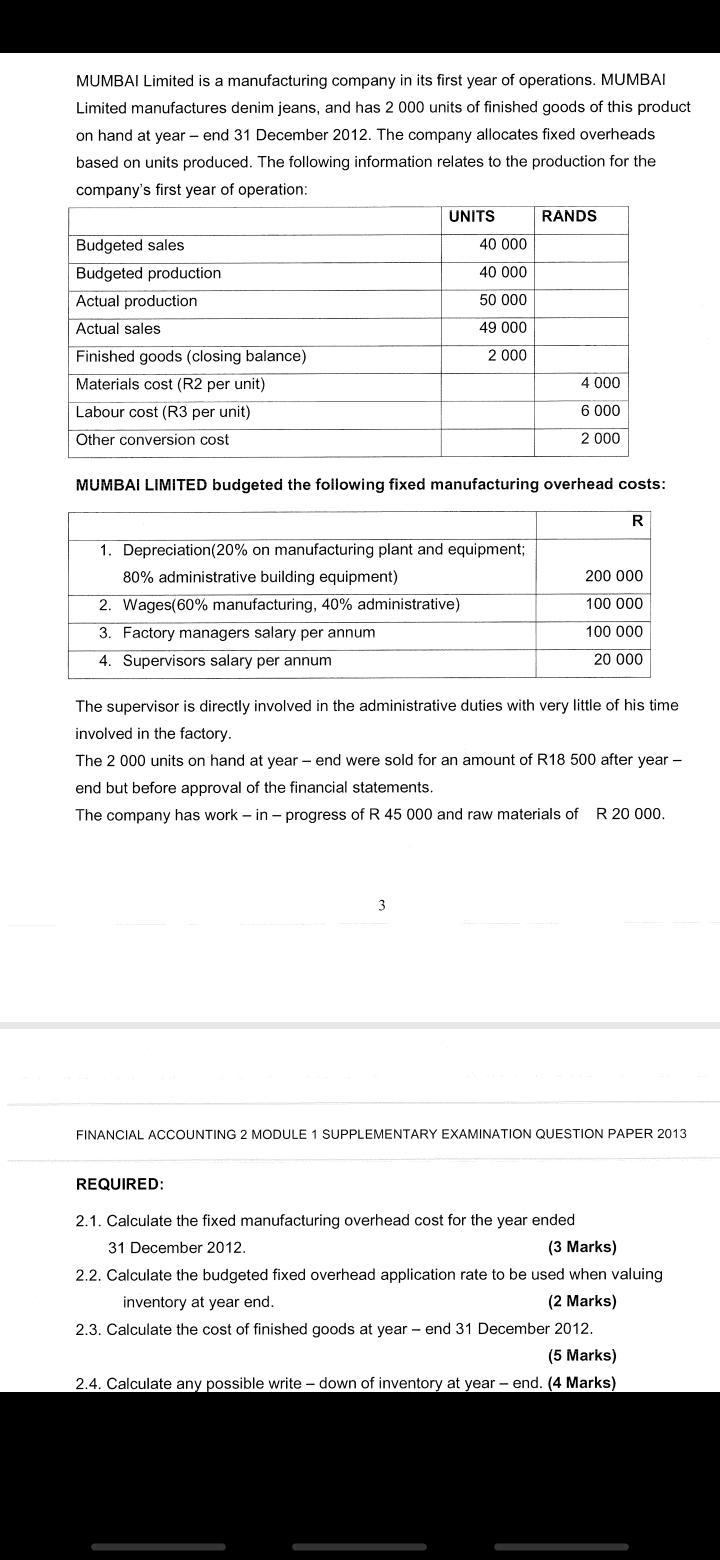

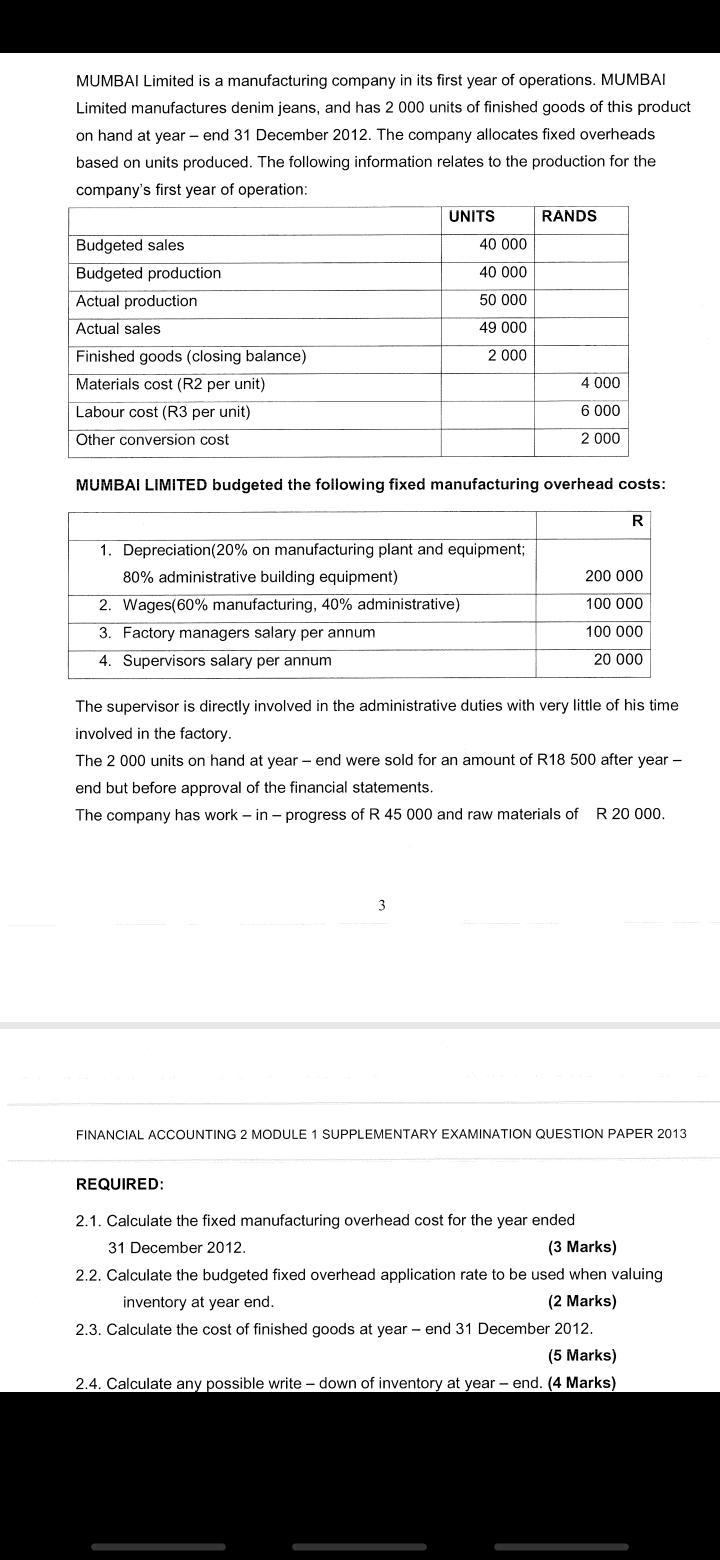

MUMBAI Limited is a manufacturing company in its first year of operations. MUMBAI Limited manufactures denim jeans, and has 2 000 units of finished goods of this product on hand at year-end 31 December 2012. The company allocates fixed overheads based on units produced. The following information relates to the production for the company's first year of operation: UNITS RANDS Budgeted sales 40 000 Budgeted production 40 000 Actual production 50 000 Actual sales 49 000 Finished goods (closing balance) 2 000 Materials cost (R2 per unit) 4 000 Labour cost (R3 per unit) 6 000 Other conversion cost 2 000 MUMBAI LIMITED budgeted the following fixed manufacturing overhead costs: R 200 000 1. Depreciation (20% on manufacturing plant and equipment; 80% administrative building equipment) 2. Wages(60% manufacturing, 40% administrative) 3. Factory managers salary per annum 4. Supervisors salary per annum 100 000 100 000 20 000 The supervisor is directly involved in the administrative duties with very little of his time involved in the factory. The 2 000 units on hand at year-end were sold for an amount of R18 500 after year - end but before approval of the financial statements. The company has work-in-progress of R 45 000 and raw materials of R20 000. FINANCIAL ACCOUNTING 2 MODULE 1 SUPPLEMENTARY EXAMINATION QUESTION PAPER 2013 REQUIRED: 2.1. Calculate the fixed manufacturing overhead cost for the year ended 31 December 2012. (3 Marks) 2.2. Calculate the budgeted fixed overhead application rate to be used when valuing inventory at year end. (2 Marks) 2.3. Calculate the cost of finished goods at year-end 31 December 2012. (5 Marks) 2.4. Calculate any possible write-down of inventory at year-end. (4 Marks) MUMBAI Limited is a manufacturing company in its first year of operations. MUMBAI Limited manufactures denim jeans, and has 2 000 units of finished goods of this product on hand at year-end 31 December 2012. The company allocates fixed overheads based on units produced. The following information relates to the production for the company's first year of operation: UNITS RANDS Budgeted sales 40 000 Budgeted production 40 000 Actual production 50 000 Actual sales 49 000 Finished goods (closing balance) 2 000 Materials cost (R2 per unit) 4 000 Labour cost (R3 per unit) 6 000 Other conversion cost 2 000 MUMBAI LIMITED budgeted the following fixed manufacturing overhead costs: R 200 000 1. Depreciation (20% on manufacturing plant and equipment; 80% administrative building equipment) 2. Wages(60% manufacturing, 40% administrative) 3. Factory managers salary per annum 4. Supervisors salary per annum 100 000 100 000 20 000 The supervisor is directly involved in the administrative duties with very little of his time involved in the factory. The 2 000 units on hand at year-end were sold for an amount of R18 500 after year - end but before approval of the financial statements. The company has work-in-progress of R 45 000 and raw materials of R20 000. FINANCIAL ACCOUNTING 2 MODULE 1 SUPPLEMENTARY EXAMINATION QUESTION PAPER 2013 REQUIRED: 2.1. Calculate the fixed manufacturing overhead cost for the year ended 31 December 2012. (3 Marks) 2.2. Calculate the budgeted fixed overhead application rate to be used when valuing inventory at year end. (2 Marks) 2.3. Calculate the cost of finished goods at year-end 31 December 2012. (5 Marks) 2.4. Calculate any possible write-down of inventory at year-end. (4 Marks)