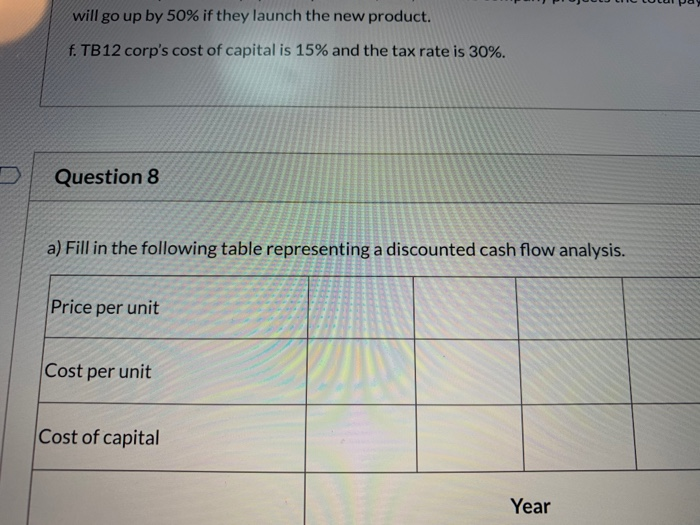

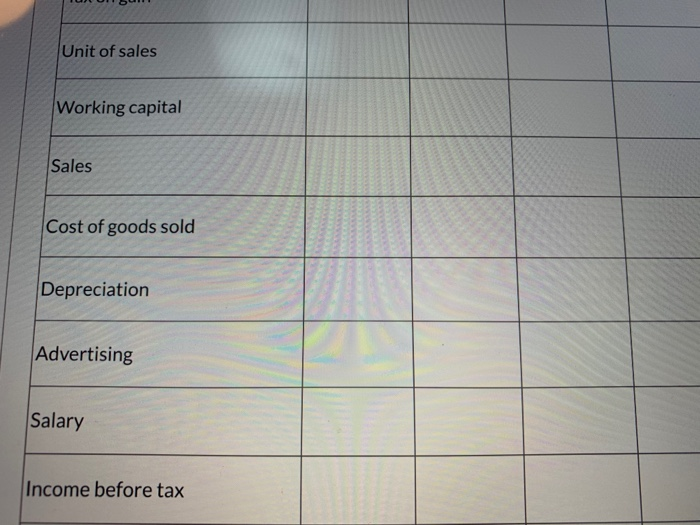

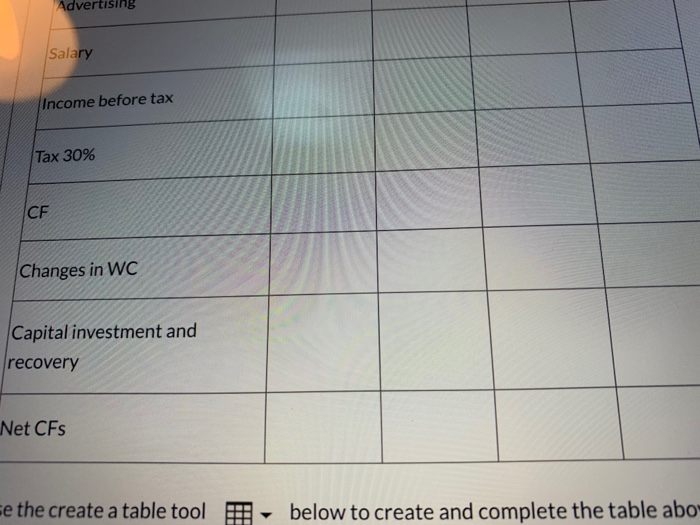

Multi-Part Question: The following applies to Questions 8-9. TB12 corp is considering launching a new product. Use the following information: a. The initial investment in equipment is $300,000. This investment will be depreciated straig over 3 years to a value of zero, but when the project comes to an end in 3 years, the equipme in fact, be sold for $100,000. b. TB12 corp already spent $120,000 on market share research. The project will require on annual advertising cost of $60,000. c. TB12 corp estimates that the first year unit of sale will be 140,000 units. The unit of sale up by 10,000 units a year. d. TB12 corp planned price per unit is $10 and each product costs $7 to make. e. TB12 corp needs to spend $100,000 in its working capital account when it launches th The company projects this working capital account will increase by $10,000 every year capital will reduce to zero in the final year of the project. e. TB12 corp's current payroll expense is $400,000. The company projects the total pay will go up by 50% if they launch the new product. f. TB12 corp's cost of capital is 15% and the tax rate is 30%. will go up by 50% if they launch the new product. f. TB12 corp's cost of capital is 15% and the tax rate is 30%. Question 8 a) Fill in the following table representing a discounted cash flow analysis. Price per unit Cost per unit Cost of capital Year Unit of sales Working capital Sales Cost of goods sold Depreciation Advertising Salary Income before tax Advertising Salary Income before tax Tax 30% CF Changes in WC Capital investment and recovery Net CFs ce the create a table tool below to create and complete the table abo Multi-Part Question: The following applies to Questions 8-9. TB12 corp is considering launching a new product. Use the following information: a. The initial investment in equipment is $300,000. This investment will be depreciated straig over 3 years to a value of zero, but when the project comes to an end in 3 years, the equipme in fact, be sold for $100,000. b. TB12 corp already spent $120,000 on market share research. The project will require on annual advertising cost of $60,000. c. TB12 corp estimates that the first year unit of sale will be 140,000 units. The unit of sale up by 10,000 units a year. d. TB12 corp planned price per unit is $10 and each product costs $7 to make. e. TB12 corp needs to spend $100,000 in its working capital account when it launches th The company projects this working capital account will increase by $10,000 every year capital will reduce to zero in the final year of the project. e. TB12 corp's current payroll expense is $400,000. The company projects the total pay will go up by 50% if they launch the new product. f. TB12 corp's cost of capital is 15% and the tax rate is 30%. will go up by 50% if they launch the new product. f. TB12 corp's cost of capital is 15% and the tax rate is 30%. Question 8 a) Fill in the following table representing a discounted cash flow analysis. Price per unit Cost per unit Cost of capital Year Unit of sales Working capital Sales Cost of goods sold Depreciation Advertising Salary Income before tax Advertising Salary Income before tax Tax 30% CF Changes in WC Capital investment and recovery Net CFs ce the create a table tool below to create and complete the table abo