Answered step by step

Verified Expert Solution

Question

1 Approved Answer

multiple choice help 35) Which of the following industry-level and business environment factors present/s A) Industry minimally affected by trends A) industry minimally affected by

multiple choice help

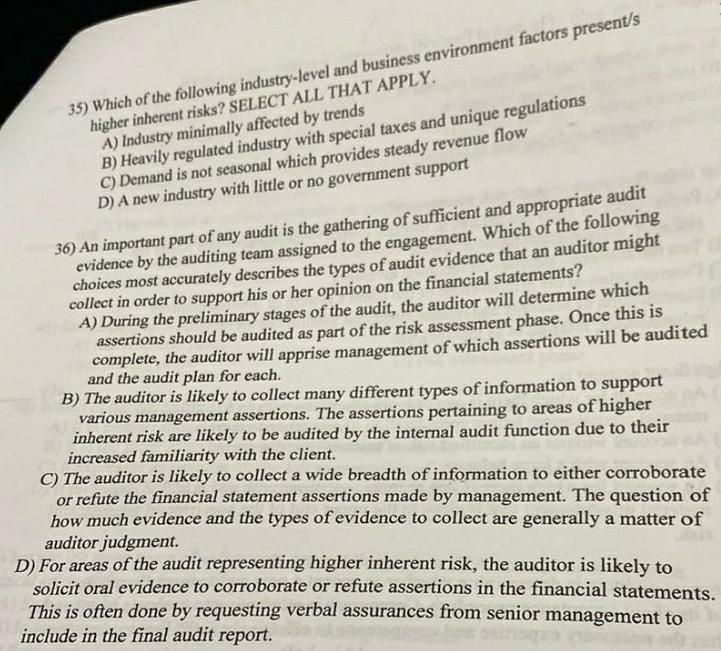

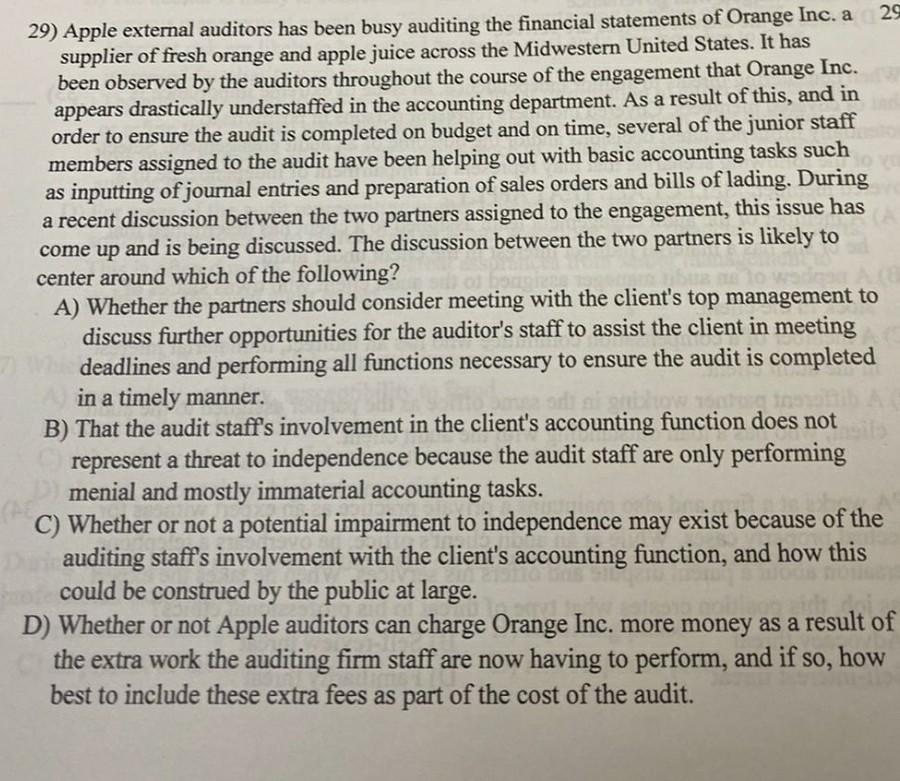

35) Which of the following industry-level and business environment factors present/s A) Industry minimally affected by trends A) industry minimally affected by trends B) Heavily regulated industry with special taxes and unique regulations D) A new industry with little or no government support evidence by the auditing team assigned to the engagement. Which audit choices most accurately describes the types of audit evidence that an auditor might collect in order to support his or her opinion on the financial statements? A) During the preliminary stages of the audit, the auditor will determine tors? assertions should be audited as part of the risk assessment phase. Once this various management assertions. The assertions pertaining to areas of higher inherent risk are likely to be audited by the internal audit function due to their increased familiarity with the client. C) The auditor is likely to collect a wide breadth of information to either corroborate or refute the financial statement assertions made by management. The question of how much evidence and the types of evidence to collect are generally a matter of auditor judgment. D) For areas of the audit representing higher inherent risk, the auditor is likely to solicit oral evidence to corroborate or refute assertions in the financial statements This is often done by requesting verbal assurances from senior management to include in the final audit report. 27) Which of the following is not a fraud risk factor? A) An incentive or pressure to commit fraud B) The firm's fiscal year end being during the busy season. C) An opportunity to commit fraud D) Rationalization to justify fraudulent actions supplier of fresh orange and apple juice across the Midwestern United States. It has been observed by the auditors throughout the course of the engagement that Orange Inc. appears drastically understaffed in the accounting department. As a result of this, and in order to ensure the audit is completed on budget and on time, several of the junior staff members assigned to the audit have been helping out with basic accounting tasks such as inputting of journal entries and preparation of sales orders and bills of lading. During a recent discussion between the two partners assigned to the engagement, this issue has come up and is being discussed. The discussion between the two partners is likely to center around which of the following? A) Whether the partners should consider meeting with the client's top management to discuss further opportunities for the auditor's staff to assist the client in meeting deadlines and performing all functions necessary to ensure the audit is completed in a timely manner. B) That the audit staff's involvement in the client's accounting function does not represent a threat to independence because the audit staff are only performing menial and mostly immaterial accounting tasks. C) Whether or not a potential impairment to independence may exist because of the auditing staff's involvement with the client's accounting function, and how this could be construed by the public at large. D) Whether or not Apple auditors can charge Orange Inc. more money as a result of the extra work the auditing firm staff are now having to perform, and if so, how best to include these extra fees as part of the cost of the audit. 35) Which of the following industry-level and business environment factors present/s A) Industry minimally affected by trends A) industry minimally affected by trends B) Heavily regulated industry with special taxes and unique regulations D) A new industry with little or no government support evidence by the auditing team assigned to the engagement. Which audit choices most accurately describes the types of audit evidence that an auditor might collect in order to support his or her opinion on the financial statements? A) During the preliminary stages of the audit, the auditor will determine tors? assertions should be audited as part of the risk assessment phase. Once this various management assertions. The assertions pertaining to areas of higher inherent risk are likely to be audited by the internal audit function due to their increased familiarity with the client. C) The auditor is likely to collect a wide breadth of information to either corroborate or refute the financial statement assertions made by management. The question of how much evidence and the types of evidence to collect are generally a matter of auditor judgment. D) For areas of the audit representing higher inherent risk, the auditor is likely to solicit oral evidence to corroborate or refute assertions in the financial statements This is often done by requesting verbal assurances from senior management to include in the final audit report. 27) Which of the following is not a fraud risk factor? A) An incentive or pressure to commit fraud B) The firm's fiscal year end being during the busy season. C) An opportunity to commit fraud D) Rationalization to justify fraudulent actions supplier of fresh orange and apple juice across the Midwestern United States. It has been observed by the auditors throughout the course of the engagement that Orange Inc. appears drastically understaffed in the accounting department. As a result of this, and in order to ensure the audit is completed on budget and on time, several of the junior staff members assigned to the audit have been helping out with basic accounting tasks such as inputting of journal entries and preparation of sales orders and bills of lading. During a recent discussion between the two partners assigned to the engagement, this issue has come up and is being discussed. The discussion between the two partners is likely to center around which of the following? A) Whether the partners should consider meeting with the client's top management to discuss further opportunities for the auditor's staff to assist the client in meeting deadlines and performing all functions necessary to ensure the audit is completed in a timely manner. B) That the audit staff's involvement in the client's accounting function does not represent a threat to independence because the audit staff are only performing menial and mostly immaterial accounting tasks. C) Whether or not a potential impairment to independence may exist because of the auditing staff's involvement with the client's accounting function, and how this could be construed by the public at large. D) Whether or not Apple auditors can charge Orange Inc. more money as a result of the extra work the auditing firm staff are now having to perform, and if so, how best to include these extra fees as part of the cost of the auditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started