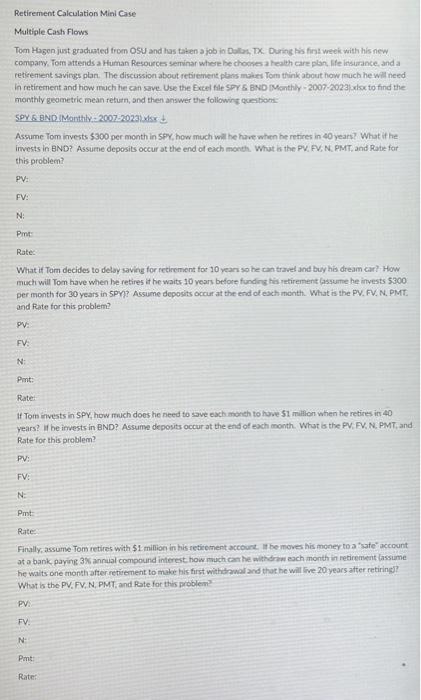

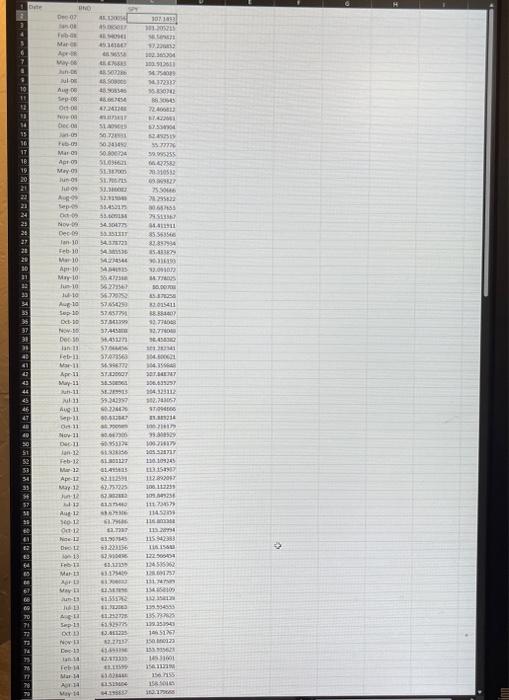

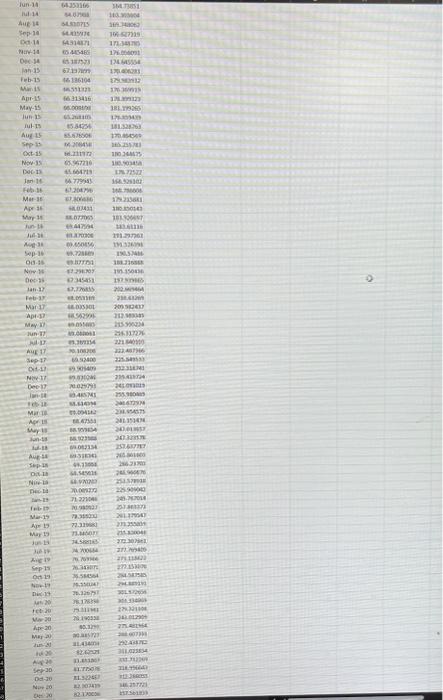

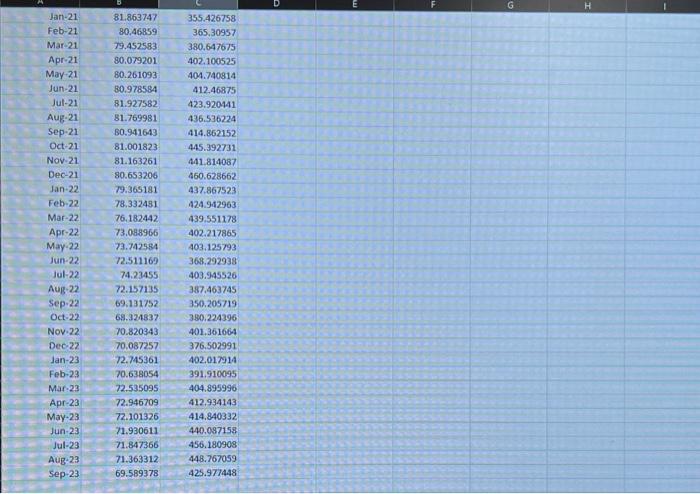

Multiple Cash Flows Tom Hagen just graduated from OSU and has taken a job in Dalbs, DX. During las first week with his new compary. Tom attends a Human Resources senvinar where be chooses a feath care plan, life insurance, and a reticenient savings plan. The discussion about retirenent plans makes Tom think about how rnuch he will need monthly geometric mean fetum, and then answer the following qoeabons: Assume Tom invests 5300 per month in SFY, how much wal he have when he retices in 40 years? What if he invests in BND? Assume deposits occur at the end of each month. What is the PV, FV, N. PMT, and Rate for this problem? PV: FV: N: Pmt: Rate: What if Tom decides to delay saving for recirement for 10 years so he can travel and buy his dream car? How muchi will Tom have when he retires it he waits 10 years before funding his retirement (assume he inyests 5300 per month for 30 years in SPY?? Assume deposits occur at the end of exch month. What is the PV. FV. N. PMT. and Fate for this problem? PV: FV: N: Pint: Rate: If Tom invests in SPY, how ruuch does he need to save exch moneh to huve 51 million when he retires ir 40 years? it he irvests in BND? Assume deposits occur at the end of exch month. Whot is the PV, FV, N, PMT, and Rate for this problem? PV: FV: N. Pmt: Rate: Finally, assume Tom retires with $1 million in his reticoment accourc. It he moves his money to a "sate" account at o bank paying 3K annual compound interest how much can he withdram ach month in retirement lassume he waits one month after retienent to mulor his first withorwal and that he will live 20 years atter retiring? What is the PV, FV, N, PMT, and Fote for this problem? PV: FV: N: Pont: Rate: Multiple Cash Flows Tom Hagen just graduated from OSU and has taken a job in Dalbs, DX. During las first week with his new compary. Tom attends a Human Resources senvinar where be chooses a feath care plan, life insurance, and a reticenient savings plan. The discussion about retirenent plans makes Tom think about how rnuch he will need monthly geometric mean fetum, and then answer the following qoeabons: Assume Tom invests 5300 per month in SFY, how much wal he have when he retices in 40 years? What if he invests in BND? Assume deposits occur at the end of each month. What is the PV, FV, N. PMT, and Rate for this problem? PV: FV: N: Pmt: Rate: What if Tom decides to delay saving for recirement for 10 years so he can travel and buy his dream car? How muchi will Tom have when he retires it he waits 10 years before funding his retirement (assume he inyests 5300 per month for 30 years in SPY?? Assume deposits occur at the end of exch month. What is the PV. FV. N. PMT. and Fate for this problem? PV: FV: N: Pint: Rate: If Tom invests in SPY, how ruuch does he need to save exch moneh to huve 51 million when he retires ir 40 years? it he irvests in BND? Assume deposits occur at the end of exch month. Whot is the PV, FV, N, PMT, and Rate for this problem? PV: FV: N. Pmt: Rate: Finally, assume Tom retires with $1 million in his reticoment accourc. It he moves his money to a "sate" account at o bank paying 3K annual compound interest how much can he withdram ach month in retirement lassume he waits one month after retienent to mulor his first withorwal and that he will live 20 years atter retiring? What is the PV, FV, N, PMT, and Fote for this problem? PV: FV: N: Pont: Rate