Answered step by step

Verified Expert Solution

Question

1 Approved Answer

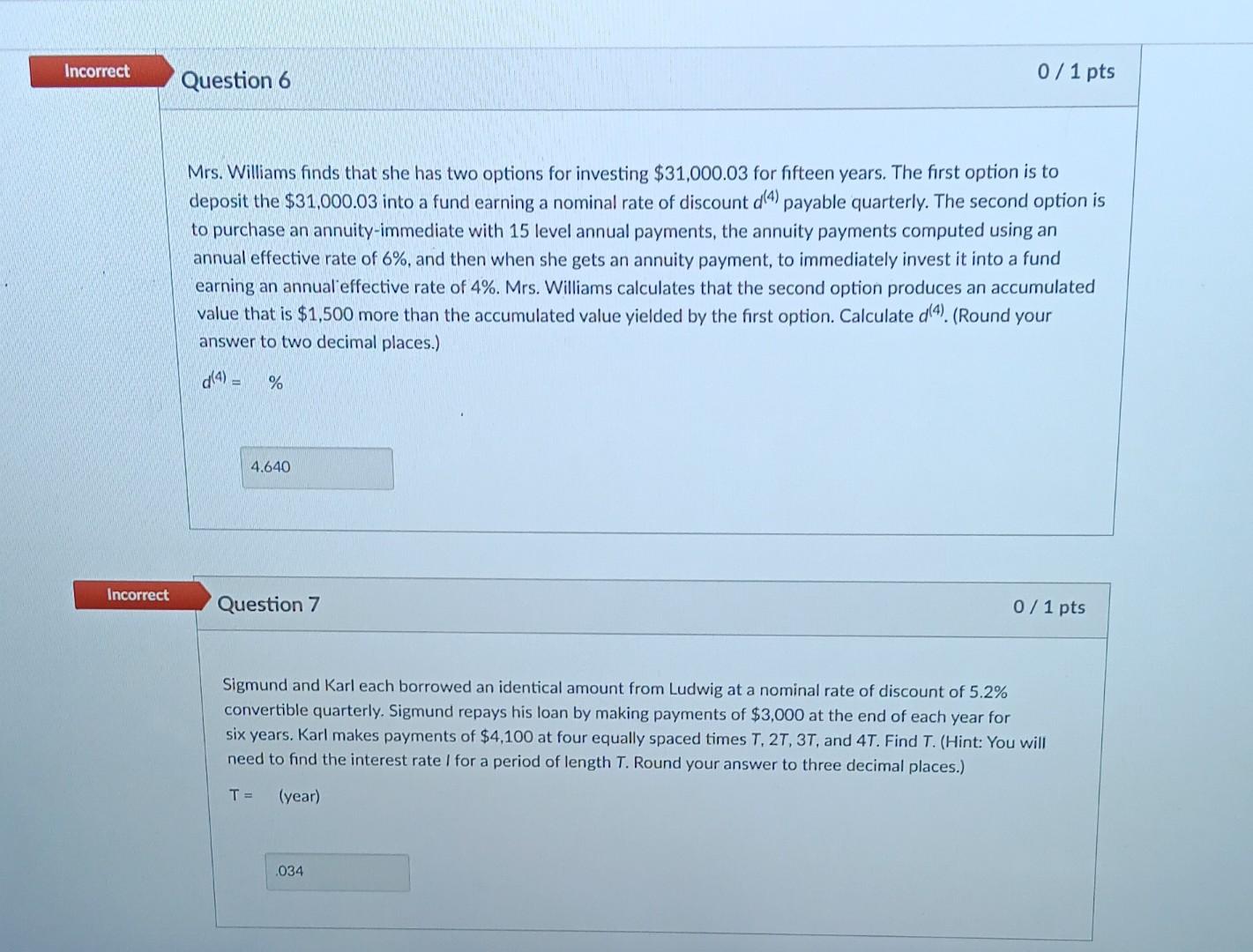

Mrs. Williams finds that she has two options for investing $31,000.03 for fifteen years. The first option is to deposit the $31,000.03 into a fund

Mrs. Williams finds that she has two options for investing $31,000.03 for fifteen years. The first option is to deposit the $31,000.03 into a fund earning a nominal rate of discount d(4) payable quarterly. The second option is to purchase an annuity-immediate with 15 level annual payments, the annuity payments computed using an annual effective rate of 6%, and then when she gets an annuity payment, to immediately invest it into a fund earning an annual effective rate of 4%. Mrs. Williams calculates that the second option produces an accumulated value that is $1,500 more than the accumulated value yielded by the first option. Calculate d(4). (Round your answer to two decimal places.) d(4)=% Question 7 0/1 pts Sigmund and Karl each borrowed an identical amount from Ludwig at a nominal rate of discount of 5.2\% convertible quarterly. Sigmund repays his loan by making payments of $3,000 at the end of each year for six years. Karl makes payments of $4,100 at four equally spaced times T,2T,3T, and 4T. Find T. (Hint: You will need to find the interest rate I for a period of length T. Round your answer to three decimal places.) T=(year)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started