multiple choice and correct word receive a like

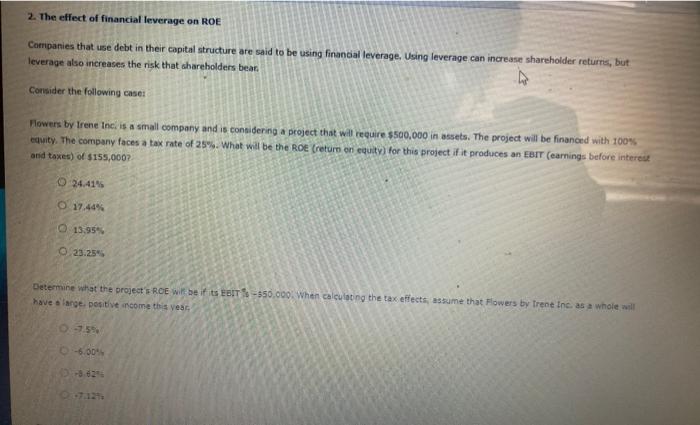

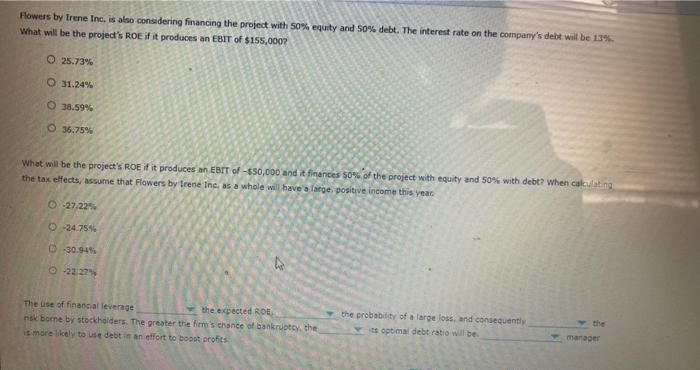

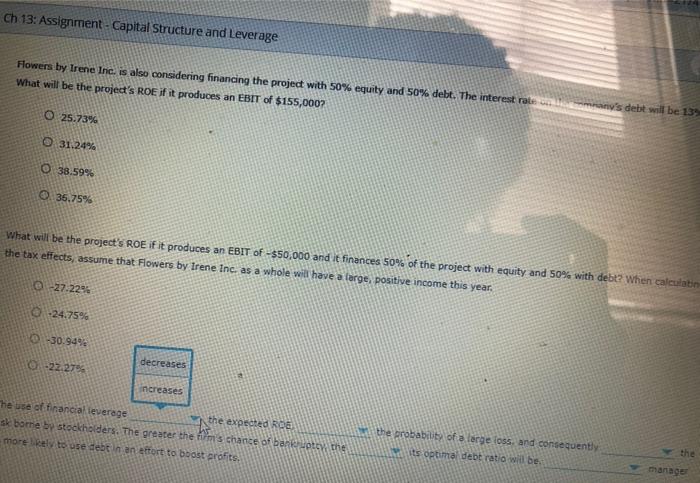

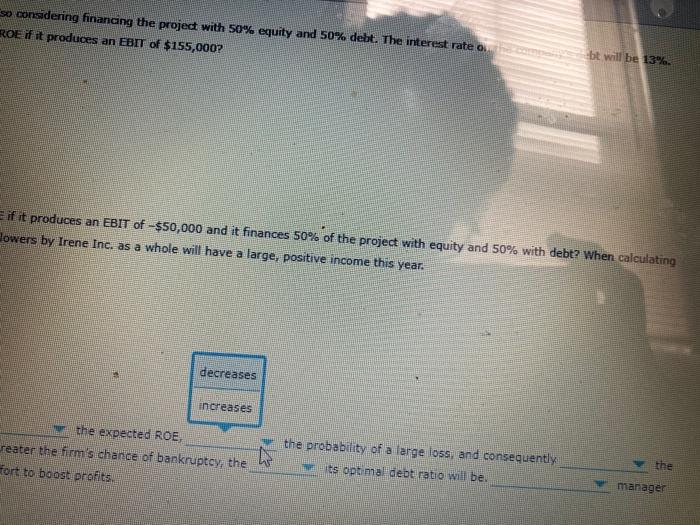

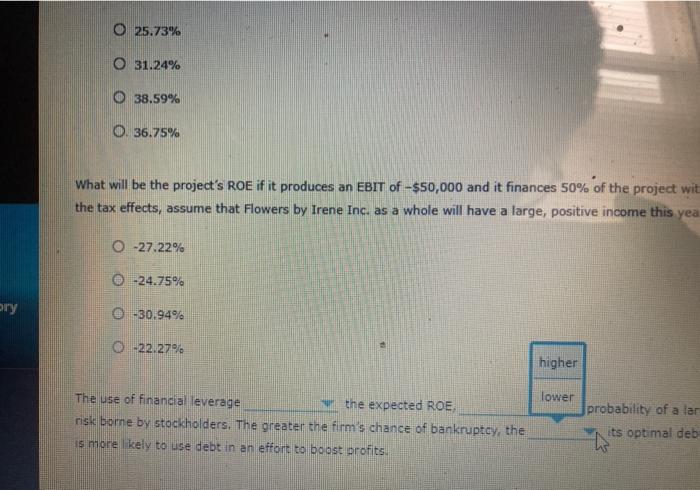

2. The effect of financial leverage on ROE Companies that use debt in their capital structure are said to be using financial leverage. Using leverage can increase shareholder returns, but leverage also increases the risk that shareholders bear Cornider the following case: Mowers by Irene Inc. is a small company and is considering a project that will require $500,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 25%. What will be the Roe (return en equity) for this project if it produces an EBIT (earnings before interest and taxes) of $155,000? O 17.44% 13.95% 0 23.255 Determine what the project's ROE betts TS-550,000. When calculating the tax effects, assume that mowers by Irene Inc. as a whole will have a large positive come this year -6.00 Howers by trene Inc. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company's debt will be 13% What will be the project's ROE if it produces an EBIT of $155,000? O 25.73% O 31.24% 38.59% 36.75% What will be the project's ROE if it produces an EBIT of - $50,000 and it finances 50% of the project with equity and 50% with debt? When calculating the tax effects, assume that Flowers by trene Inc. as a whole will have a large positive income this year 0 27.22% -24.75 0 -30.94% The use of financial leverage the expected ROE nak borne by stockholders. The greater the firm chance of bankruptcy the is more likely to use debt an effort to boost prots the probability of a large loss, and consequently optimal debt ratio will be manager Ch 13: Assignment - Capital Structure and Leverage Howers by Irene Inc. is also considering financing the project with 50% equity and 50% debt. The interest rates What will be the project's ROE if it produces an EBIT of $155,0007 many's debt will be 139 O 25.73% 31.24% O 38.59% . 36.75% What will be the project's ROE if it produces an EBIT -550,000 and it finances 50% of the project with equity and 50% with debt? When calculatin the tax effects, assume that Flowers by Irene Inc. as a whole will have a large, positive income this year. -27.229 24.75% -30.94% 22:27 decreases increases he use of financial leverage the expected RDE sk bome by stockholders. The greater the firm's chance of bauty the more rely to use deben an effort to boost grofits, the probability of a large loss, and consequently Mits optimal debt ratio will be manage so considering financing the project with 50% equity and 50% debt. The interest rate o ROE if it produces an EBIT of $155,000? bt will be 13%. if it produces an EBIT of -$50,000 and it finances 50% of the project with equity and 50% with debt? When calculating Howers by Irene Inc. as a whole will have a large, positive income this year. decreases increases the expected ROE reater the firm's change of bankruptcy, the fort to boost profits the probability of a large loss and consequently pets optimal debt ratio will be the manager Ting financing the project with 50% equity and 50% debt. The interest rate on the company's debt oduces an EBIT of $155,000? duces an EBIT of-$50,000 and it finances 50% of the project with equity and 50% with debt? When calculating y Irene Inc. as a whole will have a large, positive income this year. decreases increases the expected ROE, the fimm s chance of bankruptcy, the boost profits the probability of a large loss, and consequently its optimal debt ratio will be the manager O 25.73% O 31.24% O 38.59% O. 36.75% What will be the project's ROE if it produces an EBIT of -$50,000 and it finances 50% of the project wit the tax effects, assume that Flowers by Irene Inc. as a whole will have a large, positive income this yea O -27.22% -24.75% ary -30.94% O-22.27% higher The use of financial leverage the expected ROE risk borne by stockholders. The greater the firm's chance of bankruptcy, the is more likely to use debt in an effort to boost profits lower probability of a lar its optimal deb be 13%. an EBIT of -$50,000 and it finances 50% of the project with equity and 50% with debt? When calculating e Inc. as a whole will have a large, positive income this year. An aggressive A conservative the expected ROE Em's chance of bankruptcy, the profits the probability of a large loss, and ca its optimal debt ratio will be the manager