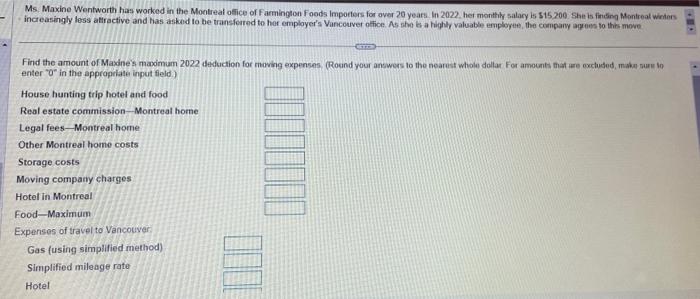

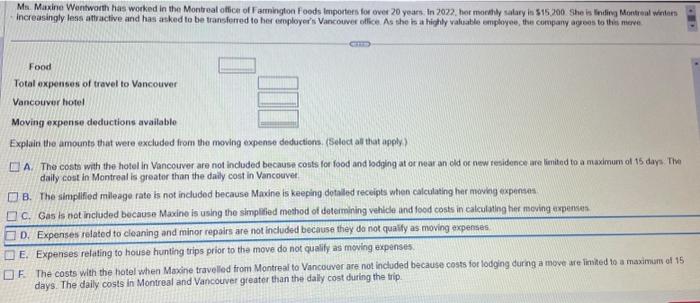

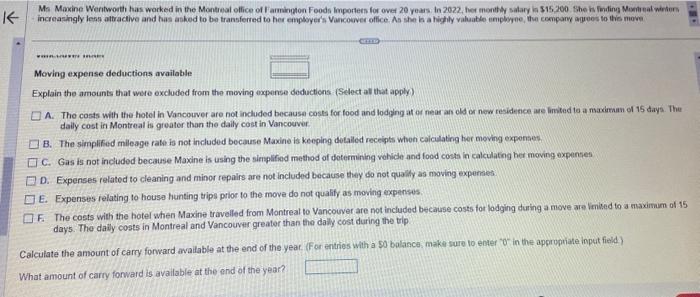

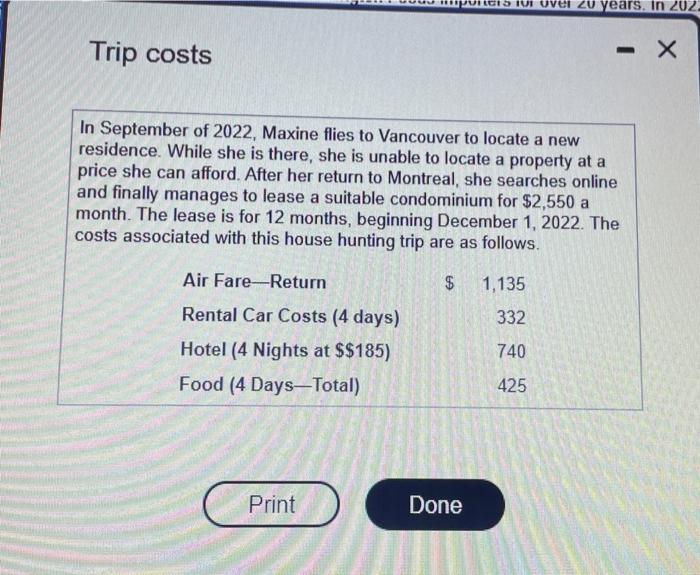

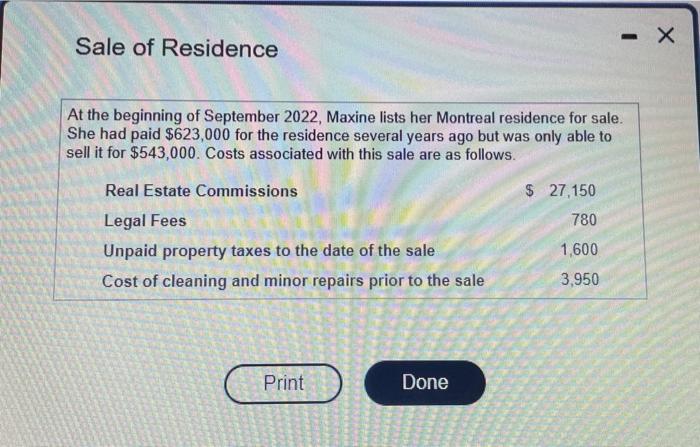

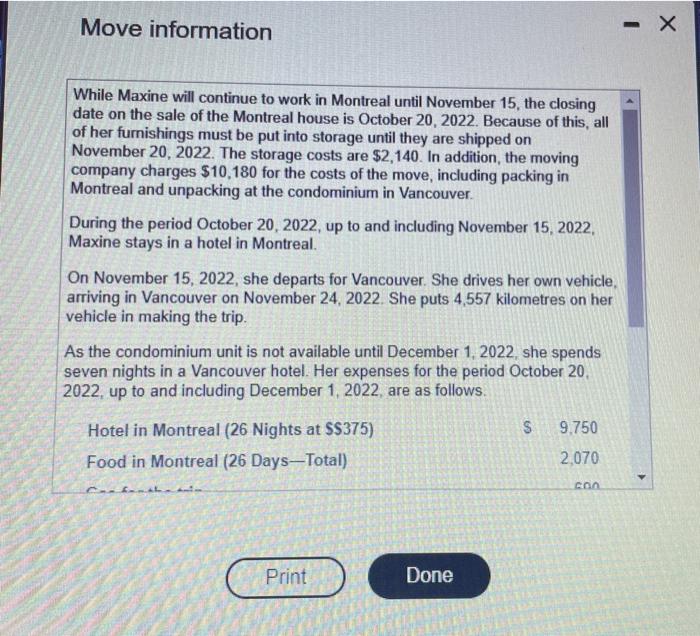

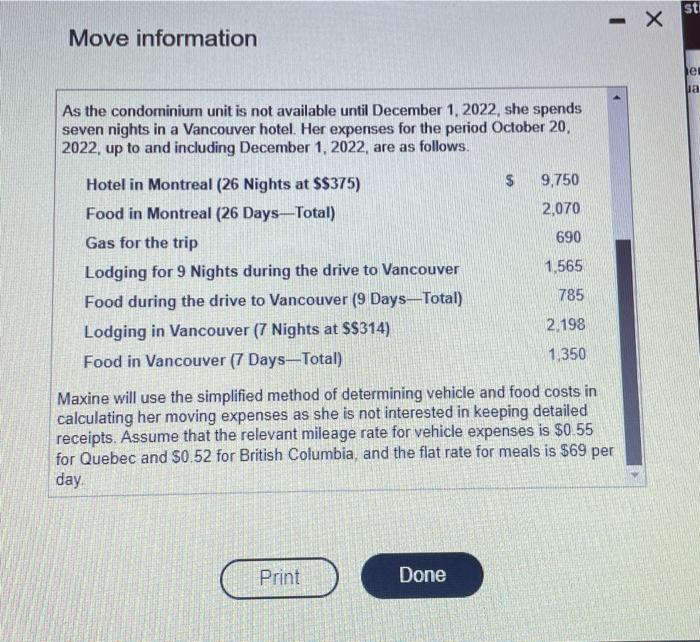

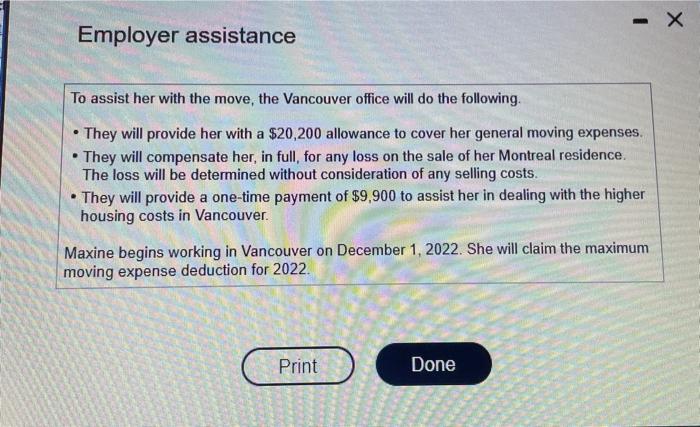

Ms. Maxine Wentworth has worked in the Mootreal otice of Farmington Foods Importers for over 20 years In 2022. her monttily salary is 515 .200. She is finding Montreal Winters Find the amount of Maxdies mabimum 2022 deduction for moving expenses. (Round your answors to the nearest whole dollar For amounts that ire oxcluded, makin nurn lo enter 0 in the appropiate input fleld.) Ms. Maxine Wentworth has worked in the Montweal otfich of F armingtoo Foods Importers for ever 20 years. In 2022 . hor mocetly salary is 515200 She is Intling Montieal witars increasingly less attractive and has atked to be transfened to hes emoployer's Vancower eflice. As the is a highly valuable employee, the compary ageos to the mecre. Explain the amounts that were excluded from the moving expense deductions. (Sieloct all that apply) A. The costs with the hotel in Vancouver are not included because costs for food and bodping at or near an cld of new tesidence are limitad to a maximum ol 15 days. Tiwe daily cost in Montreal is greator than the dally cost in Vancouvet. B. The simplified mileage rate is not included because Maxine is keeping detalled receipts when calculating her moveng expensas C. Gas is not included because Maxine is using the simplifed method of determining vehlcle and food costs in calculating her moving expenses D. Expenses related to cleaning and minor repairs are not included because they da not qualify as moving expensers E. Expenses retating to house hunting trips prior to the move do not qualify ats moving expenses. F. The costs with the hotel when Maxine travelled from Montreal to Vancouver are not included because costs for lodging durng a move are limhed to a maximum of 15 days. The daily costs in Montreal and Vancouver greater than the dally cost during the trip. increasingly leas attractive and has abked to be transferred to her employer's Vancower office. As she is a highly valuable enipbyne, itu compary angeos to this move Moving expense deductions available Explain the amounts that woe excluded from the moving axpense deductions (Select all that apply) A. The cosis with the hotel in Vancowver are not included because costs for food and lodghng at or near ans old or now residence are limbed to a maximan of 15 days. The daily cost in Montreal is greater than the daily cost in Vancouver. B. The simplifed mileage rate is not induded because Maxine is keeping dotaled receipts whoh calculating her moving exponses C. Gas is not included because Maxine is using the simplified method of dotermining vohide and food costs in calculating her moving oxpenses D. Expenses related to cleaning and minor repairs are not included because thely do not qualiy as moving expenmet. E. Expenses relating to house hunting trips prior to the move do not qualify as moving expenses. F. The costs with the hotel when Maxine travelled from Montreal to Vancouver are not included because costs for lodging during a move are lisised to a naximum of 15 days. The dally costs in Montreal and Vancouver greater than the dally cost during the trip Calculate the amount of carry forward available at the end of the year. (For entries with a \$0 balance, make sure to enter oo in the appropriate input field) What amount of carry forward is available at the end of the year? Trip costs In September of 2022, Maxine flies to Vancouver to locate a new residence. While she is there, she is unable to locate a property at a price she can afford. After her return to Montreal, she searches online and finally manages to lease a suitable condominium for $2,550 a month. The lease is for 12 months, beginning December 1,2022 . The costs associated with this house hunting trip are as follows. Sale of Residence At the beginning of September 2022, Maxine lists her Montreal residence for sale. She had paid $623,000 for the residence several years ago but was only able to sell it for $543,000. Costs associated with this sale are as follows. Move information While Maxine will continue to work in Montreal until November 15, the closing date on the sale of the Montreal house is October 20,2022 . Because of this, all of her furnishings must be put into storage until they are shipped on November 20,2022 . The storage costs are $2,140. In addition, the moving company charges $10,180 for the costs of the move, including packing in Montreal and unpacking at the condominium in Vancouver. During the period October 20, 2022, up to and including November 15, 2022. Maxine stays in a hotel in Montreal. On November 15, 2022, she departs for Vancouver. She drives her own vehicle, arriving in Vancouver on November 24, 2022. She puts 4,557 kilometres on her vehicle in making the trip. As the condominium unit is not available until December 1,2022 , she spends seven nights in a Vancouver hotel. Her expenses for the period October 20. 2022, up to and including December 1,2022 , are as follows. Move information As the condominium unit is not available until December 1,2022 , she spends seven nights in a Vancouver hotel. Her expenses for the period October 20 , 2022, up to and including December 1,2022 , are as follows. Maxine will use the simplified method of determining vehicle and food costs in calculating her moving expenses as she is not interested in keeping detailed receipts. Assume that the relevant mileage rate for vehicle expenses is $0.55 for Quebec and $0.52 for British Columbia, and the flat rate for meals is $69 per day Employer assistance To assist her with the move, the Vancouver office will do the following. - They will provide her with a $20,200 allowance to cover her general moving expenses. - They will compensate her, in full, for any loss on the sale of her Montreal residence. The loss will be determined without consideration of any selling costs. - They will provide a one-time payment of $9,900 to assist her in dealing with the higher housing costs in Vancouver. Maxine begins working in Vancouver on December 1, 2022. She will claim the maximum moving expense deduction for 2022 . Requirement Determine the amount of Maxine's maximum 2022 deduction for moving expenses and indicate the amount of any carry forward that is available at the end of the year. If any amount is excluded, explain why. Ms. Maxine Wentworth has worked in the Mootreal otice of Farmington Foods Importers for over 20 years In 2022. her monttily salary is 515 .200. She is finding Montreal Winters Find the amount of Maxdies mabimum 2022 deduction for moving expenses. (Round your answors to the nearest whole dollar For amounts that ire oxcluded, makin nurn lo enter 0 in the appropiate input fleld.) Ms. Maxine Wentworth has worked in the Montweal otfich of F armingtoo Foods Importers for ever 20 years. In 2022 . hor mocetly salary is 515200 She is Intling Montieal witars increasingly less attractive and has atked to be transfened to hes emoployer's Vancower eflice. As the is a highly valuable employee, the compary ageos to the mecre. Explain the amounts that were excluded from the moving expense deductions. (Sieloct all that apply) A. The costs with the hotel in Vancouver are not included because costs for food and bodping at or near an cld of new tesidence are limitad to a maximum ol 15 days. Tiwe daily cost in Montreal is greator than the dally cost in Vancouvet. B. The simplified mileage rate is not included because Maxine is keeping detalled receipts when calculating her moveng expensas C. Gas is not included because Maxine is using the simplifed method of determining vehlcle and food costs in calculating her moving expenses D. Expenses related to cleaning and minor repairs are not included because they da not qualify as moving expensers E. Expenses retating to house hunting trips prior to the move do not qualify ats moving expenses. F. The costs with the hotel when Maxine travelled from Montreal to Vancouver are not included because costs for lodging durng a move are limhed to a maximum of 15 days. The daily costs in Montreal and Vancouver greater than the dally cost during the trip. increasingly leas attractive and has abked to be transferred to her employer's Vancower office. As she is a highly valuable enipbyne, itu compary angeos to this move Moving expense deductions available Explain the amounts that woe excluded from the moving axpense deductions (Select all that apply) A. The cosis with the hotel in Vancowver are not included because costs for food and lodghng at or near ans old or now residence are limbed to a maximan of 15 days. The daily cost in Montreal is greater than the daily cost in Vancouver. B. The simplifed mileage rate is not induded because Maxine is keeping dotaled receipts whoh calculating her moving exponses C. Gas is not included because Maxine is using the simplified method of dotermining vohide and food costs in calculating her moving oxpenses D. Expenses related to cleaning and minor repairs are not included because thely do not qualiy as moving expenmet. E. Expenses relating to house hunting trips prior to the move do not qualify as moving expenses. F. The costs with the hotel when Maxine travelled from Montreal to Vancouver are not included because costs for lodging during a move are lisised to a naximum of 15 days. The dally costs in Montreal and Vancouver greater than the dally cost during the trip Calculate the amount of carry forward available at the end of the year. (For entries with a \$0 balance, make sure to enter oo in the appropriate input field) What amount of carry forward is available at the end of the year? Trip costs In September of 2022, Maxine flies to Vancouver to locate a new residence. While she is there, she is unable to locate a property at a price she can afford. After her return to Montreal, she searches online and finally manages to lease a suitable condominium for $2,550 a month. The lease is for 12 months, beginning December 1,2022 . The costs associated with this house hunting trip are as follows. Sale of Residence At the beginning of September 2022, Maxine lists her Montreal residence for sale. She had paid $623,000 for the residence several years ago but was only able to sell it for $543,000. Costs associated with this sale are as follows. Move information While Maxine will continue to work in Montreal until November 15, the closing date on the sale of the Montreal house is October 20,2022 . Because of this, all of her furnishings must be put into storage until they are shipped on November 20,2022 . The storage costs are $2,140. In addition, the moving company charges $10,180 for the costs of the move, including packing in Montreal and unpacking at the condominium in Vancouver. During the period October 20, 2022, up to and including November 15, 2022. Maxine stays in a hotel in Montreal. On November 15, 2022, she departs for Vancouver. She drives her own vehicle, arriving in Vancouver on November 24, 2022. She puts 4,557 kilometres on her vehicle in making the trip. As the condominium unit is not available until December 1,2022 , she spends seven nights in a Vancouver hotel. Her expenses for the period October 20. 2022, up to and including December 1,2022 , are as follows. Move information As the condominium unit is not available until December 1,2022 , she spends seven nights in a Vancouver hotel. Her expenses for the period October 20 , 2022, up to and including December 1,2022 , are as follows. Maxine will use the simplified method of determining vehicle and food costs in calculating her moving expenses as she is not interested in keeping detailed receipts. Assume that the relevant mileage rate for vehicle expenses is $0.55 for Quebec and $0.52 for British Columbia, and the flat rate for meals is $69 per day Employer assistance To assist her with the move, the Vancouver office will do the following. - They will provide her with a $20,200 allowance to cover her general moving expenses. - They will compensate her, in full, for any loss on the sale of her Montreal residence. The loss will be determined without consideration of any selling costs. - They will provide a one-time payment of $9,900 to assist her in dealing with the higher housing costs in Vancouver. Maxine begins working in Vancouver on December 1, 2022. She will claim the maximum moving expense deduction for 2022 . Requirement Determine the amount of Maxine's maximum 2022 deduction for moving expenses and indicate the amount of any carry forward that is available at the end of the year. If any amount is excluded, explain why