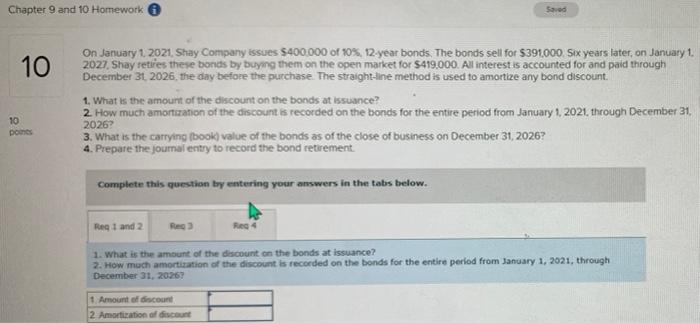

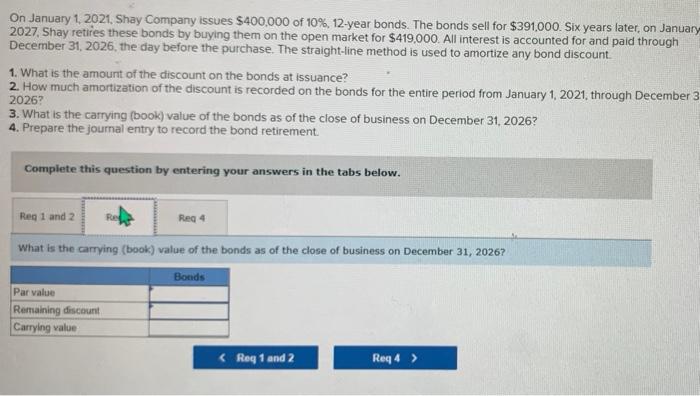

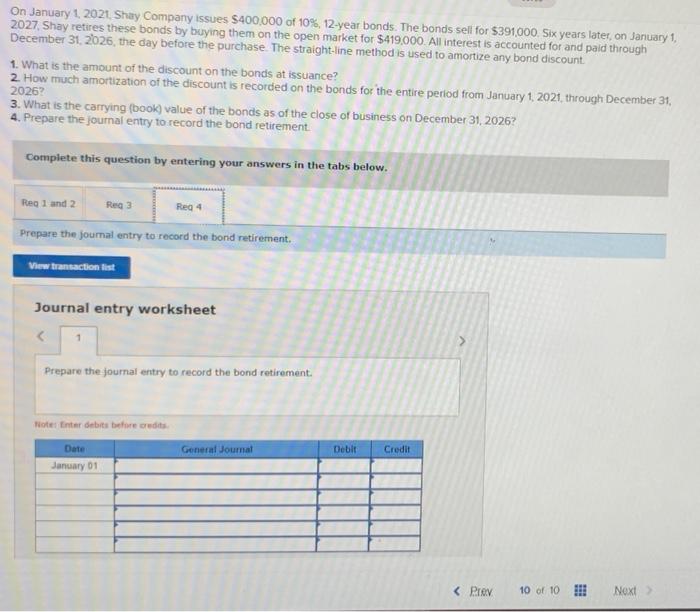

Chapter 9 and 10 Homework 6 Saved 10 On January 1 2021. Shay Company issues $400.000 of 10%, 12-year bonds. The bonds sell for $391.000. Six years later, on Januaryt. 2027. Shay retires these bonds by buying them on the open market for $419.000. Al interest is accounted for and paid through December 31, 2026, the day before the purchase. The straight-line method is used to amortize any bond discount 1. What is the amount of the discount on the bonds at Issuance? 2. How much amortization of the discount is recorded on the bonds for the entire period from January 1, 2021. through December 31, 2026 3. What is the carrying (book) value of the bonds as of the close of business on December 31, 2026? 4. Prepare the journal entry to record the bond retirement 10 pomes Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reo Ries 1. What is the amount of the discount on the bonds at issuance? 2. How much amortization of the discount is recorded on the bonds for the entire period from January 1, 2021, through December 31, 20267 1 Amount of discount 2 Amortization of discount On January 1, 2021, Shay Company issues 400,000 of 10%, 12-year bonds. The bonds sell for $391,000. Six years later, on January 2027. Shay retires these bonds by buying them on the open market for $419,000. All interest is accounted for and paid through December 31, 2026, the day before the purchase. The straight-line method is used to amortize any bond discount 1. What is the amount of the discount on the bonds at issuance? 2. How much amortization of the discount is recorded on the bonds for the entire period from January 1, 2021, through December 3 2026? 3. What is the carrying (book) value of the bonds as of the close of business on December 31, 2026? 4. Prepare the journal entry to record the bond retirement. Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg4 What is the carrying (book) value of the bonds as of the close of business on December 31, 2026? Bonds Par value Remaining discount Carrying value On January 1 2021. Shay Company issues S400,000 of 10%, 12-year bonds. The bonds sell for $391,000. Six years later, on January 1, 2027, Shay retires these bonds by buying them on the open market for $419,000. All interest is accounted for and paid through December 31, 2026, the day before the purchase. The straight-line method is used to amortize any bond discount 1. What is the amount of the discount on the bonds at issuance? 2. How much amortization of the discount is recorded on the bonds for the entire period from January 1, 2021, through December 31, 20262 3. What is the carrying (book) value of the bonds as of the close of business on December 31, 20267 4. Prepare the journal entry to record the bond retirement. Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 3 Reg 4 Prepare the journal entry to record the bond retirement. View transaction list Journal entry worksheet Prepare the journal entry to record the bond retirement. Noter Enter bits before credits General Journal Debit Credit Date January 01