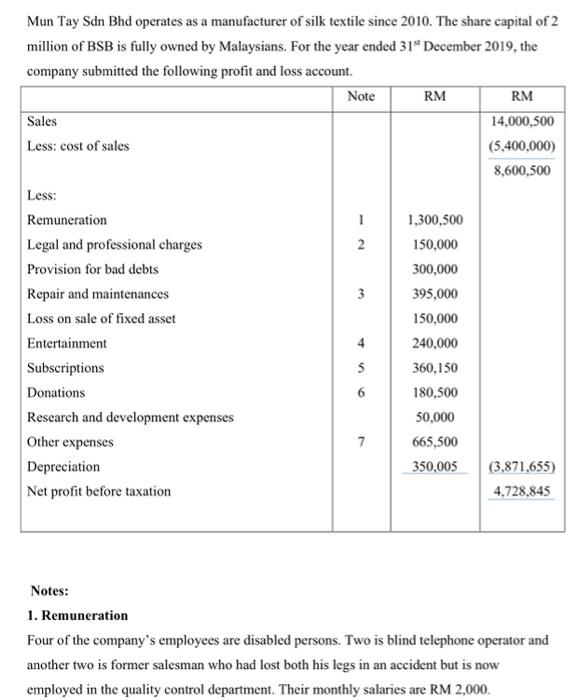

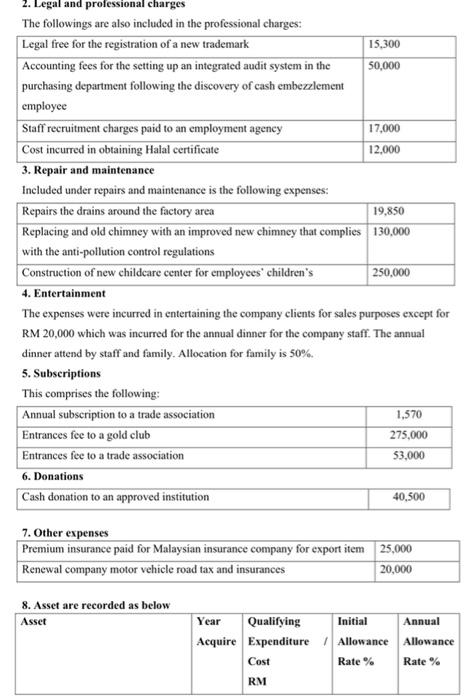

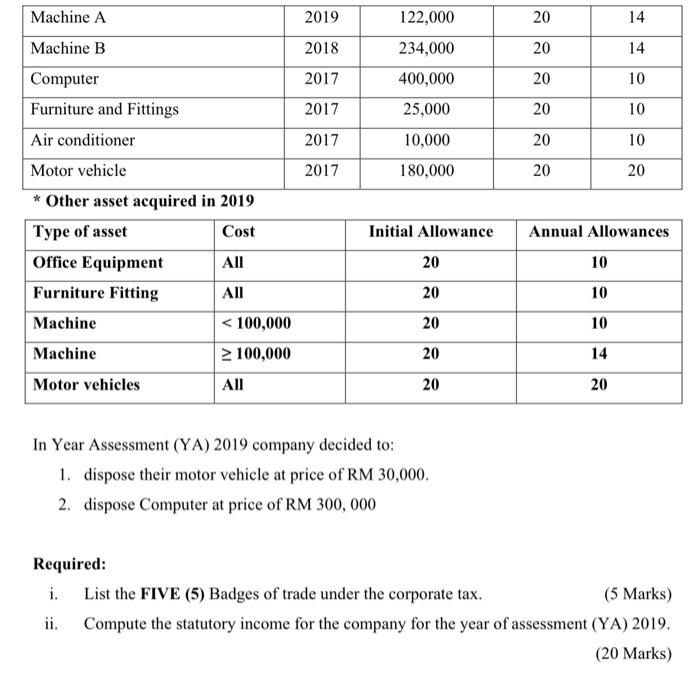

Mun Tay Sdn Bhd operates as a manufacturer of silk textile since 2010. The share capital of 2 million of BSB is fully owned by Malaysians. For the year ended 31* December 2019, the company submitted the following profit and loss account. Note RM RM Sales 14,000,500 Less: cost of sales (5,400,000) 8,600,500 Less: Remuneration 1 1,300,500 Legal and professional charges 2 150,000 Provision for bad debts 300,000 Repair and maintenances 3 395,000 Loss on sale of fixed asset 150,000 Entertainment 4 240,000 Subscriptions 5 360,150 Donations 6 180,500 Research and development expenses 50,000 Other expenses 7 665,500 Depreciation 350,005 (3,871,655) Net profit before taxation 4,728,845 Notes: 1. Remuneration Four of the company's employees are disabled persons. Two is blind telephone operator and another two is former salesman who had lost both his legs in an accident but is now employed in the quality control department. Their monthly salaries are RM 2,000 2. Legal and professional charges The followings are also included in the professional charges: Legal free for the registration of a new trademark 15,300 Accounting fees for the setting up an integrated audit system in the 50,000 purchasing department following the discovery of cash embezzlement cmployee Staff recruitment charges paid to an employment agency 17,000 Cost incurred in obtaining Halal certificate 12,000 3. Repair and maintenance Included under repairs and maintenance is the following expenses: Repairs the drains around the factory area 19,850 Replacing and old chimney with an improved new chimney that complies 130,000 with the anti-pollution control regulations Construction of new childcare center for employees' children's 250,000 4. Entertainment The expenses were incurred in entertaining the company clients for sales purposes except for RM 20,000 which was incurred for the annual dinner for the company staff. The annual dinner attend by staff and family. Allocation for family is 50% 5. Subscriptions This comprises the following: Annual subscription to a trade association 1,570 Entrance fee to a gold club 275,000 Entrances fee to a trade association 53,000 6. Donations Cash donation to an approved institution 40,500 7. Other expenses Premium insurance paid for Malaysian insurance company for export item 25,000 Renewal company motor vehicle road tax and insurances 20,000 8. Asset are recorded as below Asset Year Qualifying Initial Annual Acquire Expenditure Allowance Allowance Cost Rate % Rate % RM Machine A 2019 122,000 20 14 2018 20 14 2017 20 10 2017 234,000 400,000 25,000 10,000 180,000 20 10 2017 20 10 2017 20 20 Machine B Computer Furniture and Fittings Air conditioner Motor vehicle * Other asset acquired in 2019 Type of asset Cost Office Equipment All Furniture Fitting All Machine