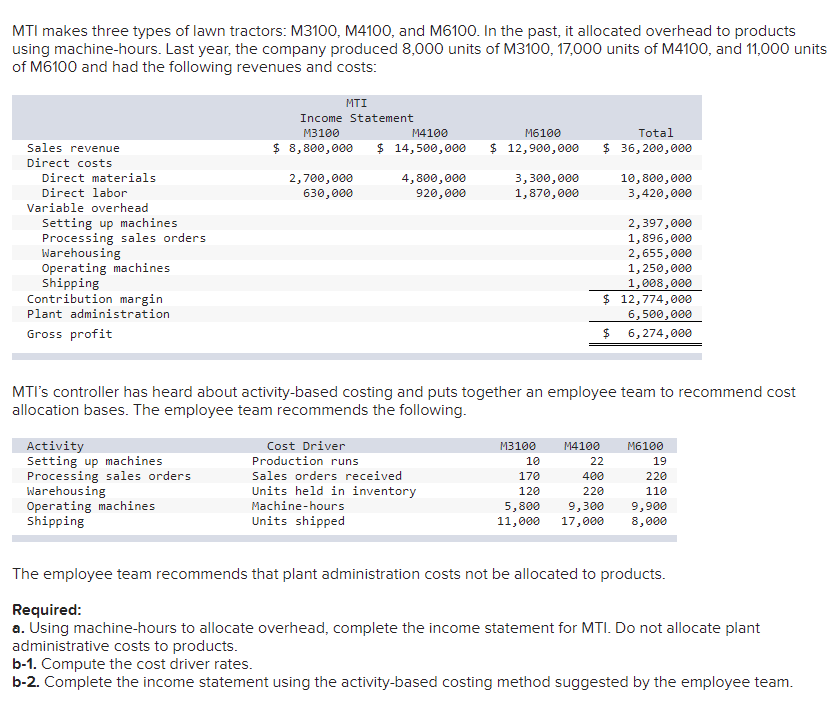

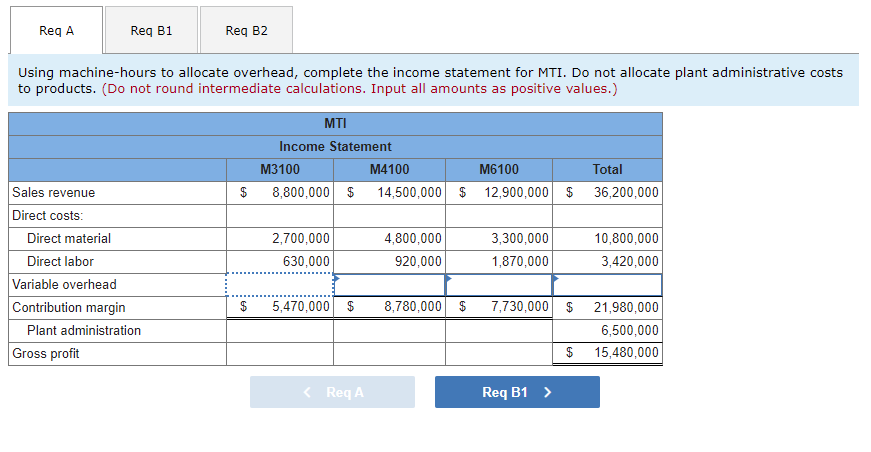

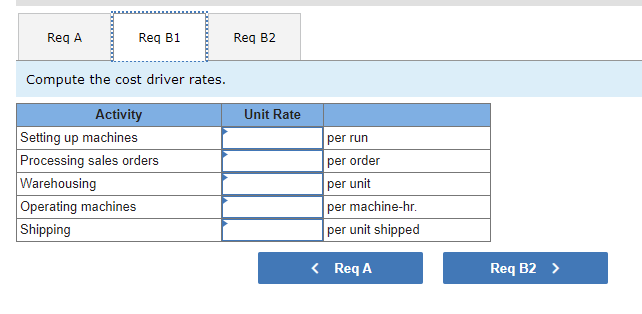

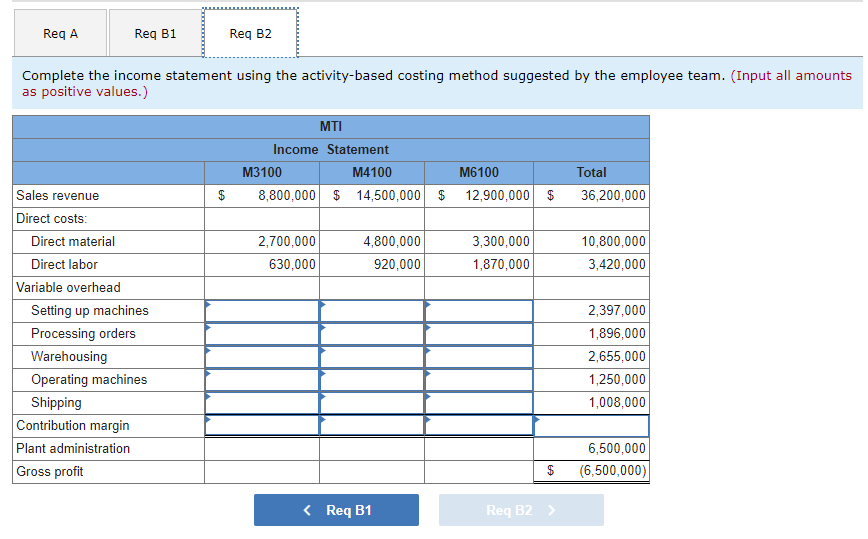

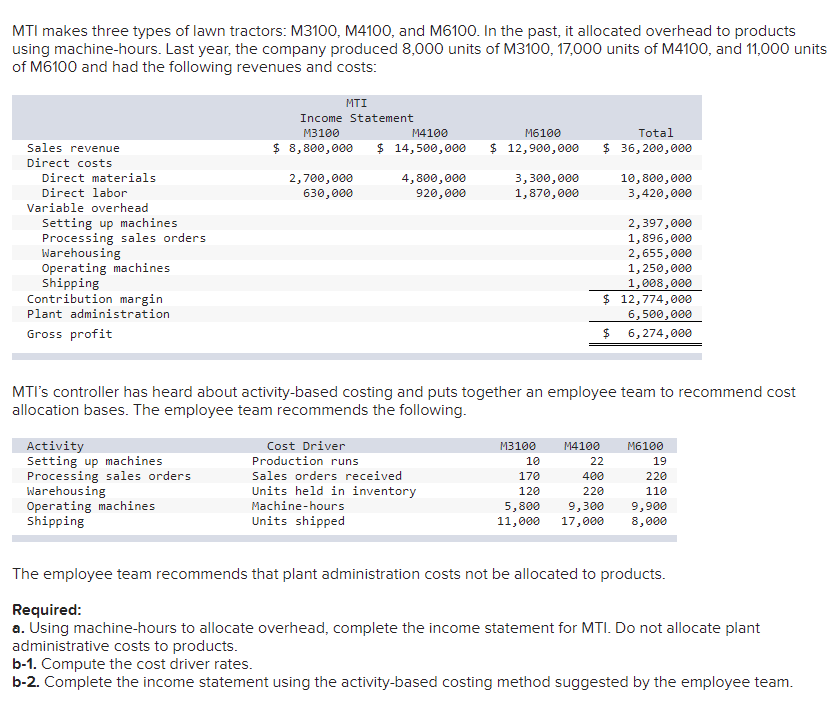

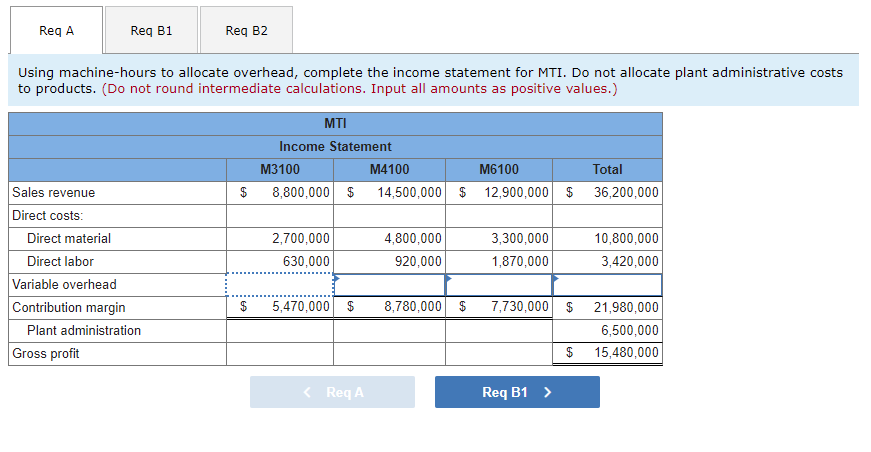

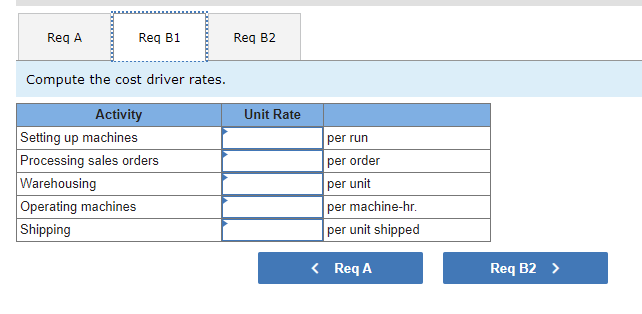

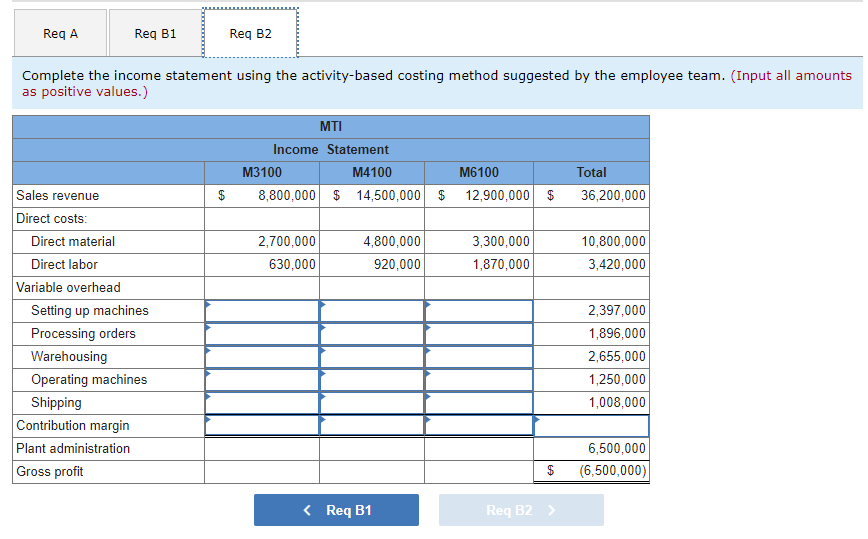

MTI makes three types of lawn tractors: M3100, M4100, and M6100. In the past, it allocated overhead to products using machine-hours. Last year, the company produced 8,000 units of M3100, 17,000 units of M4100, and 11,000 units of M6100 and had the following revenues and costs: MTI Income Statement M3100 M4100 $ 8,800,000 $ 14,500,000 M6100 $ 12,900,000 Total $ 36,200,000 2,700,000 630,000 4,800,000 920,000 3,300,000 1,870,000 10,800,000 3,420,000 Sales revenue Direct costs Direct materials Direct labor Variable overhead Setting up machines Processing sales orders Warehousing Operating machines Shipping Contribution margin Plant administration Gross profit 2,397,000 1,896,000 2,655,000 1,250,000 1,008,000 $ 12,774,000 6,500,000 $ 6,274,000 MTI's controller has heard about activity-based costing and puts together an employee team to recommend cost allocation bases. The employee team recommends the following. M4100 22 400 Activity Setting up machines Processing sales orders Warehousing Operating machines Shipping Cost Driver Production runs Sales orders received Units held in inventory Machine-hours Units shipped M3100 10 170 120 5,800 11,000 M6100 19 220 110 9,900 8,000 220 9,300 17,000 The employee team recommends that plant administration costs not be allocated to products. Required: a. Using machine-hours to allocate overhead, complete the income statement for MTI. Do not allocate plant administrative costs to products. b-1. Compute the cost driver rates. b-2. Complete the income statement using the activity-based costing method suggested by the employee team. Reg A Req B1 Req B2 Using machine-hours to allocate overhead, complete the income statement for MTI. Do not allocate plant administrative costs to products. (Do not round intermediate calculations. Input all amounts as positive values.) MTI Income Statement M3100 M4100 M6100 8,800,000 $ 14,500,000 $ 12,900,000 $ Total 36,200,000 $ 2,700,000 630,000 4,800,000 920,000 3,300,000 1,870,000 10,800,000 3,420,000 Sales revenue Direct costs: Direct material Direct labor Variable overhead Contribution margin Plant administration Gross profit 5,470,000 $ 8,780,000 $ 7,730,000 $ 21,980,000 6,500,000 15,480,000 $ Reg A Reg B1 Reg B2 Compute the cost driver rates. Unit Rate Activity Setting up machines Processing sales orders Warehousing Operating machines Shipping per run per order per unit per machine-hr. per unit shipped Reg A Req B1 Req B2 Complete the income statement using the activity-based costing method suggested by the employee team. (Input all amounts as positive values.) MTI Income Statement M3100 M4100 8,800,000 $ 14,500,000 $ M6100 12,900,000 $ Total 36,200,000 $ 2,700,000 630,000 4,800,000 920,000 3,300,000 1,870,000 10,800,000 3,420,000 Sales revenue Direct costs: Direct material Direct labor Variable overhead Setting up machines Processing orders Warehousing Operating machines Shipping Contribution margin Plant administration Gross profit 2,397,000 1,896,000 2,655,000 1,250,000 1,008,000 6,500,000 (6,500,000) $