Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Tyler is discouraged over the loss shown for the quarter, particularly because she had planned to use the statement as support for a bank

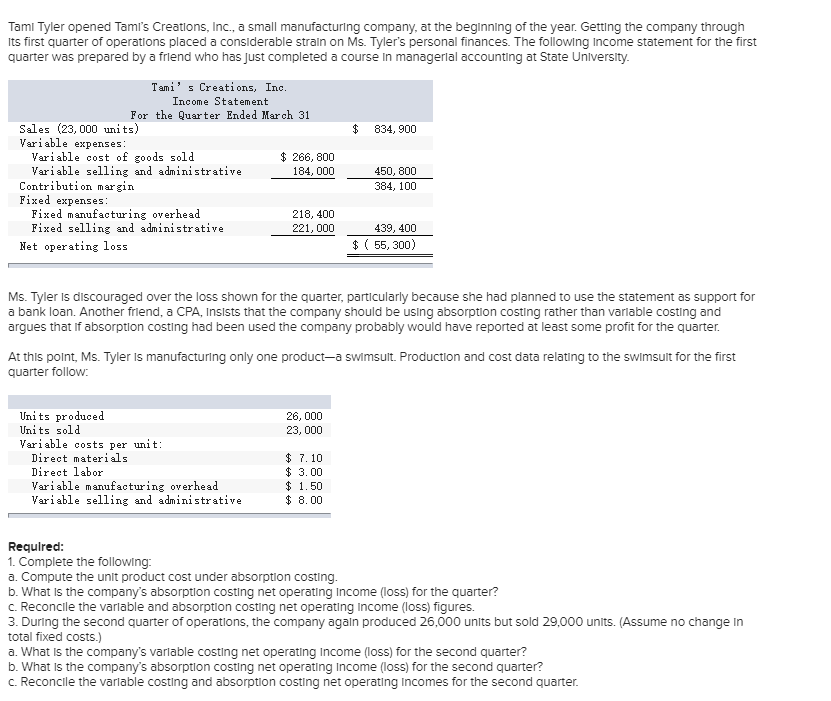

Ms. Tyler is discouraged over the loss shown for the quarter, particularly because she had planned to use the statement as support for a bank loan. Another friend, a CPA, insists that the company should be using absorption costing rather than variable costing and argues that if absorption costing had been used the company probably would have reported at least some profit for the quarter.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started