Answered step by step

Verified Expert Solution

Question

1 Approved Answer

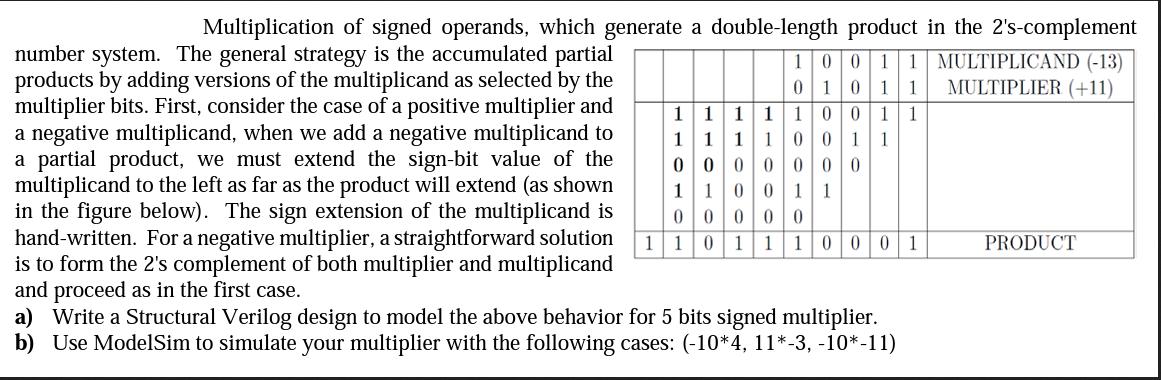

Multiplication of signed operands, which generate a double-length product in the 2's-complement 100 11 MULTIPLICAND (-13) 0 10 1 1 MULTIPLIER (+11) number system.

Multiplication of signed operands, which generate a double-length product in the 2's-complement 100 11 MULTIPLICAND (-13) 0 10 1 1 MULTIPLIER (+11) number system. The general strategy is the accumulated partial products by adding versions of the multiplicand as selected by the multiplier bits. First, consider the case of a positive multiplier and a negative multiplicand, when we add a negative multiplicand to a partial product, we must extend the sign-bit value of the multiplicand to the left as far as the product will extend (as shown in the figure below). The sign extension of the multiplicand is hand-written. For a negative multiplier, a straightforward solution is to form the 2's complement of both multiplier and multiplicand and proceed as in the first case. 1 1 1 1 1 0 0 1 1 1 111 001 0000000 1 1 0 0 11 0 1 1 1 0 111 0 0 0 a) Write a Structural Verilog design to model the above behavior for 5 bits signed multiplier. b) Use ModelSim to simulate your multiplier with the following cases: (-10*4, 11*-3, -10*-11) 1 PRODUCT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Here is a Verilog code for a structural multiplier that implements the behavior described verilog ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started