Answered step by step

Verified Expert Solution

Question

1 Approved Answer

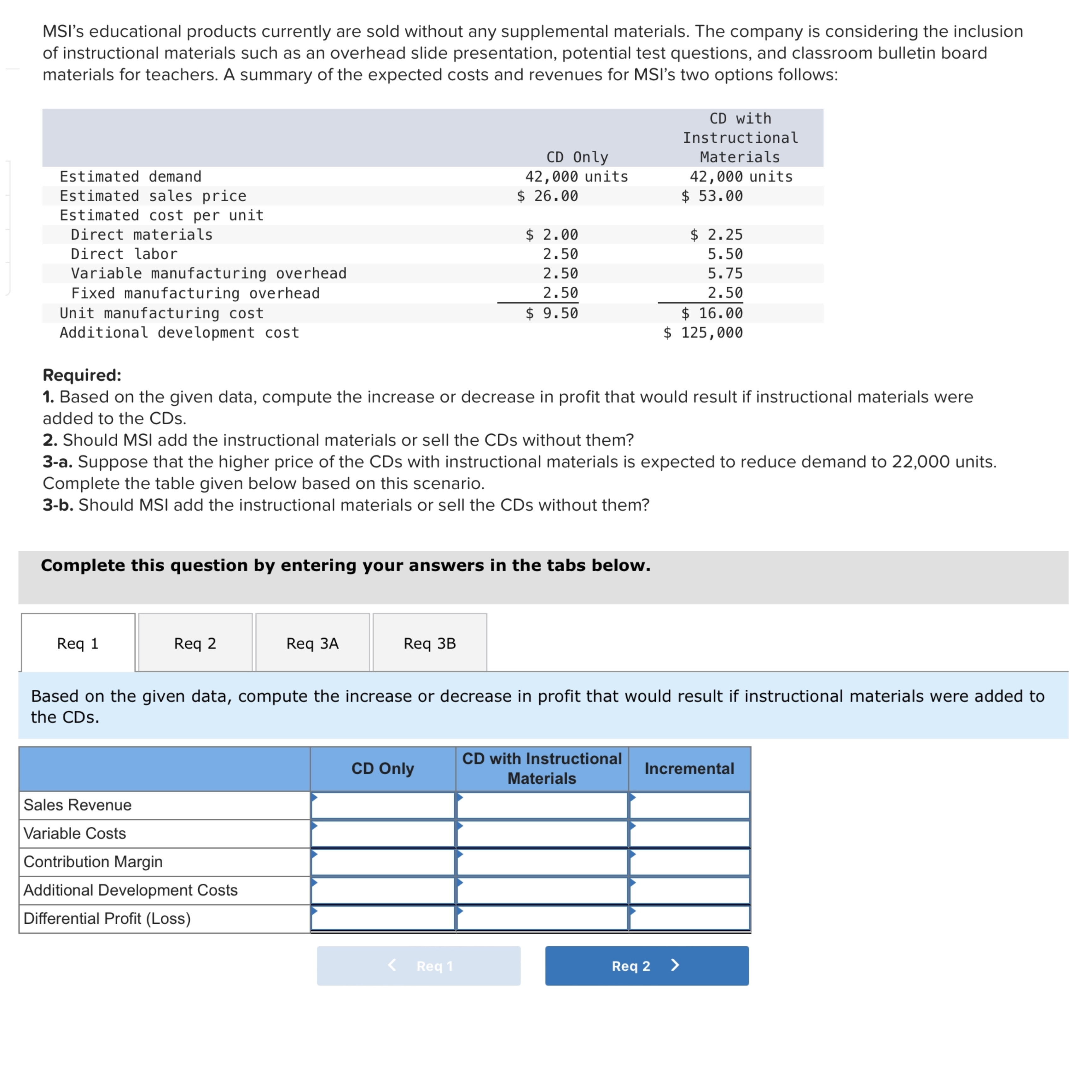

MSI's educational products currently are sold without any supplemental materials. The company is considering the inclusion of instructional materials such as an overhead slide presentation,

MSI's educational products currently are sold without any supplemental materials. The company is considering the inclusion

of instructional materials such as an overhead slide presentation, potential test questions, and classroom bulletin board

materials for teachers. A summary of the expected costs and revenues for MSI's two options follows:

Required:

Based on the given data, compute the increase or decrease in profit that would result if instructional materials were

added to the CDs

Should MSI add the instructional materials or sell the CDs without them?

a Suppose that the higher price of the CDs with instructional materials is expected to reduce demand to units.

Complete the table given below based on this scenario.

b Should MSI add the instructional materials or sell the CDs without them?

Complete this question by entering your answers in the tabs below.

Req

Req

Based on the given data, compute the increase or decrease in profit that would result if instructional materials were added to

the CDs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started