Answered step by step

Verified Expert Solution

Question

1 Approved Answer

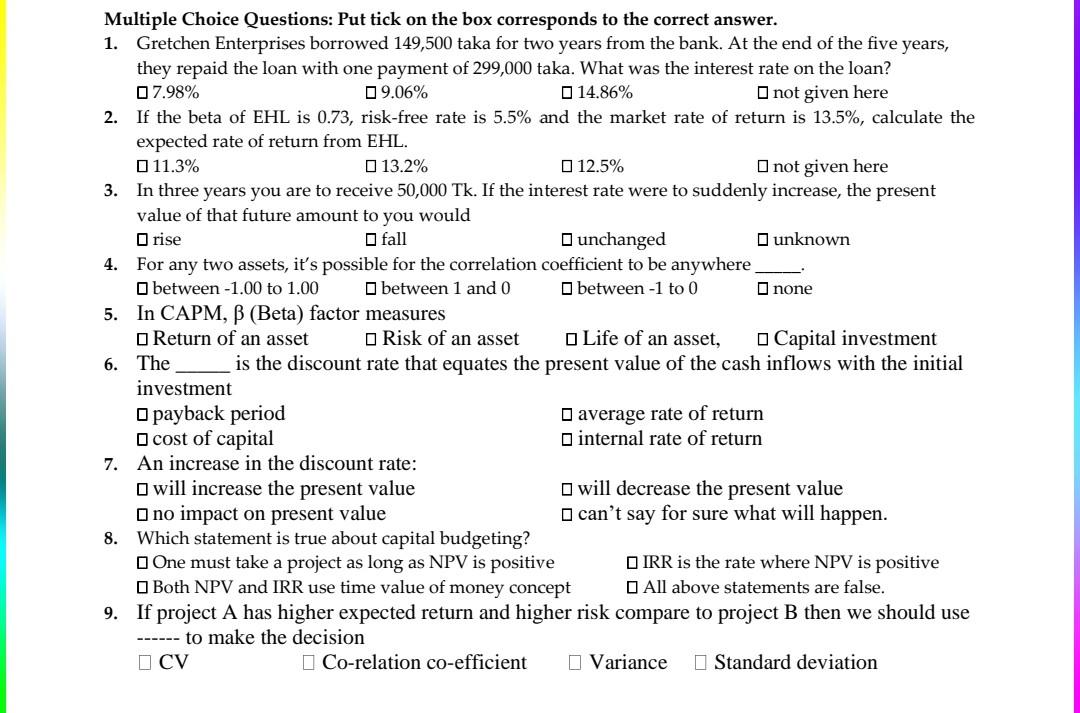

Multiple Choice Questions: Put tick on the box corresponds to the correct answer. 1. Gretchen Enterprises borrowed 149,500 taka for two years from the bank.

Multiple Choice Questions: Put tick on the box corresponds to the correct answer. 1. Gretchen Enterprises borrowed 149,500 taka for two years from the bank. At the end of the five years, they repaid the loan with one payment of 299,000 taka. What was the interest rate on the loan? 07.98% 09.06% 14.86% not given here 2. If the beta of EHL is 0.73, risk-free rate is 5.5% and the market rate of return is 13.5%, calculate the expected rate of return from EHL. 0 11.3% 13.2% 12.5% not given here 3. In three years you are to receive 50,000 Tk. If the interest rate were to suddenly increase, the present value of that future amount to you would rise fall unchanged unknown 4. For any two assets, it's possible for the correlation coefficient to be anywhere between -1.00 to 1.00 between 1 and 0 between -1 to 0 I none 5. In CAPM, B (Beta) factor measures Return of an asset Risk of an asset Life of an asset, Capital investment 6. The is the discount rate that equates the present value of the cash inflows with the initial investment Opayback period average rate of return cost of capital internal rate of return 7. An increase in the discount rate: will increase the present value will decrease the present value Ono impact on present value can't say for sure what will happen. 8. Which statement is true about capital budgeting? One must take a project as long as NPV is positive IRR is the rate where NPV is positive Both NPV and IRR use time value of money concept All above statements are false. 9. If project A has higher expected return and higher risk compare to project B then we should use to make the decision I CV Co-relation co-efficient I Variance Standard deviation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started