Answered step by step

Verified Expert Solution

Question

1 Approved Answer

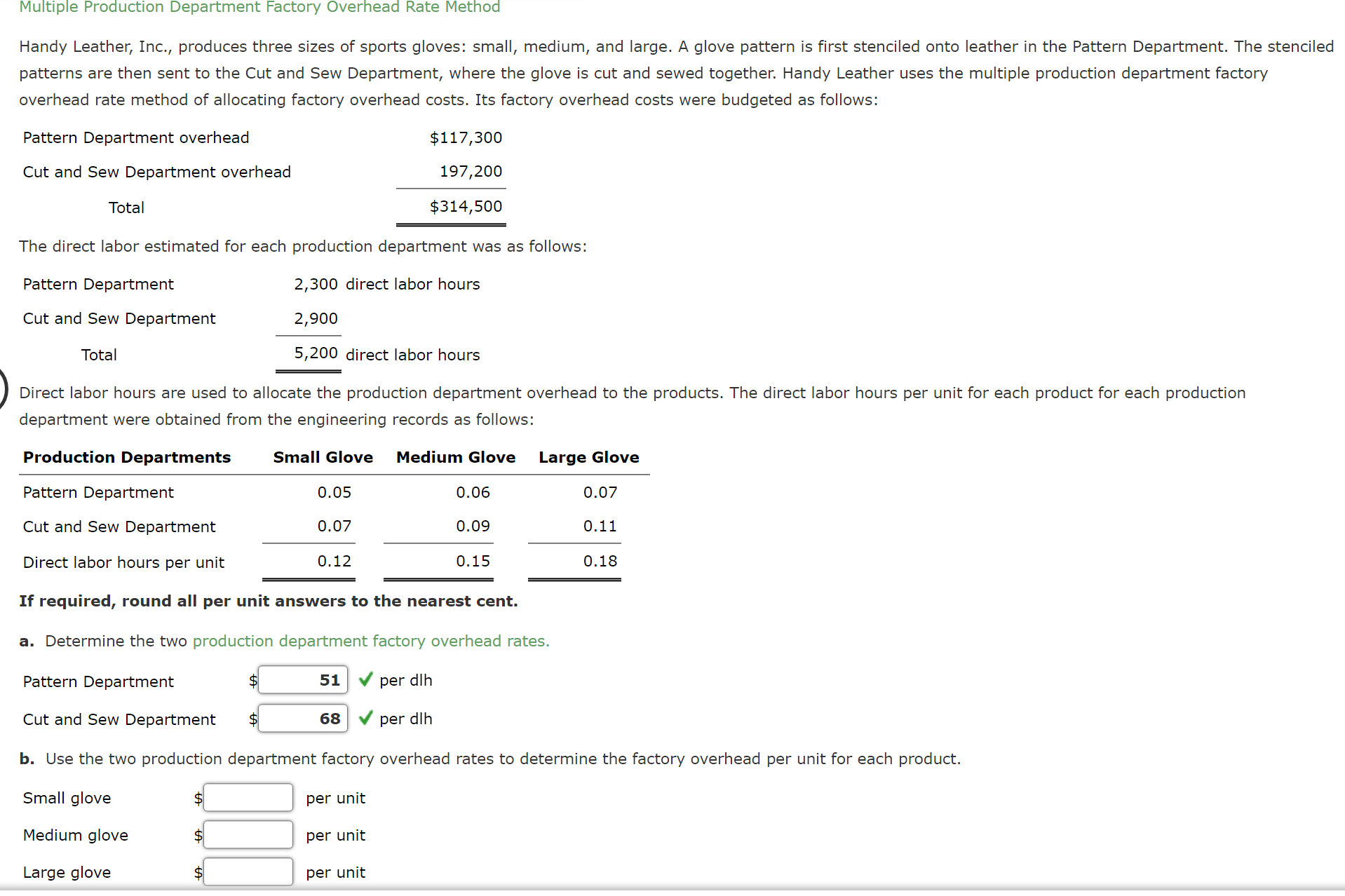

Multiple Production Department Factory Overhead Rate Method Handy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is

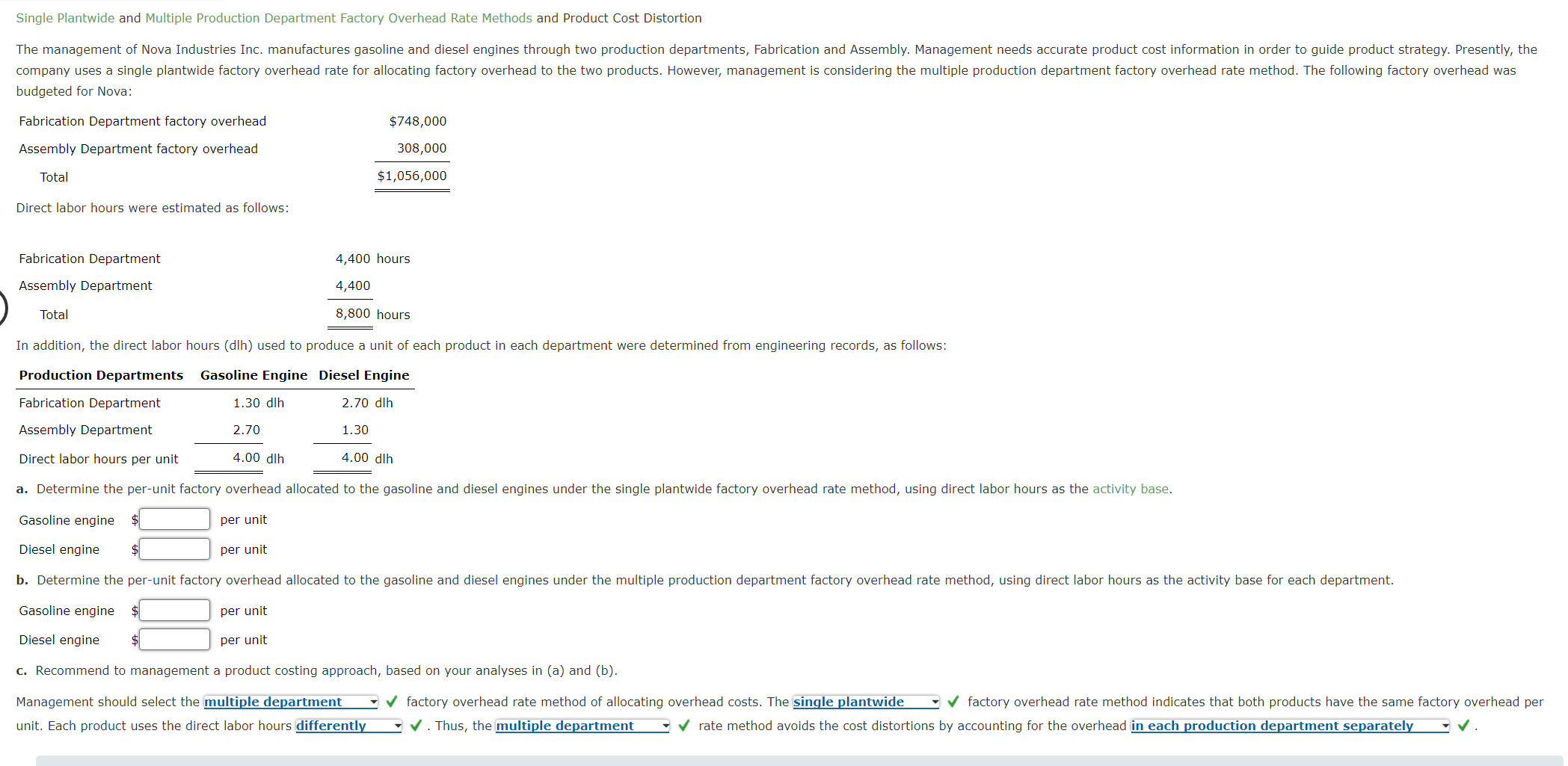

Multiple Production Department Factory Overhead Rate Method Handy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stenciled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Handy Leather uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows: Pattern Department overhead Cut and Sew Department overhead Total $117,300 197,200 $314,500 The direct labor estimated for each production department was as follows: Pattern Department Cut and Sew Department Total 2,300 direct labor hours 2,900 5,200 direct labor hours Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: Production Departments Pattern Department Cut and Sew Department Direct labor hours per unit Small Glove Medium Glove Large Glove 0.05 0.06 0.07 0.07 0.09 0.11 0.12 0.15 0.18 If required, round all per unit answers to the nearest cent. a. Determine the two production department factory overhead rates. Pattern Department 51 per dlh Cut and Sew Department $ 68 per dlh b. Use the two production department factory overhead rates to determine the factory overhead per unit for each product. Small glove $ per unit Medium glove $ per unit Large glove $ per unit Single Plantwide and Multiple Production Department Factory Overhead Rate Methods and Product Cost Distortion The management of Nova Industries Inc. manufactures gasoline and diesel engines through two production departments, Fabrication and Assembly. Management needs accurate product cost information in order to guide product strategy. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering the multiple production department factory overhead rate method. The following factory overhead was budgeted for Nova: Fabrication Department factory overhead Assembly Department factory overhead Total Direct labor hours were estimated as follows: $748,000 308,000 $1,056,000 Fabrication Department Assembly Department Total 4,400 hours 4,400 8,800 hours In addition, the direct labor hours (dlh) used to produce a unit of each product in each department were determined from engineering records, as follows: Production Departments Fabrication Department Assembly Department Gasoline Engine Diesel Engine 2.70 dlh 1.30 Direct labor hours per unit 1.30 dlh 2.70 4.00 dlh 4.00 dlh a. Determine the per-unit factory overhead allocated to the gasoline and diesel engines under the single plantwide factory overhead rate method, using direct labor hours as the activity base. Gasoline engine $ Diesel engine $ per unit per unit b. Determine the per-unit factory overhead allocated to the gasoline and diesel engines under the multiple production department factory overhead rate method, using direct labor hours as the activity base for each department. Gasoline engine $ Diesel engine per unit per unit c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Management should select the multiple department unit. Each product uses the direct labor hours differently factory overhead rate method of allocating overhead costs. The single plantwide factory overhead rate method indicates that both products have the same factory overhead per . Thus, the multiple department rate method avoids the cost distortions by accounting for the overhead in each production department separately .

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started