a percentage of Sales for the Income Statement, as well as a horizontal analysis of the Balance Sheet and Income Statement. Complete this for both years. In addition to the vertical and horizontal analysis, you need to calculate the following ratios:

Liquidity & Efficiency:

- Current Ratio

- Acid-Test Ratio

- Receivables Turnover & Days Sales Uncollected

- Inventory Turnover & Days sales in Inventory

Solvency:

- Debt Ratio

- Equity Ratio

- Debt to Equity Ratio

Profitability:

- Profit Margin Ratio

- Gross Margin Ratio

- Return on Total Assets (ROA)

- Return on Equity (ROE)

This information then needs to be incorporated into a written memo to Mr. Smith that include:

- What is the purpose of creating a vertical analysis and why is it useful in analyzing a potential investment?

- What is the purpose of creating a horizontal analysis and why is it useful in analyzing a potential investment?

- Overall, what do each of the three sections of ratios (Profitability, Liquidity & Solvency) tell a person about a company?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started