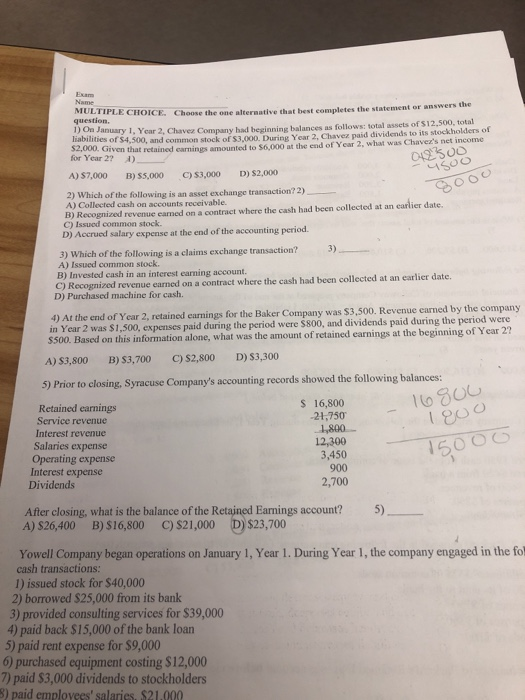

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question, January 1, Year 2, Chaves Company had beginning balances as follows: total assets of $12,500, total a tes of $4,500, and common stock of $3.000. During Year 2, Chavez paid dividends to its ockholders of $2,000. Given that retained samines amounted to $6.000 at the end of Year 2, what was Chave's net income 042500 A) 57,000 B) 55,000 C) $3,000 D) $2,000 for Year 2? 1) usoo 2) Which of the following is an asset exchange transaction? 2) A) Collected cash on accounts receivable. B) Recognized revenue camed on a contract where the cash had been collected at an earlier date. C) Issued common stock. D) Accrued salary expense at the end of the accounting period. 3) Which of the following is a claims exchange transaction? 3) A) Issued common stock B) Invested cash in an interest earning account. C) Recognized revenue earned on a contract where the cash had been collected at an earlier date. D) Purchased machine for cash. 4) At the end of Year 2, retained earnings for the Baker Company was $3,500. Revenue carned by the company in Year 2 was $1,500, expenses paid during the period were $800, and dividends paid during the period were $500. Based on this information alone, what was the amount of retained earnings at the beginning of Year 2? A) $3,800 B) 53,700 C) $2,800 D) $3,300 5) Prior to closing, Syracuse Company's accounting records showed the following balances: - 16800 1900 Retained earnings Service revenue Interest revenue Salaries expense Operating expense Interest expense Dividends $ 16,800 21,750 1,800 12,300 3,450 900 2,700 15000 After closing, what is the balance of the Retained Earnings account? 5) A) S26,400 B) $16,800 C) $21,000 D) $23,700 Yowell Company began operations on January 1, Year 1. During Year 1, the company engaged in the fol cash transactions: 1) issued stock for $40,000 2) borrowed $25,000 from its bank 3) provided consulting services for $39,000 4) paid back $15,000 of the bank loan 5) paid rent expense for $9,000 6) purchased equipment costing $12,000 7) paid $3,000 dividends to stockholders 3) paid employees' salaries. $21.000