Answered step by step

Verified Expert Solution

Question

1 Approved Answer

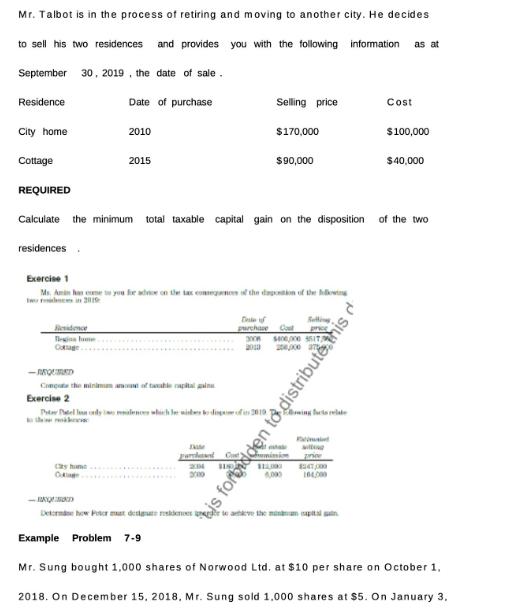

Mr. Talbot is in the process of retiring and moving to another city. He decides to sell his two residences and provides you with

Mr. Talbot is in the process of retiring and moving to another city. He decides to sell his two residences and provides you with the following information as at September 30, 2019, the date of sale. Residence City home Cottage Date of purchase Be 2010 2015 Cay home. -REQUIRED Compute the minimum amount of table capital gain Exercise 2 Exercise 1 Ms. Amihan come to you for adnoe on the tax conseqnces of the deption of the hollowing REQUIRED Calculate the minimum total taxable capital gain on the disposition of the two residences Patelylences which he wishes to dispose of its 2010 Selling price JAAM pard Ce 2004 3000 -BAQD Detom how Pote mat dedigute rsdener e $170,000 300 2013 $90,000 Def purchase Co $400,000 $ITA ma 11100 Selling 1,000 willing $247,000 104,000 Cost is forbidden to distribute this $100,000 $40,000 Example Problem 7-9 Mr. Sung bought 1,000 shares of Norwood Ltd. at $10 per share on October 1, 2018. On December 15, 2018, Mr. Sung sold 1,000 shares at $5. On January 3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started