Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Stack is the vice president in charge of finance and he has been provided with an Acura that was purchased by the Company

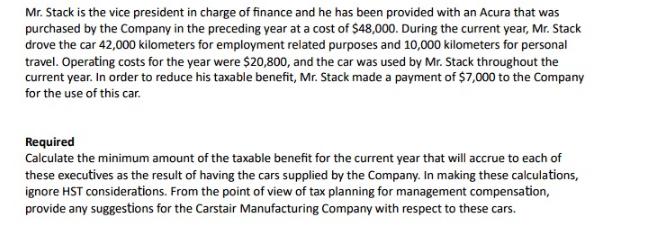

Mr. Stack is the vice president in charge of finance and he has been provided with an Acura that was purchased by the Company in the preceding year at a cost of $48,000. During the current year, Mr. Stack drove the car 42,000 kilometers for employment related purposes and 10,000 kilometers for personal travel. Operating costs for the year were $20,800, and the car was used by Mr. Stack throughout the current year. In order to reduce his taxable benefit, Mr. Stack made a payment of $7,000 to the Company for the use of this car. Required Calculate the minimum amount of the taxable benefit for the current year that will accrue to each of these executives as the result of having the cars supplied by the Company. In making these calculations, ignore HST considerations. From the point of view of tax planning for management compensation, provide any suggestions for the Carstair Manufacturing Company with respect to these cars.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Taxable Benefit Calculation for Mr Stack Step 1 Calculate total kilometers driven Total kilometers Employment kms Personal kms Total kilometers 42000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started