Question

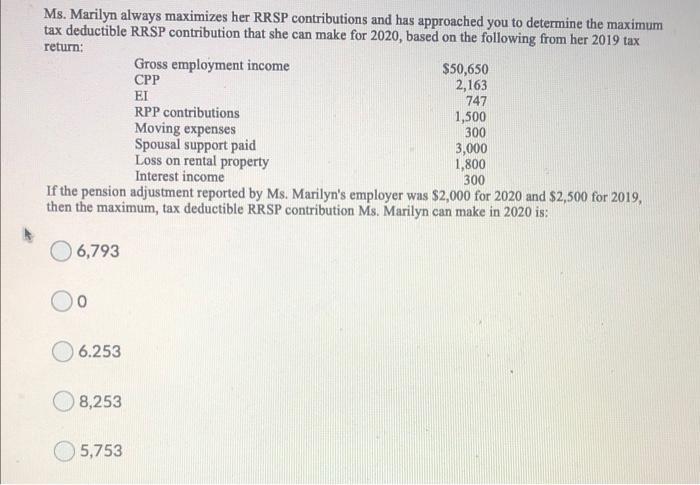

Ms. Marilyn always maximizes her RRSP contributions and has approached you to determine the maximum tax deductible RRSP contribution that she can make for

Ms. Marilyn always maximizes her RRSP contributions and has approached you to determine the maximum tax deductible RRSP contribution that she can make for 2020, based on the following from her 2019 tax return: 6,793 1,500 300 3,000 1,800 300 If the pension adjustment reported by Ms. Marilyn's employer was $2,000 for 2020 and $2,500 for 2019, then the maximum, tax deductible RRSP contribution Ms. Marilyn can make in 2020 is: 0 6.253 8,253 Gross employment income CPP EI RPP contributions 5,753 Moving expenses Spousal support paid $50,650 2,163 747 Loss on rental property Interest income

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Add The RRSP deduction limit for the 2020 tox year 18 of taxpayers pretax ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Advanced Accounting in Canada

Authors: Hilton Murray, Herauf Darrell

8th edition

1259087557, 1057317623, 978-1259087554

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App