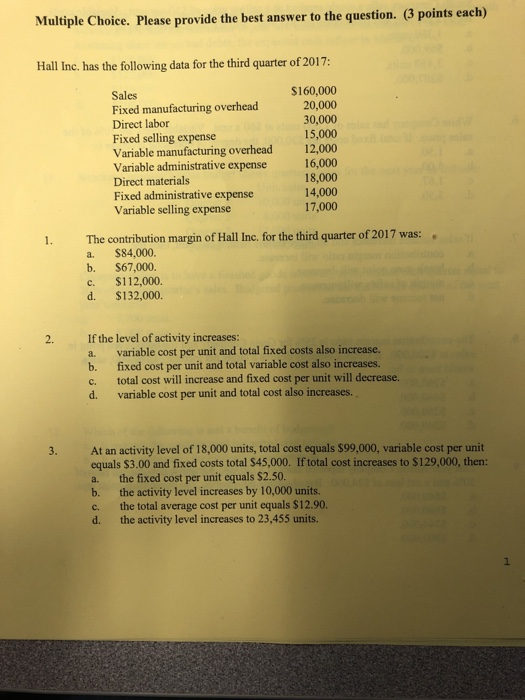

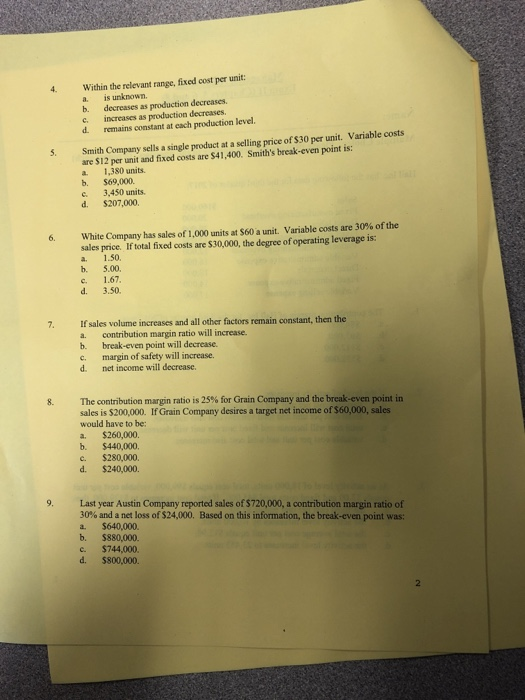

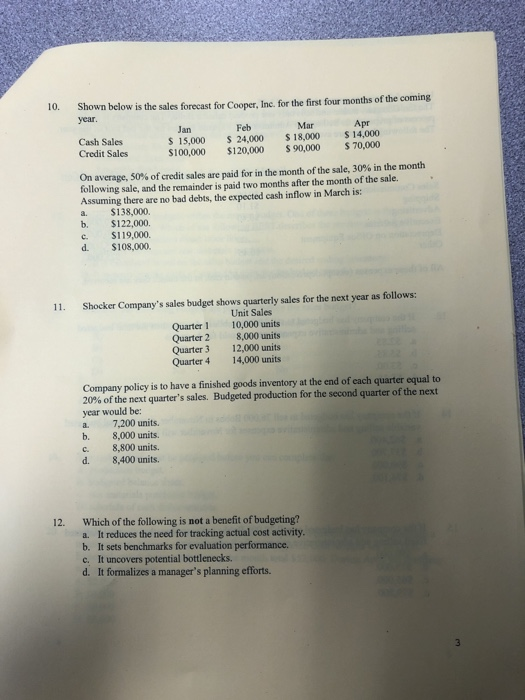

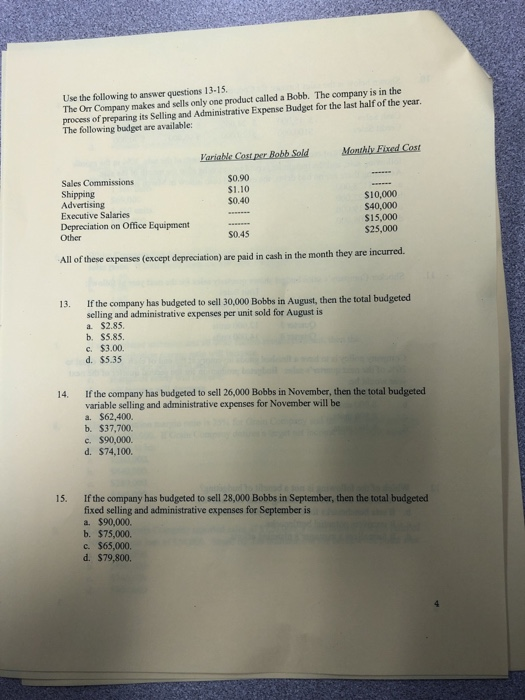

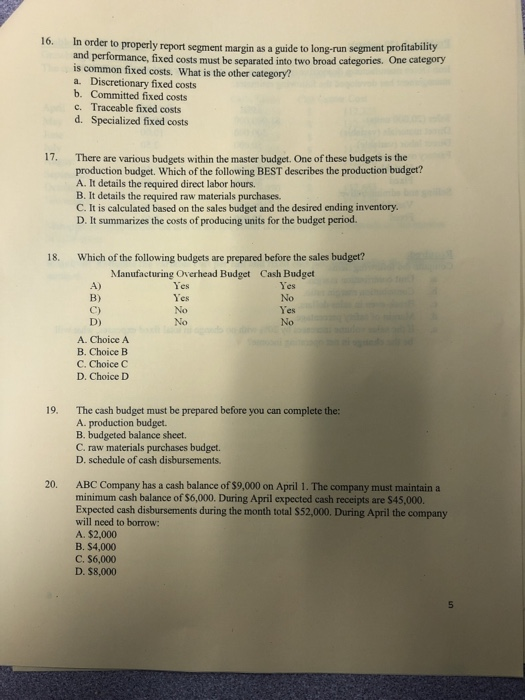

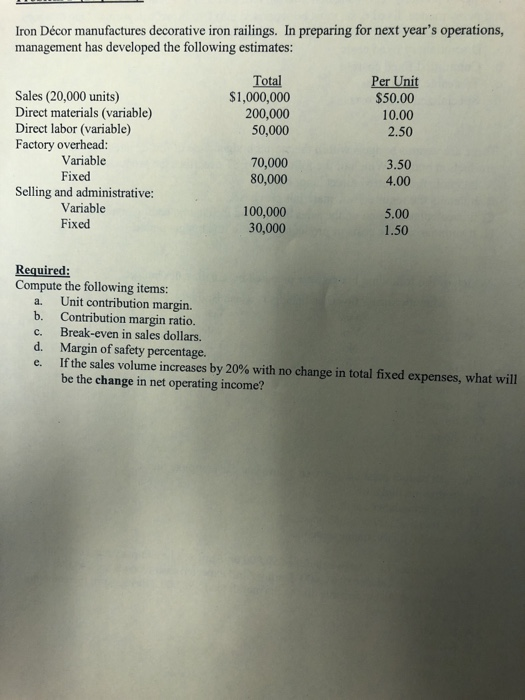

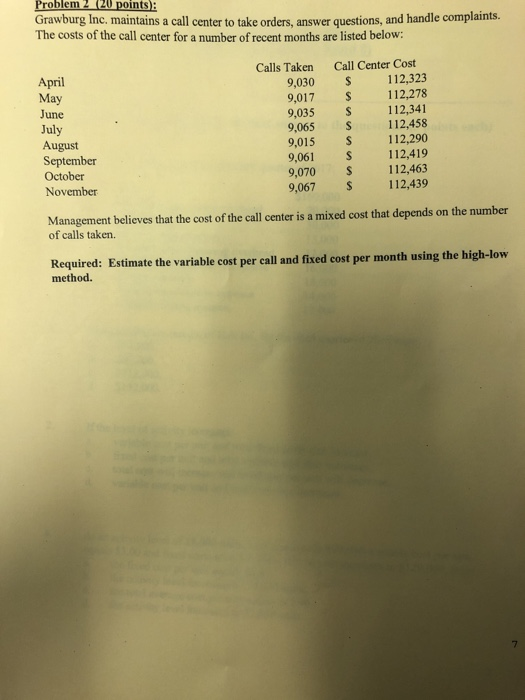

Multiple Choice. Please provide the best answer to the question. (3 points each) Hall Inc. has the following data for the third quarter of 2017: $160,000 20,000 30,000 15,000 12,000 16,000 18,000 14,000 17,000 Sales Fixed manufacturing overhead Direct labor Fixed selling expense Variable manufacturing overhead Variable administrative expense Direct materials Fixed administrative expense Variable selling expense The contribution margin of Hall Inc. for the third quarter of 2017 was: $84,000. $67,000. $112,000 $132,000. 1 a. b. c. d. If the level of activity increases: variable cost per unit and total fixed costs also increase. 2. a. fixed cost per unit and total variable cost also increases. b. total cost will increase and fixed cost per unit will decrease. variable cost per unit and total cost also increases. c. d. activity level of 18,000 units, total cost equals $99,000, variable cost per unit 3. At an equals $3.00 and fixed costs total $45,000. If total cost increases to $129,000, then: the fixed cost per unit equals $2.50. the activity level increases by 10,000 units. the total average cost per unit equals $12.90. the activity level increases to 23,455 units. a. b. c. d. Within the relevant range, fixed cost per unit: is unknown. decreases as production decreases. increases as production decreases. remains constant at each production level. 4 a h. c. d Smith Company sells a single product at a selling price of $30 per unit. Variable costs are $12 per unit and fixed costs are $41.400. Smith's break-even point is: 1,380 units. $69,000. 3,450 units $207,000. d. White Company has sales of 1,000 units at S60 a unit. Variable costs are 30 % of the sales price. If total fixed costs are $30,000, the degree of operating leverage is: 1.50 6. a 5.00 b 1.67 3.50 d. If sales volume increases and all other factors remain constant, then the contribution margin ratio will increase. break-even point will decrease. margin of safety will increase. net income will decrease. 7 h c. d. The contribution margin ratio is 25% for Grain Company and the break-even point in sales is $200,000. If Grain Company desires a target net income of $60,000, sales 8. would have to be: $260,000. 3 h $440,000. $280,000. $240,000. d. Last year Austin Company reported sales of $720,000, a contribution margin ratio of 30% and a net loss of $24,000. Based on this information, the break-even point was: $640,000. $880,000. $744,000. d. 9. h $800,000. 10. Shown below is the sales forecast for Cooner, Inc. for the first four months of the coming year Apr $14,000 S70,000 Mar Feb Jan S 15,000 $100,000 $ 24,000 $120,000 $18,000 $ 90,000 Cash Sales Credit Sales On average, 50% of credit sales are naid for in the month of the sale, 30% in the month following sale, and the remainder is paid two months after the month of the sale. Assuming there are no bad debts, the expected cash inflow in March is: $138,000. $122,000 $119,000. a. b. $108,000 d Shocker Company's sales budget shows quarterly sales for the next year as follows: Unit Sales 10,000 units 8,000 units 12,000 units 14,000 units 11 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Company policy is to have a finished goods inventory at the end of cach quarter equal to 20% of the next quarter's sales. Budgeted production for the second quarter of the next year would be 7,200 units. 8,000 units. 8,800 units. 8,400 units. a. b c. d. Which of the following is not a benefit of budgeting? a. It reduces the need for tracking actual cost activity. b. It sets benchmarks for evaluation performance. c. It uncovers potential bottlenecks. d. It formalizes a manager's planning efforts. 12. Use the following to answer questions 13-15 The Orr Company makes and sells only one product called a Bobb. The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget are available: Monthly Fixed Cost Variable Cost per Bobb Sold Sales Commissions $0.90 $1.10 Shipping Advertising Executive Salaries Depreciation on Office Equipment Other $10,000 $40,000 $15,000 $25,000 S0.40 S0.45 All of these expenses (except depreciation) are paid in cash in the month they are incured. 13. If the company has budgeted to sell 30,000 Bobbs in August, then the total budgeted selling and administrative expenses per unit sold for August is a $2.85. b. $5.85 c. $3.00. d. $5.35 If the company has budgeted to sell 26,000 Bobbs in November, then the total budgeted variable selling and administrative expenses for November will be a. $62,400. b. $37,700. c. $90,000, d. $74,100. 14. If the company has budgeted to sell 28,000 Bobbs in September, then the total budgeted fixed selling and administrative expenses for September is a. $90,000. b. $75,000. c. $65,000. d. $79,800. 15. 16. In order to properly report segment margin as a guide to long-run segment profitability and performance, fixed costs must be separated into two broad categories. One category is common fixed costs. What is the other category? Discretionary fixed costs b. Committed fixed costs c. Traceable fixed costs d. Specialized fixed costs a 17 There are various budgets within the master budget. One of these budgets is the production budget. Which of the following BEST describes the production budget? A. It details the required direct labor hours. B. It details the required raw materials purchases. C. It is calculated based on the sales budget and the desired ending inventory. D. It summarizes the costs of producing units for the budget period. Which of the following budgets are prepared before the sales budget? 18. Manufacturing Overhead Budget A) B) C) D) Cash Budget Yes Yes Yes No No No Yes No A. Choice A B. Choice B C. Choice C D. Choice D The cash budget must be prepared before you can complete the: A. production budget. B. budgeted balance sheet. C. raw materials purchases budget. 19 D. schedule of cash disbursements. ABC Company has a cash balance of $9,000 on April 1. The company must maintain a minimum cash balance of $6,000. During April expected cash receipts are $45,000. Expected cash disbursements during the month total $52,000. During April the company will need to borrow A. $2,000 B. $4,000 C. $6,000 D. $8,000 20. 5 Iron Dcor manufactures decorative iron railings. In preparing for next year's operations, management has developed the following estimates: Per Unit $50.00 Total $1,000,000 Sales (20,000 units) Direct materials (variable) Direct labor (variable) Factory overhead: Variable 200,000 50,000 10.00 2.50 70,000 80,000 3.50 Fixed Selling and administrative: Variable 4.00 100,000 30,000 5.00 Fixed 1.50 Required: Compute the following items: Unit contribution margin. Contribution margin ratio. Break-even in sales dollars, d. a. b. c. Margin of safety percentage. If the sales volume increases by 20% with no be the change in net operating income? e. change in total fixed expenses, what will Problem 2 (20 points): Grawburg Inc. maintains a call center to take orders, answer questions, and handle complaints. The costs of the call center for a number of recent months are listed below: Call Center Cost 112,323 112,278 112,341 112,458 112,290 112,419 112,463 112,439 Calls Taken April May 9,030 9,017 9,035 June July August September October 9,065 9,015 S 9,061 9,070 9,067 November $ Management believes that the cost of the call center is a mixed cost that depends of calls taken. on the number Required: Estimate the variable cost per call and fixed cost per month using the high-low method