Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Wong owned two homes from 2016 to 2018 . She had purchased Home A in 2011 for $260,000. In 2016 , she purchased Home

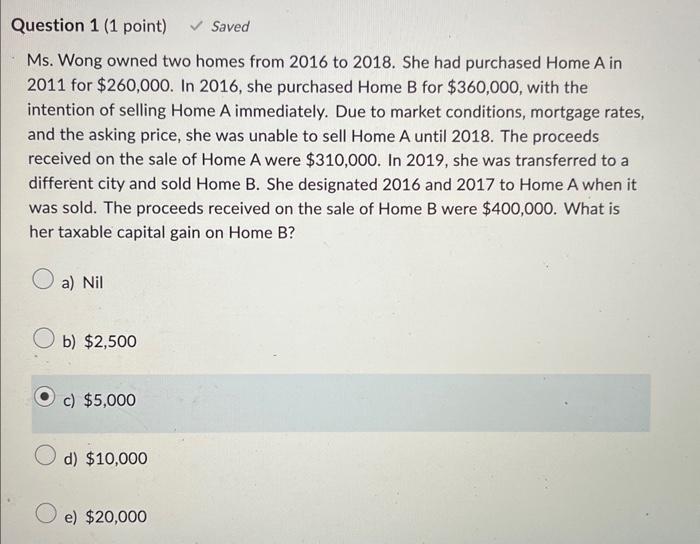

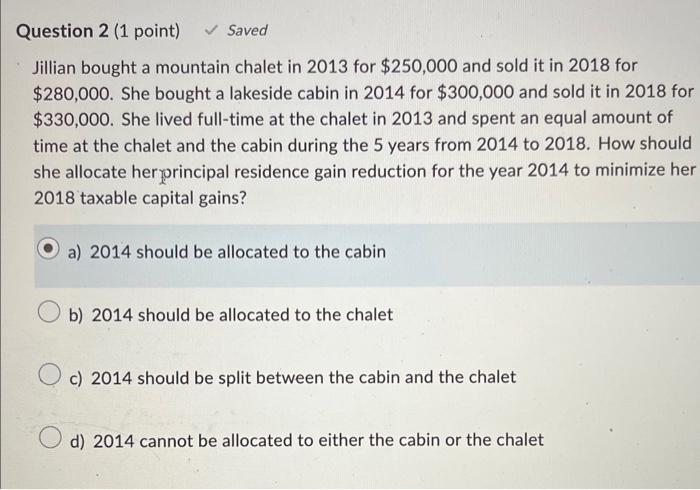

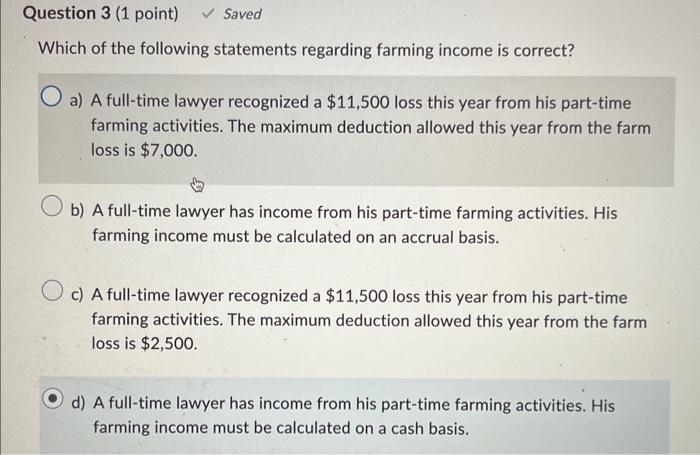

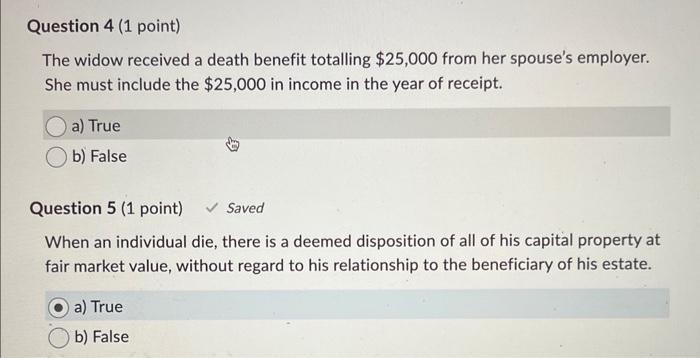

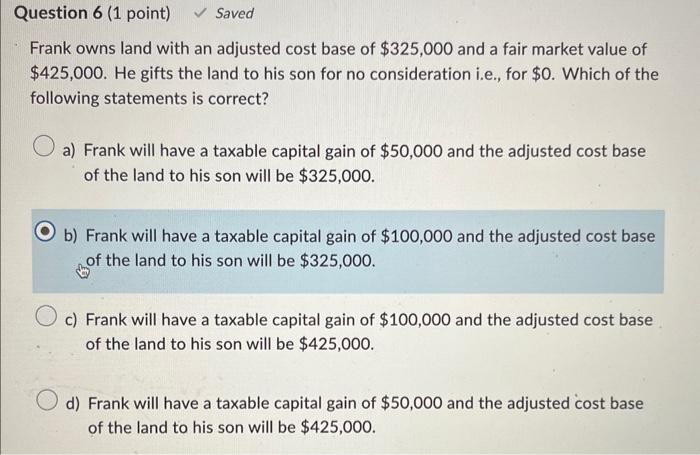

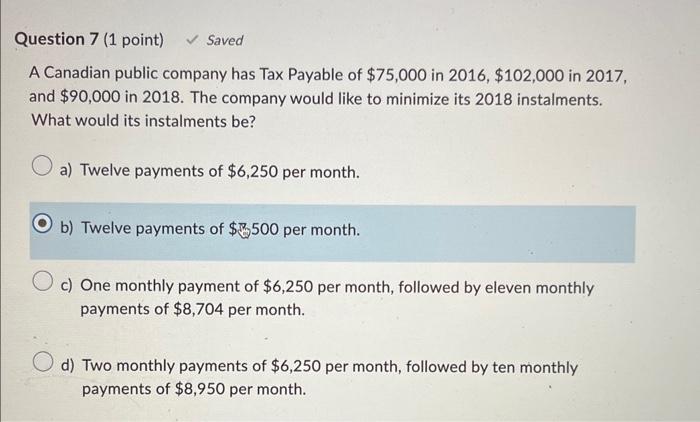

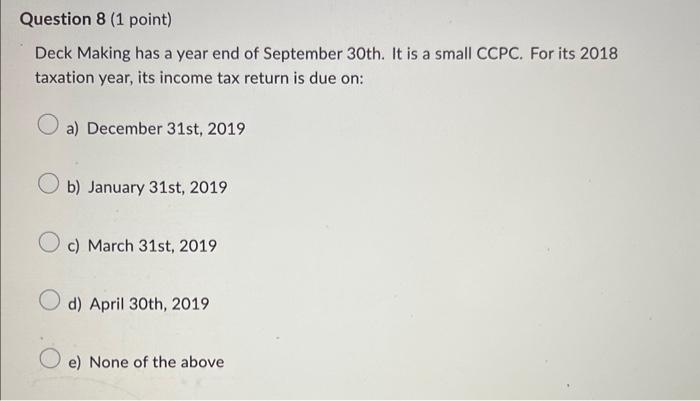

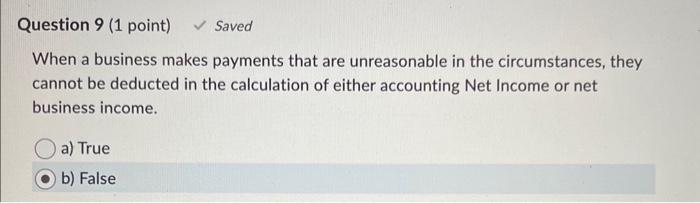

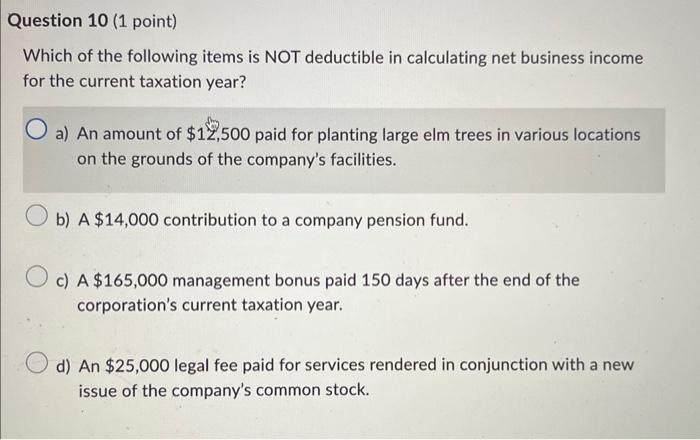

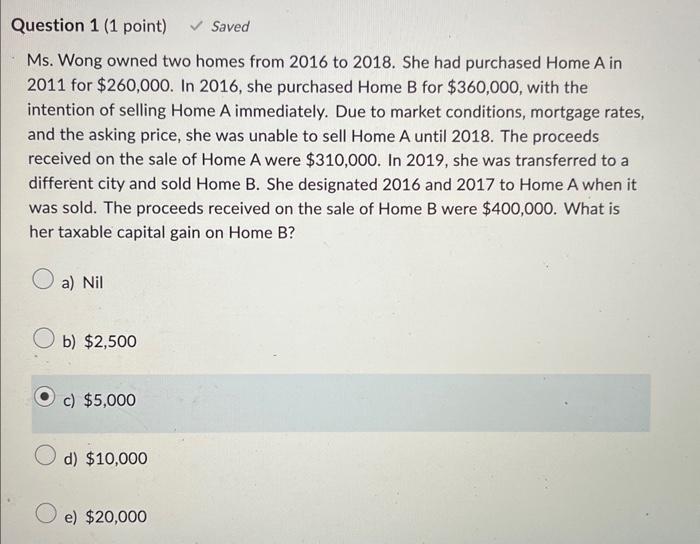

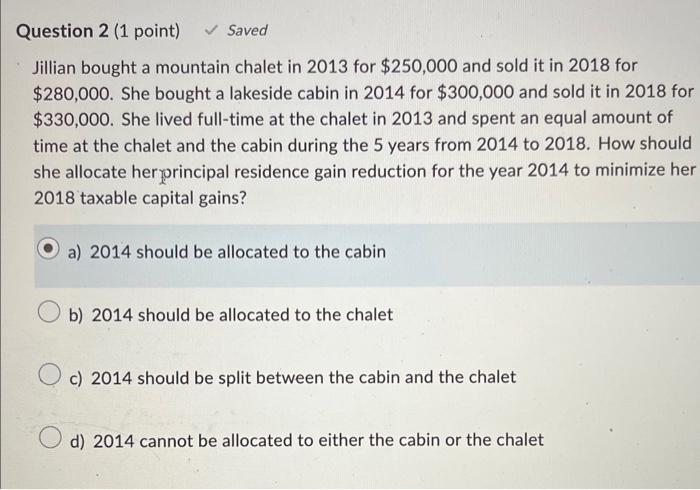

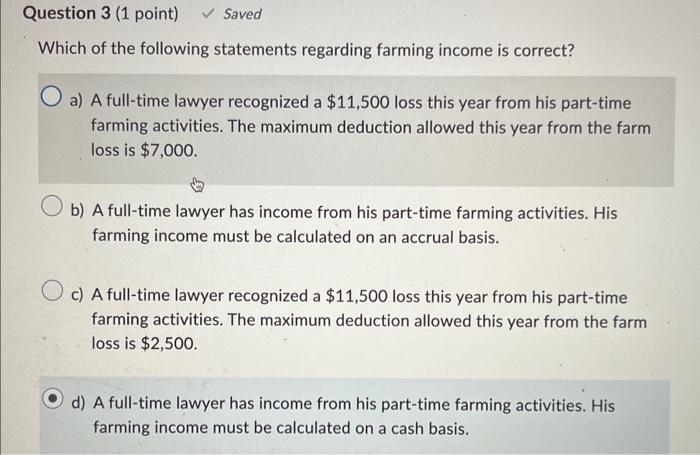

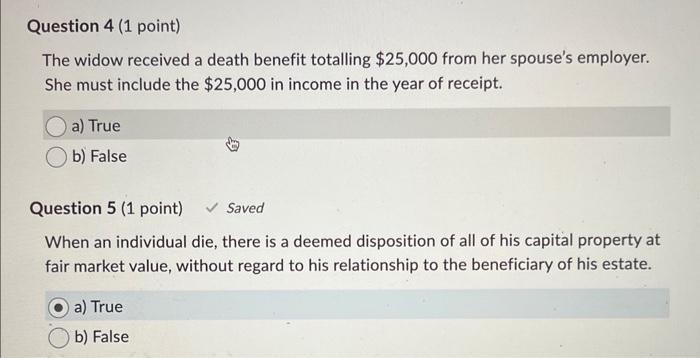

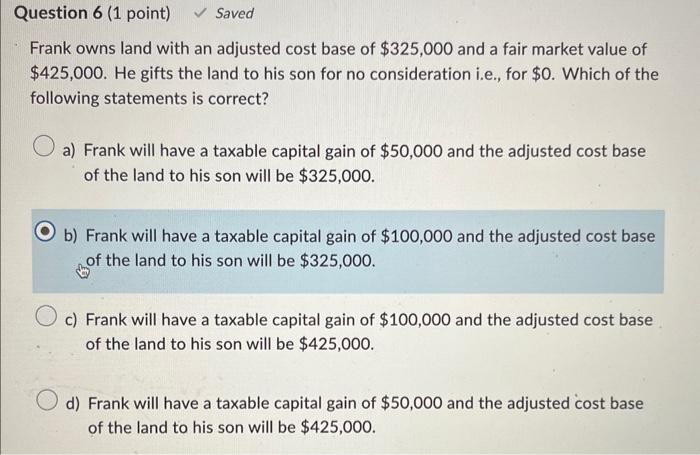

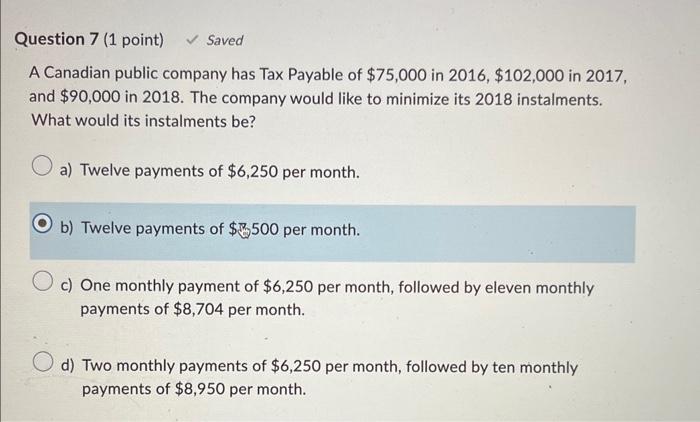

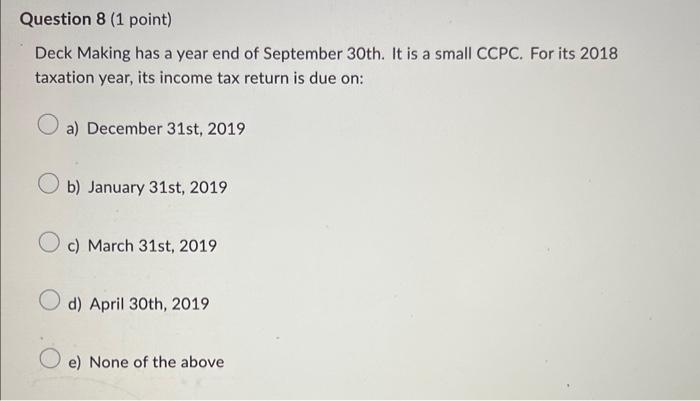

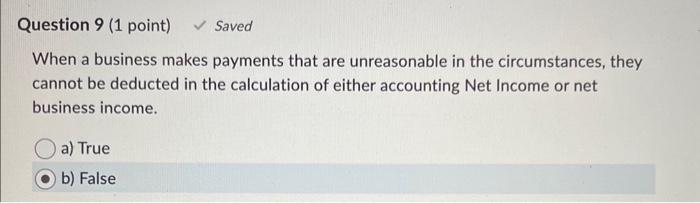

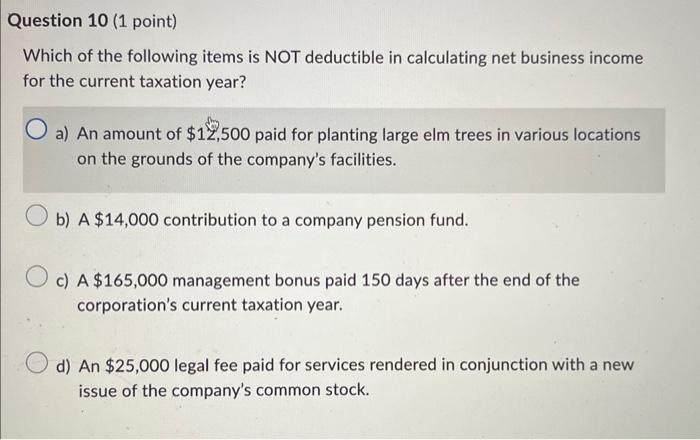

Ms. Wong owned two homes from 2016 to 2018 . She had purchased Home A in 2011 for $260,000. In 2016 , she purchased Home B for $360,000, with the intention of selling Home A immediately. Due to market conditions, mortgage rates, and the asking price, she was unable to sell Home A until 2018. The proceeds received on the sale of Home A were $310,000. In 2019 , she was transferred to a different city and sold Home B. She designated 2016 and 2017 to Home A when it was sold. The proceeds received on the sale of Home B were $400,000. What is her taxable capital gain on Home B? a) Nil b) $2,500 c) $5,000 d) $10,000 e) $20,000 Jillian bought a mountain chalet in 2013 for $250,000 and sold it in 2018 for $280,000. She bought a lakeside cabin in 2014 for $300,000 and sold it in 2018 for $330,000. She lived full-time at the chalet in 2013 and spent an equal amount of time at the chalet and the cabin during the 5 years from 2014 to 2018 . How should she allocate her porincipal residence gain reduction for the year 2014 to minimize her 2018 taxable capital gains? a) 2014 should be allocated to the cabin b) 2014 should be allocated to the chalet c) 2014 should be split between the cabin and the chalet d) 2014 cannot be allocated to either the cabin or the chalet Which of the following statements regarding farming income is correct? a) A full-time lawyer recognized a $11,500 loss this year from his part-time farming activities. The maximum deduction allowed this year from the farm loss is $7,000. b) A full-time lawyer has income from his part-time farming activities. His farming income must be calculated on an accrual basis. c) A full-time lawyer recognized a $11,500 loss this year from his part-time farming activities. The maximum deduction allowed this year from the farm loss is $2,500. d) A full-time lawyer has income from his part-time farming activities. His farming income must be calculated on a cash basis. The widow received a death benefit totalling $25,000 from her spouse's employer. She must include the $25,000 in income in the year of receipt. a) True b) False Question 5 (1 point) Saved When an individual die, there is a deemed disposition of all of his capital property at fair market value, without regard to his relationship to the beneficiary of his estate. a) True b) False Frank owns land with an adjusted cost base of $325,000 and a fair market value of $425,000. He gifts the land to his son for no consideration i.e., for $0. Which of the following statements is correct? a) Frank will have a taxable capital gain of $50,000 and the adjusted cost base of the land to his son will be $325,000. b) Frank will have a taxable capital gain of $100,000 and the adjusted cost base of the land to his son will be $325,000. c) Frank will have a taxable capital gain of $100,000 and the adjusted cost base of the land to his son will be $425,000. d) Frank will have a taxable capital gain of $50,000 and the adjusted cost base of the land to his son will be $425,000. A Canadian public company has Tax Payable of $75,000 in 2016,$102,000 in 2017 , and $90,000 in 2018 . The company would like to minimize its 2018 instalments. What would its instalments be? a) Twelve payments of $6,250 per month. b) Twelve payments of $8500 per month. c) One monthly payment of $6,250 per month, followed by eleven monthly payments of $8,704 per month. d) Two monthly payments of $6,250 per month, followed by ten monthly payments of $8,950 per month. Deck Making has a year end of September 30th. It is a small CCPC. For its 2018 taxation year, its income tax return is due on: a) December 31 st, 2019 b) January 31 st, 2019 c) March 31st, 2019 d) April 30th, 2019 e) None of the above When a business makes payments that are unreasonable in the circumstances, they cannot be deducted in the calculation of either accounting Net Income or net business income. a) True b) False question 10 (1 point) Which of the following items is NOT deductible in calculating net business income for the current taxation year? a) An amount of $12,500 paid for planting large elm trees in various locations on the grounds of the company's facilities. b) A $14,000 contribution to a company pension fund. c) A$165,000 management bonus paid 150 days after the end of the corporation's current taxation year. d) An $25,000 legal fee paid for services rendered in conjunction with a new issue of the company's common stock

Ms. Wong owned two homes from 2016 to 2018 . She had purchased Home A in 2011 for $260,000. In 2016 , she purchased Home B for $360,000, with the intention of selling Home A immediately. Due to market conditions, mortgage rates, and the asking price, she was unable to sell Home A until 2018. The proceeds received on the sale of Home A were $310,000. In 2019 , she was transferred to a different city and sold Home B. She designated 2016 and 2017 to Home A when it was sold. The proceeds received on the sale of Home B were $400,000. What is her taxable capital gain on Home B? a) Nil b) $2,500 c) $5,000 d) $10,000 e) $20,000 Jillian bought a mountain chalet in 2013 for $250,000 and sold it in 2018 for $280,000. She bought a lakeside cabin in 2014 for $300,000 and sold it in 2018 for $330,000. She lived full-time at the chalet in 2013 and spent an equal amount of time at the chalet and the cabin during the 5 years from 2014 to 2018 . How should she allocate her porincipal residence gain reduction for the year 2014 to minimize her 2018 taxable capital gains? a) 2014 should be allocated to the cabin b) 2014 should be allocated to the chalet c) 2014 should be split between the cabin and the chalet d) 2014 cannot be allocated to either the cabin or the chalet Which of the following statements regarding farming income is correct? a) A full-time lawyer recognized a $11,500 loss this year from his part-time farming activities. The maximum deduction allowed this year from the farm loss is $7,000. b) A full-time lawyer has income from his part-time farming activities. His farming income must be calculated on an accrual basis. c) A full-time lawyer recognized a $11,500 loss this year from his part-time farming activities. The maximum deduction allowed this year from the farm loss is $2,500. d) A full-time lawyer has income from his part-time farming activities. His farming income must be calculated on a cash basis. The widow received a death benefit totalling $25,000 from her spouse's employer. She must include the $25,000 in income in the year of receipt. a) True b) False Question 5 (1 point) Saved When an individual die, there is a deemed disposition of all of his capital property at fair market value, without regard to his relationship to the beneficiary of his estate. a) True b) False Frank owns land with an adjusted cost base of $325,000 and a fair market value of $425,000. He gifts the land to his son for no consideration i.e., for $0. Which of the following statements is correct? a) Frank will have a taxable capital gain of $50,000 and the adjusted cost base of the land to his son will be $325,000. b) Frank will have a taxable capital gain of $100,000 and the adjusted cost base of the land to his son will be $325,000. c) Frank will have a taxable capital gain of $100,000 and the adjusted cost base of the land to his son will be $425,000. d) Frank will have a taxable capital gain of $50,000 and the adjusted cost base of the land to his son will be $425,000. A Canadian public company has Tax Payable of $75,000 in 2016,$102,000 in 2017 , and $90,000 in 2018 . The company would like to minimize its 2018 instalments. What would its instalments be? a) Twelve payments of $6,250 per month. b) Twelve payments of $8500 per month. c) One monthly payment of $6,250 per month, followed by eleven monthly payments of $8,704 per month. d) Two monthly payments of $6,250 per month, followed by ten monthly payments of $8,950 per month. Deck Making has a year end of September 30th. It is a small CCPC. For its 2018 taxation year, its income tax return is due on: a) December 31 st, 2019 b) January 31 st, 2019 c) March 31st, 2019 d) April 30th, 2019 e) None of the above When a business makes payments that are unreasonable in the circumstances, they cannot be deducted in the calculation of either accounting Net Income or net business income. a) True b) False question 10 (1 point) Which of the following items is NOT deductible in calculating net business income for the current taxation year? a) An amount of $12,500 paid for planting large elm trees in various locations on the grounds of the company's facilities. b) A $14,000 contribution to a company pension fund. c) A$165,000 management bonus paid 150 days after the end of the corporation's current taxation year. d) An $25,000 legal fee paid for services rendered in conjunction with a new issue of the company's common stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started