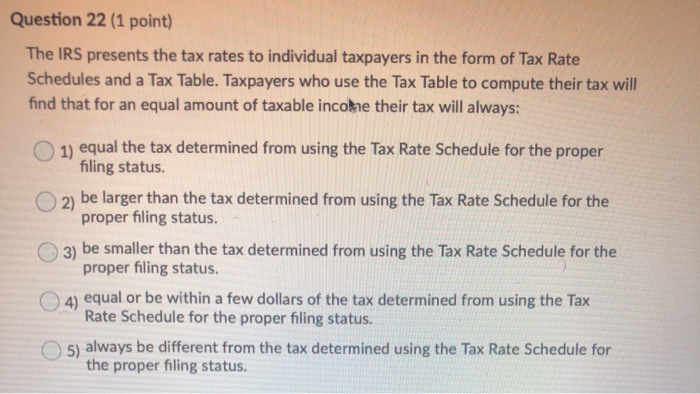

Question 13 (1 point) For purposes of the child and dependent care credit, a dependent child who is not incapacitated must be under age 13. 1) True 2) False Question 14 (1 point) The maximum retirement savings contributions credit for any taxpayer is $1,000. 1) True 2) False Question 15 (1 point) The adoption credit cannot be taken if the adoption of a foreign child is never finalized. 1) True 2) False Question 16 (1 point) The adoption credit cannot be taken if the adoption of a U.S. child is never finalized. 1) True 2) False Question 17 (1 point) The education credit is not available to a person filing married filing separately. 1) True 2) False Question 18 (1 point) Any unused child tax credit (due to not having enough tax liability) can be carried forward and used in the next tax year. 1) True 2) False Question 18 (1 point) Any unused child tax credit (due to not having enough tax liability) can be carried forward and used in the next tax year. 1) True 2) False Question 19 (1 point) Tuition paid in 2019 for courses that begin before April 1, 2020 count toward the 2019 education credit. 1) True 2) False Question 20 (1 point) When there is no custodial parent, the parent with the least amount of AGI gets to claim the earned income credit for the qualifying child. 1) True 2) False Question 21 (1 point) The maximum adoption credit for 2019 is: 1) $2,400. O2) $5,000 3) $6,000. 4) $9,350. 5) $14,080. Question 22 (1 point) The IRS presents the tax rates to individual taxpayers in the form of Tax Rate Schedules and a Tax Table. Taxpayers who use the Tax Table to compute their tax will find that for an equal amount of taxable income their tax will always: 1) equal the tax determined from using the Tax Rate Schedule for the proper filing status. 2) be larger than the tax determined from using the Tax Rate Schedule for the proper filing status. 3) be smaller than the tax determined from using the Tax Rate Schedule for the proper filing status. 4) equal or be within a few dollars of the tax determined from using the Tax Rate Schedule for the proper filing status. 5) always be different from the tax determined using the Tax Rate Schedule for the proper filing status