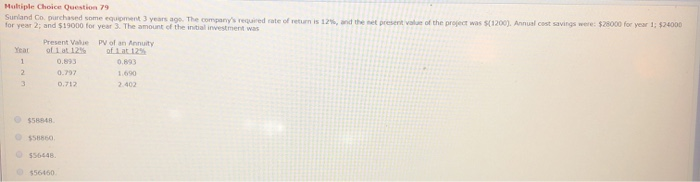

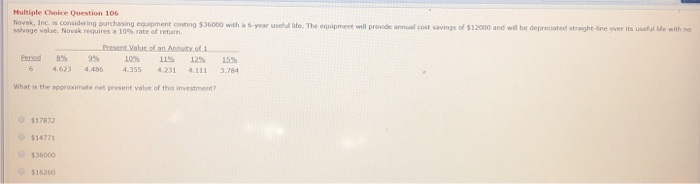

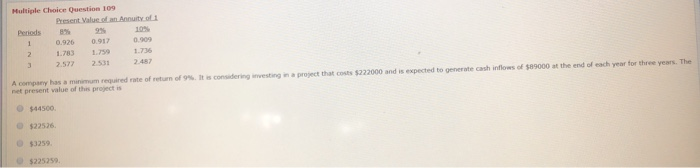

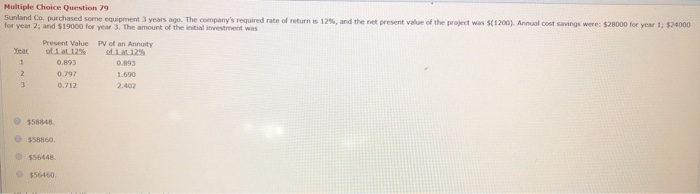

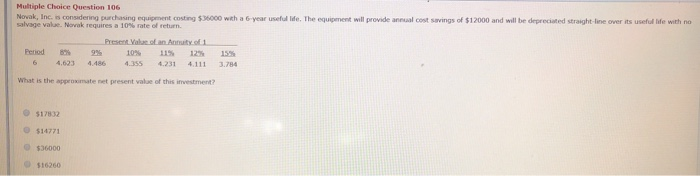

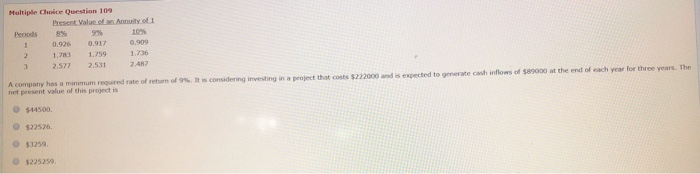

Multiple Choice Question 79 Sunland Co. purchased some equipment 3 years ago. The company's required rate of return is 12 % , and the set present value of the project was $(1200), Annual cost savings were: $28000 for year 1; $24000 for year 2; and $19000 for year 3. The amount ef the intial investment was Present Value of 1 at 12% PV of an Annuity of 1 at 12% Year 0.893 1 0.893 2 0.797 1.690 3 0.712 2.402 $58848 $58860 $56448. 0$56460. Multiple Choice Question 106 Novak, Inc. is considering purchasing equipment costing $36000 with a 6-year useful life. The equipment will provide annual cost savings of $12000 and will be depreciated straight-ine over its useful lfe with no salvage value. Novak requires a 10% rate of return Present Value of an Annuty.of 1 Period 8% 9% 10% 11% 12% 15% 6 4.623 4.486 4.355 4,231 4,111 3,784 What is the approximate net present valae of this investment?h $17832 $14771 $30000 $16260 Multiple Choice Question 109 Present Value of an Annuity of 1 10% 9% 8% Periods 0.909 0.917 0.926 1.736 1.759 1.783 A company has a minimum required rate of return of 9%. It is considering investing in a project that costs $222000 and is expected to generate cash inflows of s89000 at the end of each year for theee years. Ther net present value of this project is 2.487 2.531 2.577 e $44500. O $22526. $3259. e $225259. Multiple Choice Question 79 Sunland Co. purchased some equipment 3 years ago. The company's required rate of return is 12%, and the net present value of the project was $(1200). Annual cost savings were: $28000 for year 1; $24000 for year 2; and $19000 for year 3. The amount of the initial investment was Present Value of 1 at 12% PV of an Annuity Year of L at 12% 0.893 0.893 0.797 1.690 3 0.712 2.402 $58848. $58860 $56448. $56460. Multiple Choice Question 106 Novak, Inc. is considering purchasing equipment costing $36000 wth a 6-year useful lde. The equipment will provide anual cost savings of $12000 and will be depreciated straight-line over its useful life with no salvage valae, Novak requires a 10% rate of return, Present Value of an Annuty of 1 9 % Period 8% 10% 11% 12% 15% 4.623 .486 4.355 4.231 4.111 3.784 What is the approximate net present value of this investment?h $17832 e$14771 $36000 s16260 Multiple Choice Question 109 Present Valac of an Annuity of 1 8 % 10% % Periods 0,909 0.926 0.917 1.736 1.759 1,783 2,487 A company has a minimum required rate of return of 9 % t is considering investing in a project that costs 5222000 and is expected to generate cah inflows of s89000 at the end of each year for three years. The net present value of this project is 2.531 2.577 O $44500. $22526. O 13259 O $225259