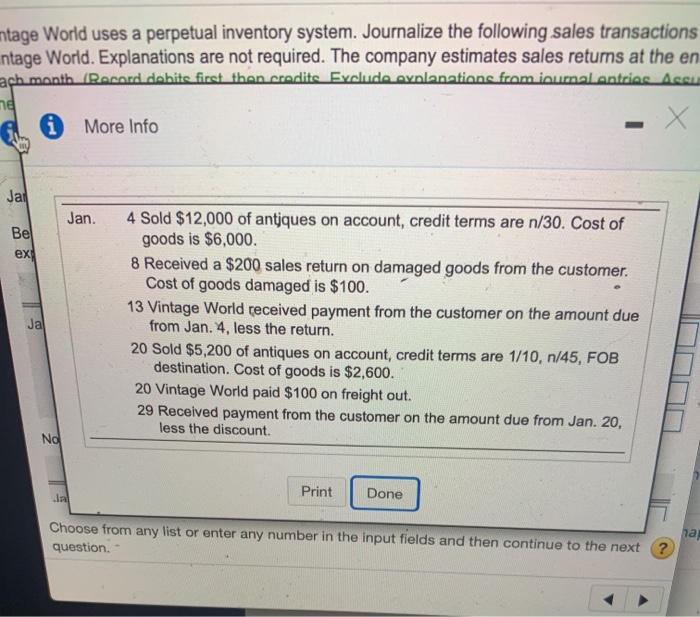

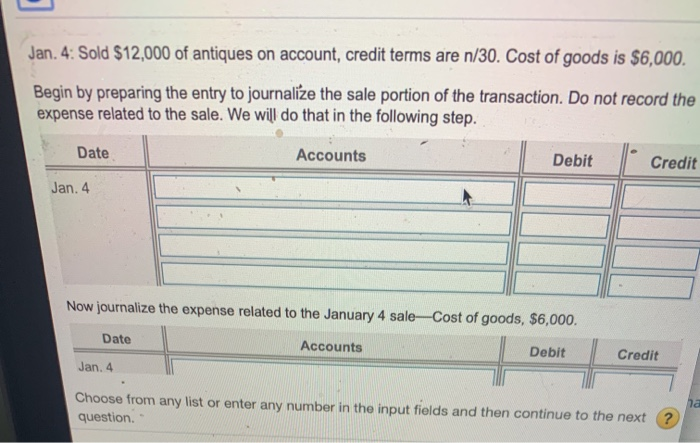

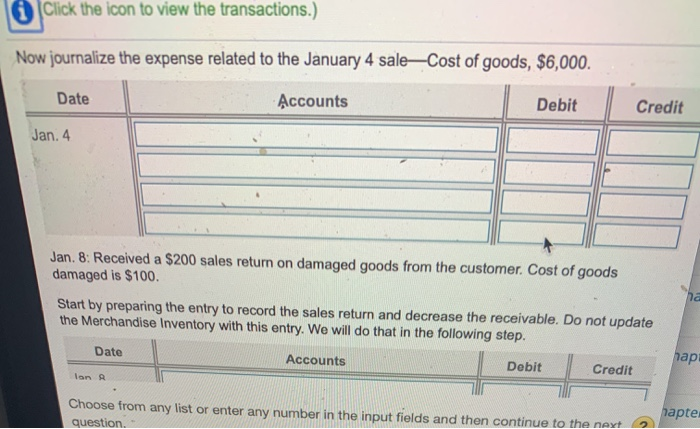

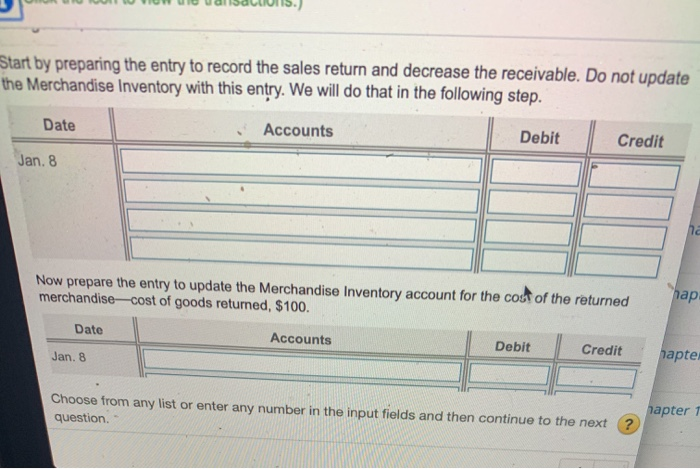

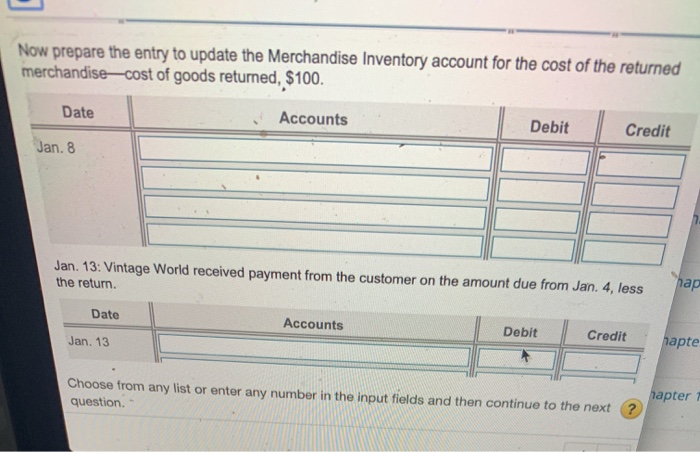

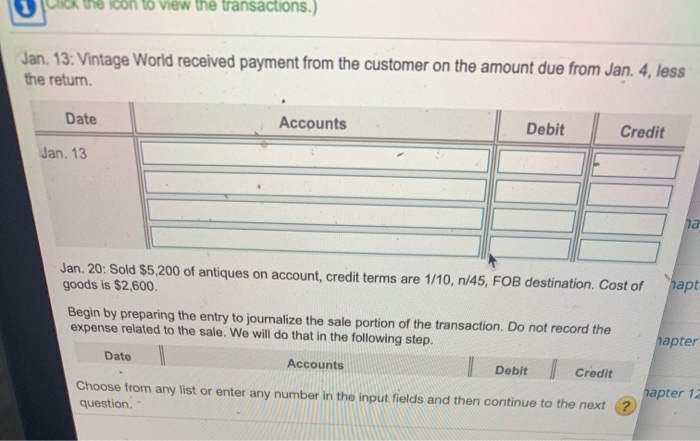

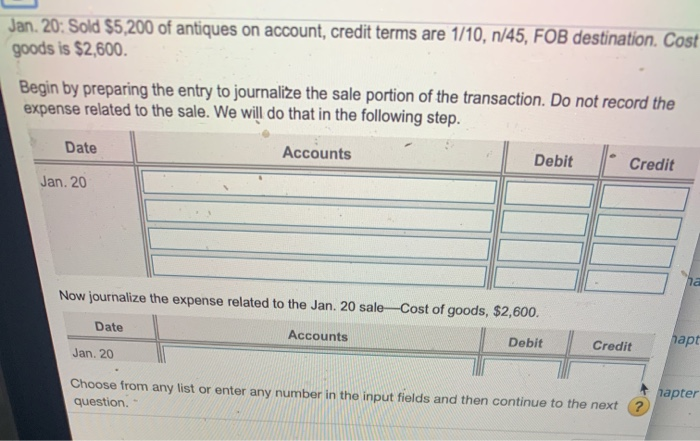

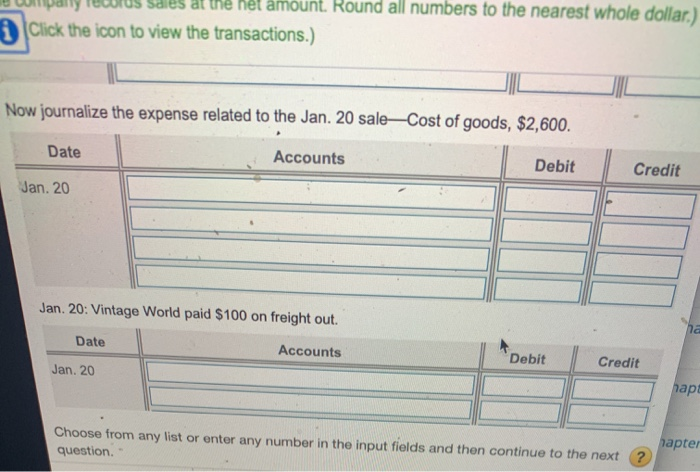

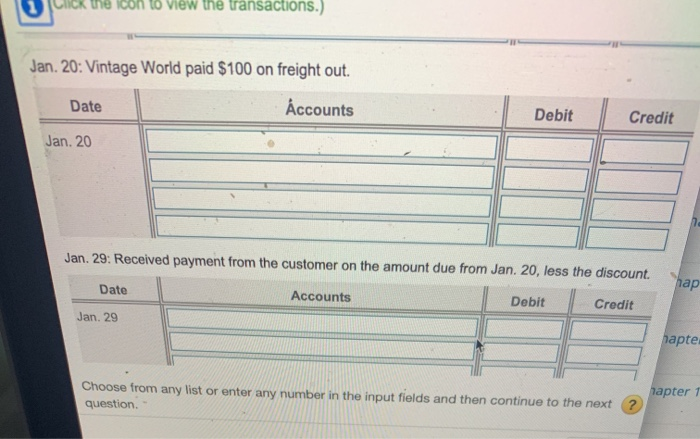

mtage World uses a perpetual inventory system. Journalize the following sales transactions intage World. Explanations are not required. The company estimates sales returns at the en ach month (Record dahits first then credits Exclude aynlanations from ournal entries Assu ng More Info Jai Jan. Be ext Ja 4 Sold $12,000 of antiques on account, credit terms are n/30. Cost of goods is $6,000. 8 Received a $200 sales return on damaged goods from the customer. Cost of goods damaged is $100. 13 Vintage World received payment from the customer on the amount due from Jan. 4, less the return. 20 Sold $5,200 of antiques on account, credit terms are 1/10, n/45, FOB destination. Cost of goods is $2,600. 20 Vintage World paid $100 on freight out. 29 Received payment from the customer on the amount due from Jan. 20, less the discount No Print Done Choose from any list or enter any number in the input fields and then continue to the next ? question. na, Jan. 4: Sold $12,000 of antiques on account, credit terms are n/30. Cost of goods is $6,000. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts Debit Credit Jan. 4 Now journalize the expense related to the January 4 saleCost of goods, $6,000. Date Accounts Debit Credit Jan. 4 Choose from any list or enter any number in the input fields and then continue to the next ? question. na Click the icon to view the transactions.) Now journalize the expense related to the January 4 sale-Cost of goods, $6,000. Date Accounts Debit Credit Jan. 4 Jan. 8: Received a $200 sales return on damaged goods from the customer. Cost of goods damaged is $100. na Start by preparing the entry to record the sales return and decrease the receivable. Do not update the Merchandise Inventory with this entry. We will do that in the following step. Date Accounts nap: Debit Credit lan a Choose from any list or enter any number in the input fields and then continue to the next question. Tapte Start by preparing the entry to record the sales return and decrease the receivable. Do not update the Merchandise Inventory with this entry. We will do that in the following step. Date Accounts Debit Credit Jan. 8 na Now prepare the entry to update the Merchandise Inventory account for the cost of the returned merchandise-cost of goods returned, $100. nap Date Accounts Debit Credit Jan. 8 hapte Choose from any list or enter any number in the input fields and then continue to the next ? question. hapter 1 Now prepare the entry to update the Merchandise Inventory account for the cost of the returned merchandise-cost of goods returned, $100. Date Accounts Debit Credit Jan. 8 Jan. 13: Vintage World received payment from the customer on the amount due from Jan. 4, less the return. hap Date Accounts Debit Jan. 13 Credit hapte Choose from any list or enter any number in the input fields and then continue to the next question hapter 1 ? on to view the transactions.) Jan. 13: Vintage World received payment from the customer on the amount due from Jan. 4, less the return Date Accounts Debit Credit Jan. 13 ia Jan. 20: Sold $5,200 of antiques on account, credit terms are 1/10, n/45, FOB destination. Cost of goods is $2,600 hapt Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts | Debit Credit hapter Choose from any list or enter any number in the input fields and then continue to the next ? question. Tapter 12 Jan. 20: Sold $5,200 of antiques on account, credit terms are 1/10, n/45, FOB destination. Cost goods is $2,600. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts Debit Credit Jan. 20 Now journalize the expense related to the Jan. 20 sale Cost of goods, $2,600. Date Accounts Debit hapt Credit Jan. 20 Choose from any list or enter any number in the input fields and then continue to the next ? question Tapter sales at the nel amount. Round all numbers to the nearest whole dollar.) Click the icon to view the transactions.) Now journalize the expense related to the Jan. 20 saleCost of goods, $2,600. Date Accounts Debit Credit Jan. 20 Jan. 20: Vintage World paid $100 on freight out. ha Date Accounts Debit Credit Jan. 20 hapt Choose from any list or enter any number in the input fields and then continue to the next? question. apter ne icon to view the transactions.) Jan. 20: Vintage World paid $100 on freight out. Date Accounts Debit Credit Jan. 20 Jan. 29: Received payment from the customer on the amount due from Jan. 20, less the discount. hap Date Accounts Debit Credit Jan. 29 tapte Choose from any list or enter any number in the input fields and then continue to the next ? question Tapter 1