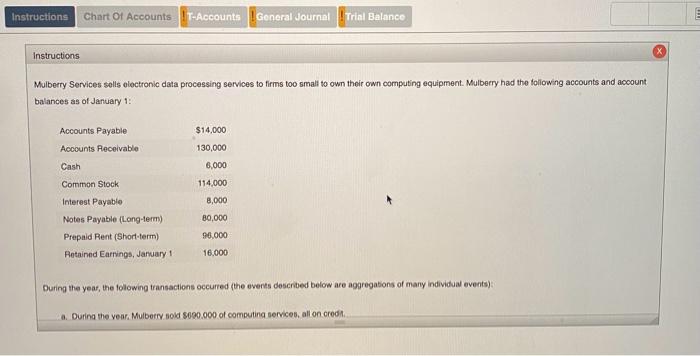

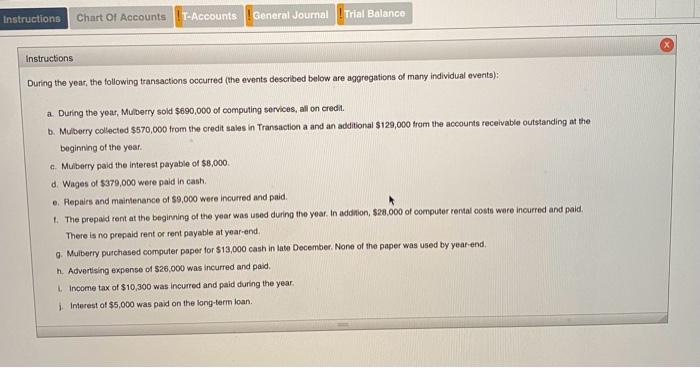

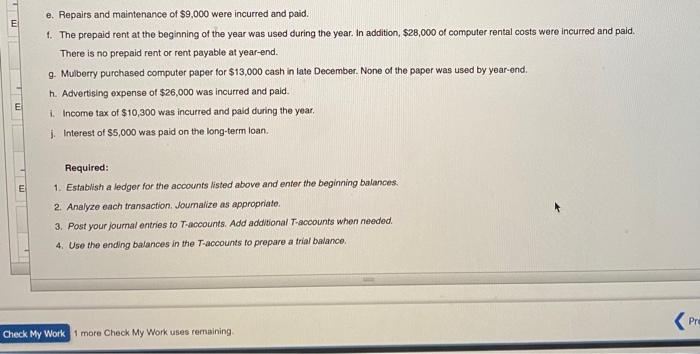

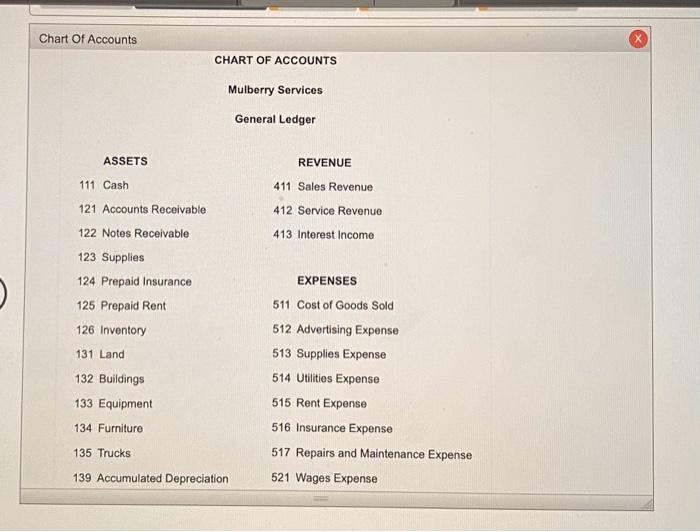

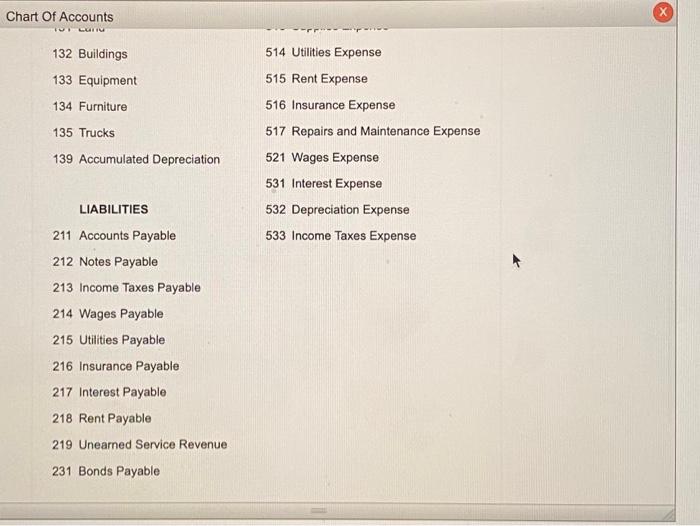

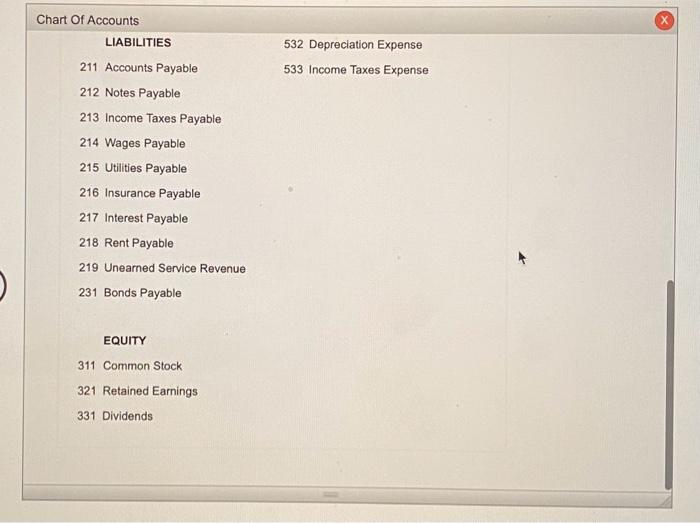

Mulberry Services sells oloctronic data processing services to firms too small to own their own computing equipment. Mulberry had the toliowing accounts and account balances as of January 1 : During the year, the folowing transactions occurred (the events described below are agaregations of many individuad events): a. Durina the vear, Mulberry sold $090.000 of computing serviceb, all on credA. During the year, the following transactions occurred (the events described below are aggrogations of many individual ovents): a. During the year, Mulberry sold $690,000 of computing services, all on credit. b. Mulberry collected $570,000 from the credit sales in Transacticn a and an additional $129,000 Irom the acoounts receivable outstanding at the beginning of the year. 4. Muiberry paid the interest payable of $8,000. d. Wages of $379,000 were paid in cash. e. Fepairs and maintenance of \$9,000 were incurred and paid. 1. The prepaid tent at the beginning of the year was used during the year. In addition, 528.000 of computer rental oosts wore incurred and paid. There is no prepaid rent or rent payable at year-end. 9. Mulberry purchased cemputer paper for $13,000 cash in late December. None of the paper was used by yeaf.end. h. Advertising expense of $26,000 was incurred and paid. 1. Income tax of $10,300 was incurred and paid during the year. 1. Interest of $5,000 was paid on the long-term loan. e. Repairs and maintenance of $9,000 were incurred and paid. f. The prepaid rent at the beginning of the year was used during the year. In addition, $28,000 of computer rental costs were incurred and paid. There is no prepaid rent or rent payable at year-end. 9. Mulberry purchased computer paper for $13,000 cash in late December. None of the paper was used by year-end. h. Advertising expense of $26,000 was incurred and paid. i. Income tax of $10,300 was incurred and paid during the year. j. Interest of $5,000 was paid on the long-term loan. Required: 1. Estabish a ledger for the accounts listed above and enter the beginning balances: 2. Analyze each transaction. Joumalize as appropriate. 3. Post your joumal entries to Taccounts. Add addlitional Traccounts when needed. 4. Use the ending balances in the T-accounts to prepare a trial balance. Chart Of Accounts CHART OF ACCOUNTS Mulberry Services General Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 412 Service Revenue 122 Notes Receivable 413 Interest Income 123 Supplies 124 Prepaid Insurance EXPENSES 125 Prepaid Rent 511 Cost of Goods Sold 126 Inventory 512 Advertising Expense 131 Land 513 Supplies Expense 132 Buildings 514 Utilities Expense 133 Equipment 515 Rent Expense 134 Furniture 516 Insurance Expense 135 Trucks 517 Repairs and Maintenance Expense 139 Accumulated Depreciation 521 Wages Expense Chart Of Accounts 132 Buildings 514 Utilities Expense 133 Equipment 515 Rent Expense 134 Furniture 516 Insurance Expense 135 Trucks 517 Repairs and Maintenance Expense 139 Accumulated Depreciation 521 Wages Expense 531 Interest Expense LIABILITIES 532 Depreciation Expense 211 Accounts Payable 533 Income Taxes Expense 212 Notes Payable 213 Income Taxes Payable 214 Wages Payable 215 Utilities Payable 216 Insurance Payable 217 Interest Payable 218 Rent Payable 219 Unearned Service Revenue 231 Bonds Payable Chart Of Accounts LIABILITIES 532 Depreciation Expense 211 Accounts Payable 533 Income Taxes Expense 212 Notes Payable 213 Income Taxes Payable 214 Wages Payable 215 Utilities Payable 216 Insurance Payable 217 Interest Payable 218 Rent Payable 219 Unearned Service Revenue 231 Bonds Payable EQUITY 311 Common Stock 321 Retained Earnings 331 Dividends