Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mullet, Shark and Starfish operate a business which conducts deep sea fishing trips. Their partnership agreement states that all profits and losses are to be

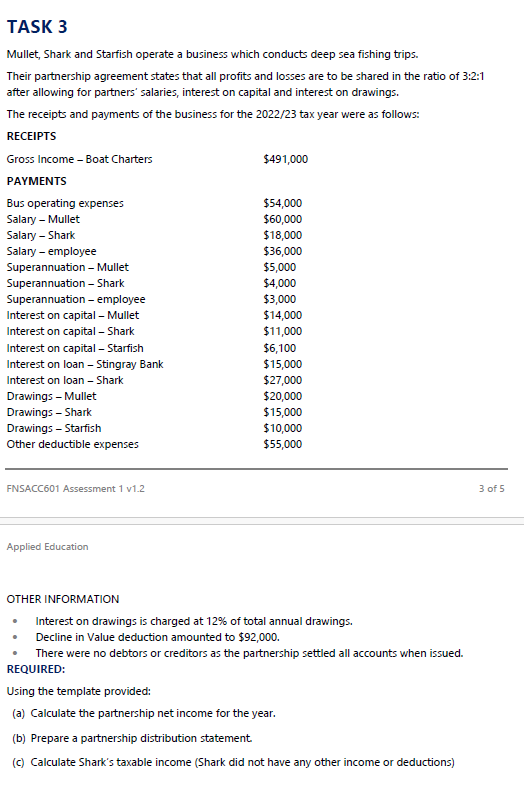

Mullet, Shark and Starfish operate a business which conducts deep sea fishing trips. Their partnership agreement states that all profits and losses are to be shared in the ratio of :: after allowing for partners' salaries, interest on capital and interest on drawings. The receipts and payments of the business for the tax year were as follows: RECEIPTS Gross Income Boat Charters $ PAYMENTS Applied Education OTHER INFORMATION Interest on drawings is charged at of total annual drawings. Decline in Value deduction amounted to $ There were no debtors or creditors as the partnership settled all accounts when issued. REQUIRED: Using the template provided: a Calculate the partnership net income for the year. b Prepare a partnership distribution statement. c Calculate Shark's taxable income Shark did not have any other income or deductions

Mullet, Shark and Starfish operate a business which conducts deep sea fishing trips.

Their partnership agreement states that all profits and losses are to be shared in the ratio of ::

after allowing for partners' salaries, interest on capital and interest on drawings.

The receipts and payments of the business for the tax year were as follows:

RECEIPTS

Gross Income Boat Charters

$

PAYMENTS

Applied Education

OTHER INFORMATION

Interest on drawings is charged at of total annual drawings.

Decline in Value deduction amounted to $

There were no debtors or creditors as the partnership settled all accounts when issued.

REQUIRED:

Using the template provided:

a Calculate the partnership net income for the year.

b Prepare a partnership distribution statement.

c Calculate Shark's taxable income Shark did not have any other income or deductions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started