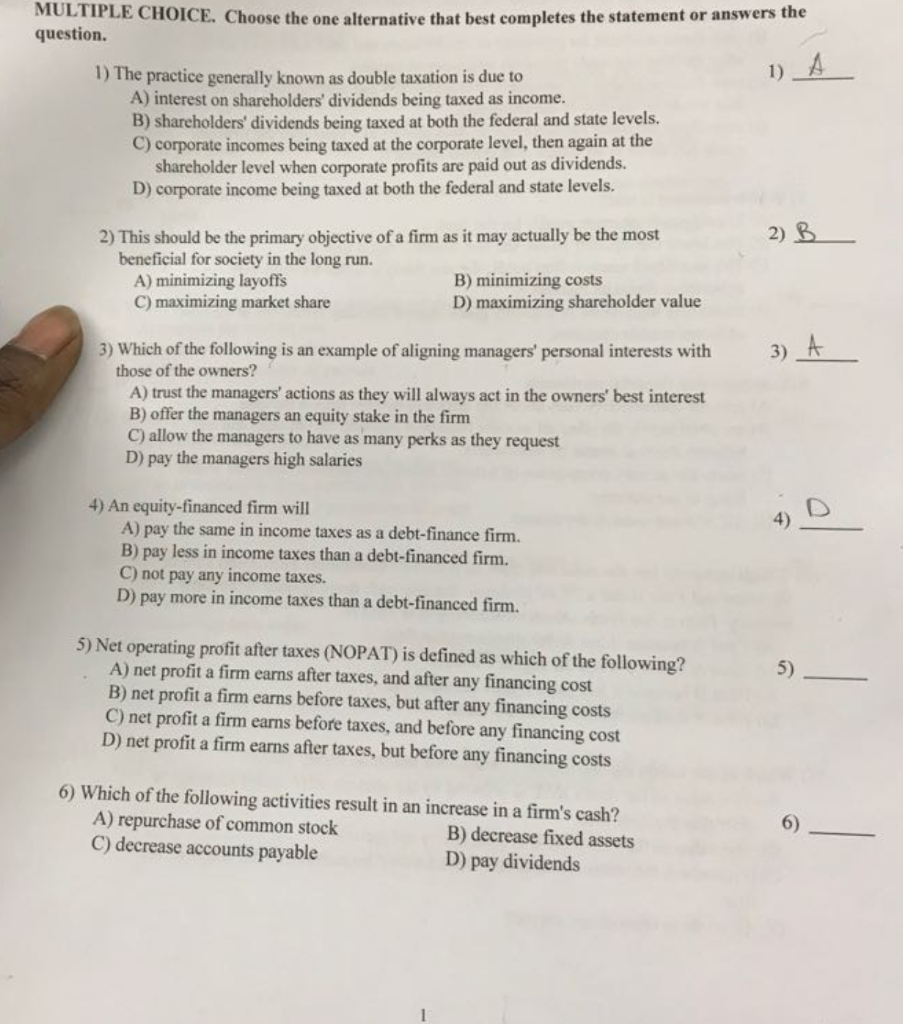

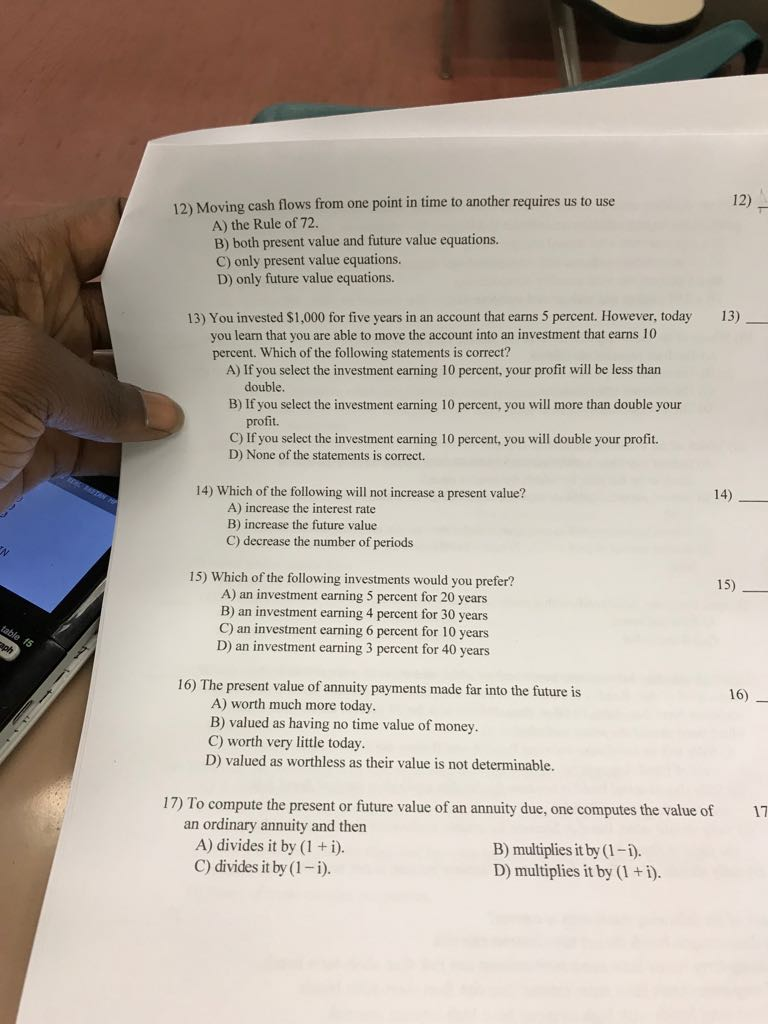

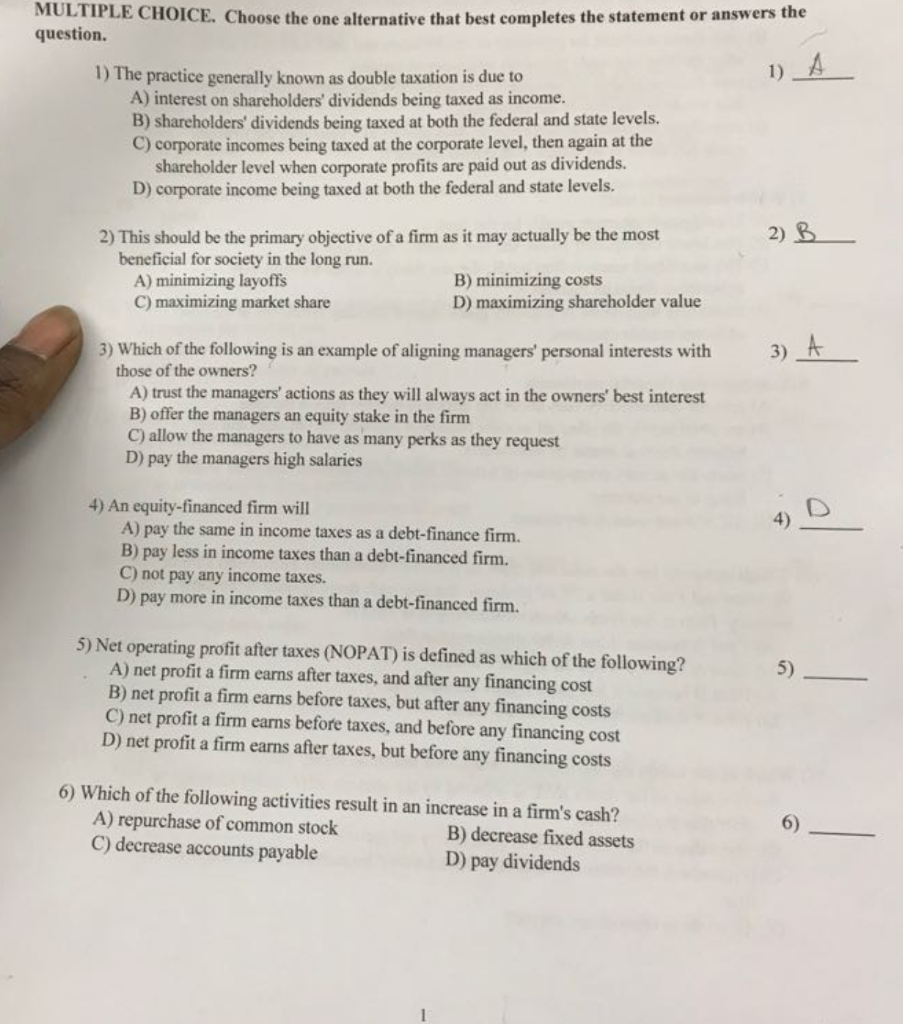

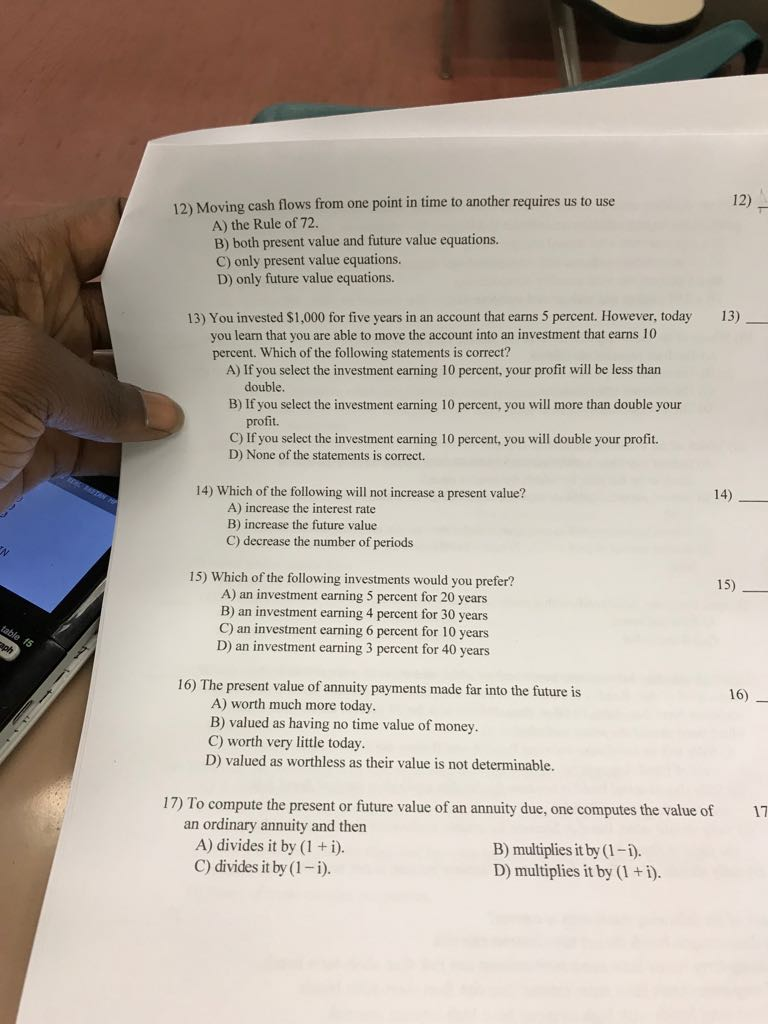

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) 1) The practice generally known as double taxation is due to A) interest on shareholders' dividends being taxed as income. B) shareholders' dividends being taxed at both the federal and state levels. C) corporate incomes being taxed at the corporate level, then again at the shareholder level when corporate profits are paid out as dividends. D) corporate income being taxed at both the federal and state levels. 2) 3_ 2) This should be the primary objective of a firm as it may actually be the most beneficial for society in the long run. A) minimizing layoffs C) maximizing market share B) minimizing costs D) maximizing shareholder value 3) 3) Which of the following is an example of aligning managers' personal interests with those of the owners? A) trust the managers' actions as they will always act in the owners' best interest B) offer the managers an equity stake in the firm C) allow the managers to have as many perks as they request D) pay the managers high salaries 4) An equity-financed firm will 4) A) pay the same in income taxes as a debt-finance firm. B) pay less in income taxes than a debt-financed firm. C) not pay any income taxes. D) pay more in income taxes than a debt-financed firm. 5) Net operating profit after taxes (NOPAT) is defined as which of the following? 5 A) net profit a firm earns after taxes, and after any financing cost B) net profit a firm earns before taxes, but after any financing costs C) net profit a firm earns before taxes, and before any financing cost D) net profit a firm earns after taxes, but before any financing costs 6) Which of the following activities result in an increase in a firm's cash? A) repurchase of common stock C) decrease accounts payable B) decrease fixed assets D) pay dividends 12) Moving cash flows from one point in time to another requires us to use 12) A) the Rule of 72. B) both present value and future value equations. C) only present value equations. D) only future value equations. 13) You invested $1,000 for five years in an account that earns 5 percent. However, today 13)_ you learn that you are able to move the account into an investment that earns 10 percent. Which of the following statements is correct? A) If you select the investment earning 10 percent, your profit will be less than double. B) If you select the investment earning 10 percent, you will more than double your profit. C) If you select the investment earning 10 percent, you will double your profit. D) None of the statements is correct. 14) Which of the following will not increase a present value? 14) A) increase the interest rate B) increase the future value C) decrease the number of periods 15) Which of the following investments would you prefer? A) an investment earning 5 percent for 20 years B) an investment earning 4 percent for 30 years C) an investment earning 6 percent for 10 years D) an investment earning 3 percent for 40 years 15) 16) The present value of annuity payments made far into the future is 16) A) worth much more today. B) valued as having no time value of money. C) worth very little today. D) valued as worthless as their value is not determinable. 17) To compute the present or future value of an annuity due, one computes the value of 17 an ordinary annuity and then A) divides it by (1 +i). C) divides it by (1-i) B) multiplies it by (1-). D) multiplies it by (1 +i)