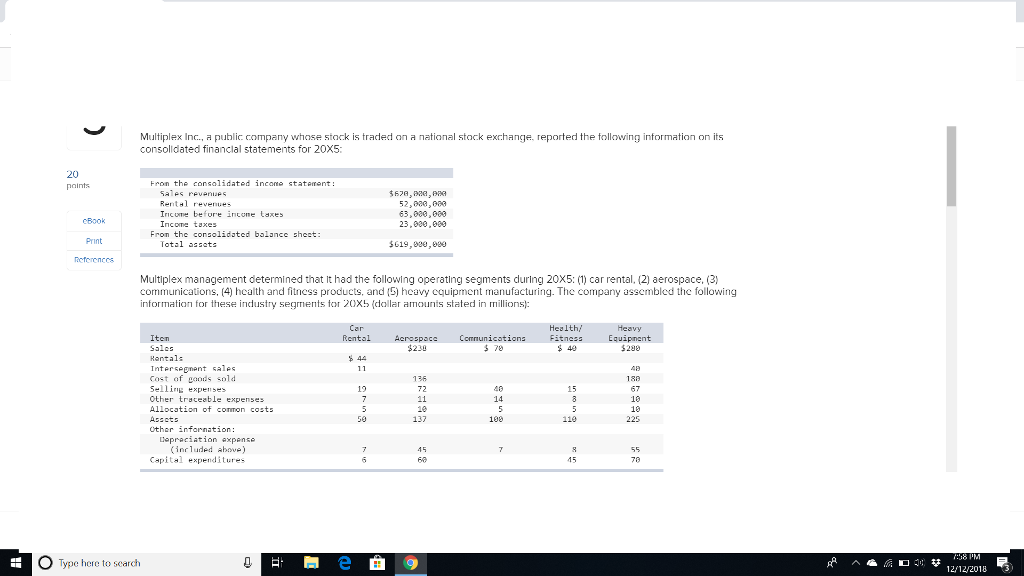

Multiplex Inc., a public company whose stock is traded on a national stock exchange, reported the following information on its consolidated financial statements for 20X5:

Multiplex Inc., a public company whose stock is traded on a national stock exchange, reported the following information on its consolidated financial statements for 20X5:

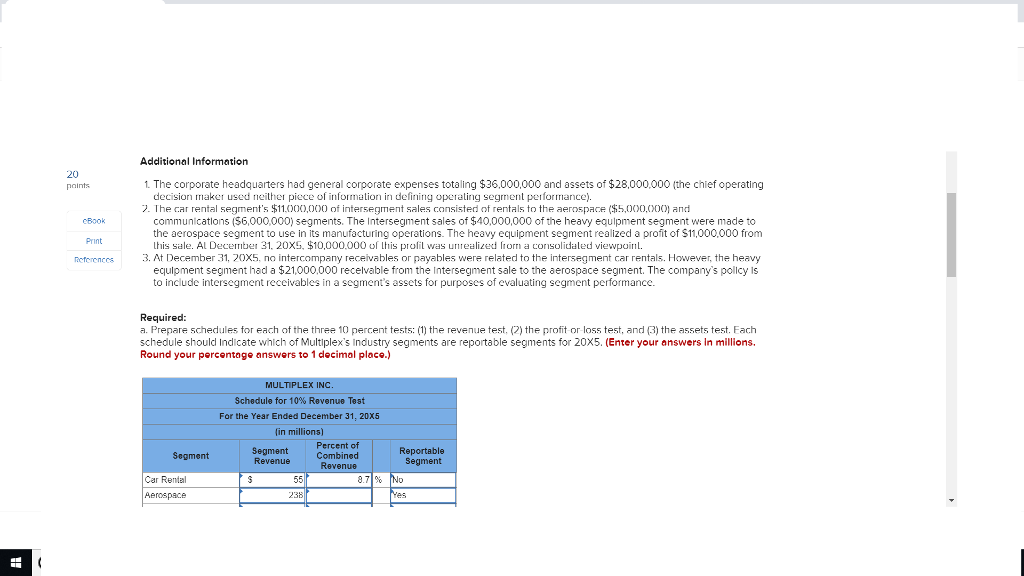

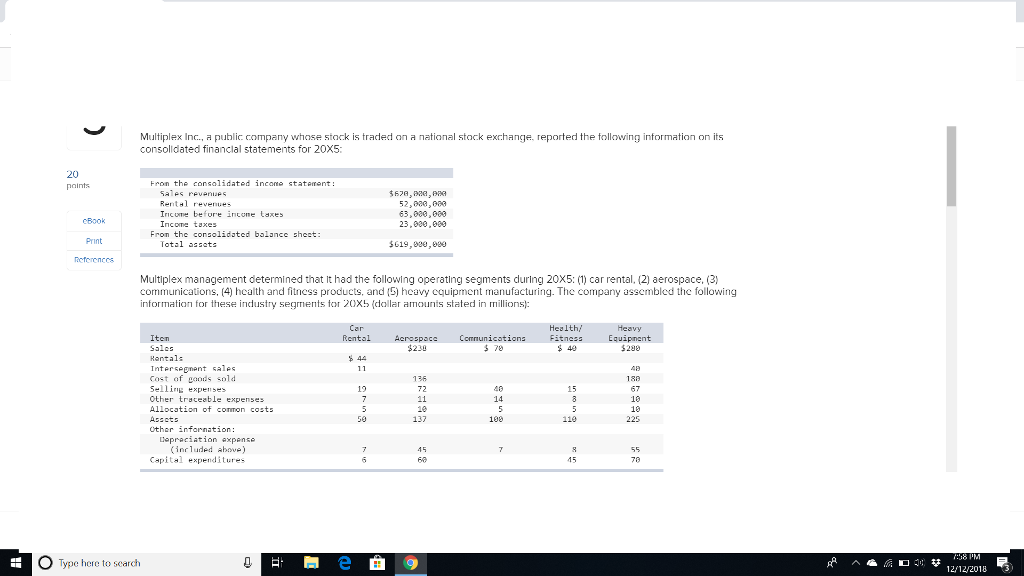

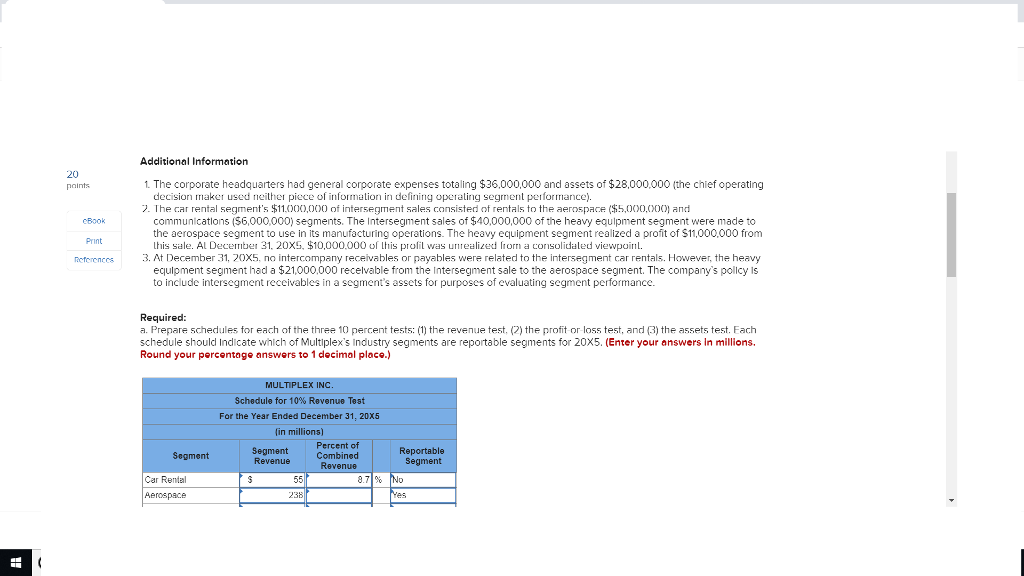

Multiplex Inc., public company whos. stock is trader1an national stock exchange. reported the following information on its consolidated financlal statements for 20X5 20 Fron the consolidated incoms staterent: sales revenUP Rental revenues Iric ume before income taxes Income taxes $678,, RA 52,820,88 63,880,883 23,930,989 Fron the consolidated balancc shest Print otal assets $619,830,889 Multiplex management determined that It had the following operating segments during 20X5: 1 car rental, 2) erospace, (3) communications, (4) health and fitness products, and (5) heavy cquipment manufacturing. The company assembled the following informatian for these industry segments o 20x (doll amounis stated in millions Healt Fitness Heavy Equipnent 238 Iten Solcs Rontal: Intersegment sales Cost of ads sold Sellig expenses Other traceable expenses Allocation of conmon costs RentolAcnospac 3 78 136 188 48 14 15 18 18 137 108 110 other infornation: topreciation axpenso inrluded abave) Capital expenditures 60 15 O Type here to search F 12/12/2018 3 Additional Information 1. The corporate headquarters had general corporate expenses totaling $36,000,000 and assets of $28,000,000 (the chief operating 2. Ihe car rental segment's $11.OOX),()()0 of intersegment sales consisted of rentals to the aerospace ($5,0()0.OOO) and 20 points decision maker used either piece of information in defining opertg segment performance). communlcatlons ($6,000,000) segments. The ntersegment sales of $40,000,000 of the heavy equlpment segment were made to the aerospace segment to use in its manufacturing operations. The heavy equipment segment realized a profit of $11,000,000 from this sale. Al December 31. 20XS, $10,000,000 of lhis profil was unealized fro a cosolidaled viewpoin. Print ncferences3. At December 31, 20X5, no intercompany receivables or payables were related to the intersegment car rentals. Hovever, the heavy equlpment segment had a $21,000,000 recelvable from the Intersegment sale to the aerospace segment. The company's policy Is to include intersegment reccivables in a segment's assets for purposes of evaluating segment performance. Required: a. Prepare schedules for each of the three 10 percent tests: (1) the revenue test, (2) the profit or loss test, and 3) the assets test. Each schedule should Indicate which of Multiplex's Industry segments are reportable segiments for 20x5. (Enter your answers In millions. Round your percentage answers to 1 decimal placo.) MULTIPLEX I Schedule for 1096 Revenue Test For the Year Ended December 31. 20X5 fin millions) Segment Revenue Percent of Combined Reportable Segment Segment Revenue Car Rendal 238 Multiplex Inc., public company whos. stock is trader1an national stock exchange. reported the following information on its consolidated financlal statements for 20X5 20 Fron the consolidated incoms staterent: sales revenUP Rental revenues Iric ume before income taxes Income taxes $678,, RA 52,820,88 63,880,883 23,930,989 Fron the consolidated balancc shest Print otal assets $619,830,889 Multiplex management determined that It had the following operating segments during 20X5: 1 car rental, 2) erospace, (3) communications, (4) health and fitness products, and (5) heavy cquipment manufacturing. The company assembled the following informatian for these industry segments o 20x (doll amounis stated in millions Healt Fitness Heavy Equipnent 238 Iten Solcs Rontal: Intersegment sales Cost of ads sold Sellig expenses Other traceable expenses Allocation of conmon costs RentolAcnospac 3 78 136 188 48 14 15 18 18 137 108 110 other infornation: topreciation axpenso inrluded abave) Capital expenditures 60 15 O Type here to search F 12/12/2018 3 Additional Information 1. The corporate headquarters had general corporate expenses totaling $36,000,000 and assets of $28,000,000 (the chief operating 2. Ihe car rental segment's $11.OOX),()()0 of intersegment sales consisted of rentals to the aerospace ($5,0()0.OOO) and 20 points decision maker used either piece of information in defining opertg segment performance). communlcatlons ($6,000,000) segments. The ntersegment sales of $40,000,000 of the heavy equlpment segment were made to the aerospace segment to use in its manufacturing operations. The heavy equipment segment realized a profit of $11,000,000 from this sale. Al December 31. 20XS, $10,000,000 of lhis profil was unealized fro a cosolidaled viewpoin. Print ncferences3. At December 31, 20X5, no intercompany receivables or payables were related to the intersegment car rentals. Hovever, the heavy equlpment segment had a $21,000,000 recelvable from the Intersegment sale to the aerospace segment. The company's policy Is to include intersegment reccivables in a segment's assets for purposes of evaluating segment performance. Required: a. Prepare schedules for each of the three 10 percent tests: (1) the revenue test, (2) the profit or loss test, and 3) the assets test. Each schedule should Indicate which of Multiplex's Industry segments are reportable segiments for 20x5. (Enter your answers In millions. Round your percentage answers to 1 decimal placo.) MULTIPLEX I Schedule for 1096 Revenue Test For the Year Ended December 31. 20X5 fin millions) Segment Revenue Percent of Combined Reportable Segment Segment Revenue Car Rendal 238

Multiplex Inc., a public company whose stock is traded on a national stock exchange, reported the following information on its consolidated financial statements for 20X5:

Multiplex Inc., a public company whose stock is traded on a national stock exchange, reported the following information on its consolidated financial statements for 20X5: