Answered step by step

Verified Expert Solution

Question

1 Approved Answer

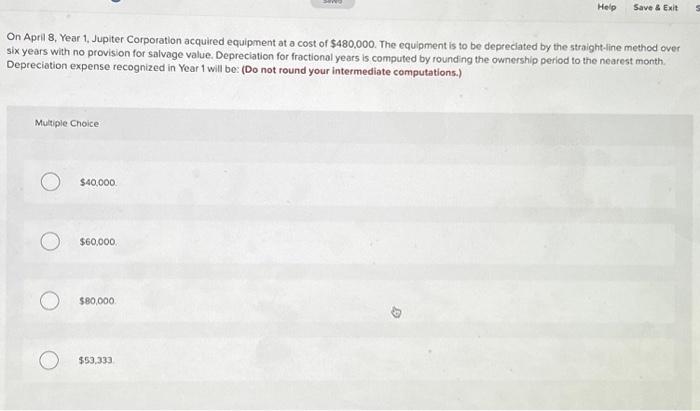

Multiple Choice $40,000. On April 8, Year 1, Jupiter Corporation acquired equipment at a cost of $480,000. The equipment is to be depreciated by the

Multiple Choice $40,000. On April 8, Year 1, Jupiter Corporation acquired equipment at a cost of $480,000. The equipment is to be depreciated by the straight-line method over six years with no provision for salvage value. Depreciation for fractional years is computed by rounding the ownership period to the nearest month. Depreciation expense recognized in Year 1 will be: (Do not round your intermediate computations.) $60,000. $80,000. Saved $53,333. Help Save & Exit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started