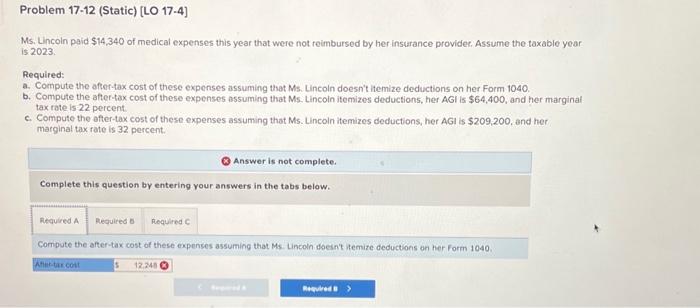

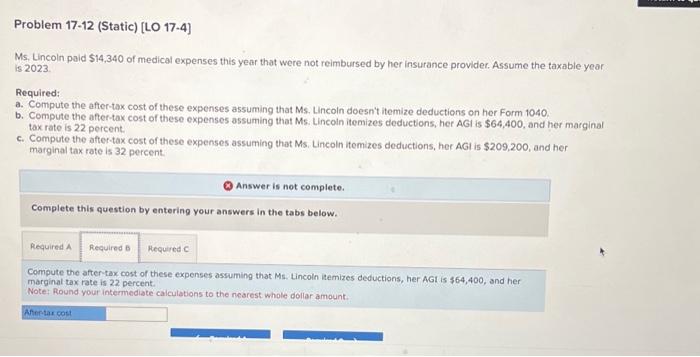

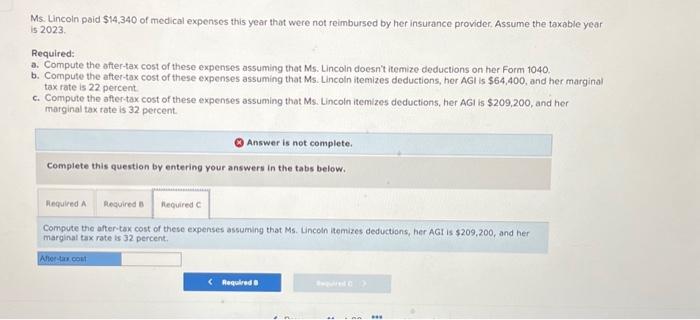

Ms. Lincoln paid $14,340 of medical expenses this year that were not reimbursed by her insurance provider. Assume the taxable year is 2023 . Required: a. Compute the after-tax cost of these expenses assuming that Ms. Lincoln doesn't itemize deductions on her Form 1040. b. Compute the after-tax cost of these expenses assuming that Ms. Lincoin itemizes deductions, her AGI is $64,400, and her marginal tax rate is 22 percent. c. Compute the ofter-tax cost of these expenses assuming that Ms. Lincoln itemizes deductions, her AGI is $209,200, and her marginal tax rate is 32 percent. Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the after-tax cost of these expenses assuming that Ms. Lincoln doesn't hemire deductions on her form 1040. Ms, Lincoln paid $14,340 of medical expenses this year that were not reimbursed by her insurance provider. Assume the taxable year is 2023. Required: a. Compute the after-tax cost of these expenses assuming that Ms. Lincoln doesn't itemize deductions on her Form 1040. b. Compute the after-tax cost of these expenses assuming that Ms. Lincoin itemizes deductions, her AGI is $64,400, and her marginal tax rate is 22 percent. c. Compute the aftertax cost of these expenses assuming that Ms. Lincoln itemizes deductions, her AGI is $209,200, and her marginal tax rote is 32 percent. Q Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the after-ax cost of these expenses assuming that Ms. Lincoln itemizes deductions, her AGI is $64,400, and her marginal tax rate is 22 percent. Note: Round your intermediate calculations to the nearest whole dollar amount. Ms. Lincoln paid $14,340 of medical expenses this year that were not reimbursed by her insurance provider. Assume the taxable year is 2023 . Required: a. Compute the ofter-tax cost of these expenses assuming that Ms. Lincoln doesn't itemize deductions on her form 1040. b. Compute the after-tax cost of these expenses assuming that Ms. Lincoln itemizes deductions, her AGI is $64,400, and her marginal tax rate is 22 percent. c. Compute the after-tax cost of these expenses assuming that Ms. Lincoln itemizes deductions, her AGI is $209,200, and her marginal tax tate is 32 percent. Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the after-tax cost of these expenses assuming that Ms. Lincoin itemizes deductions, her AGI is $209,200, and her marginal tax rate is 32 percent