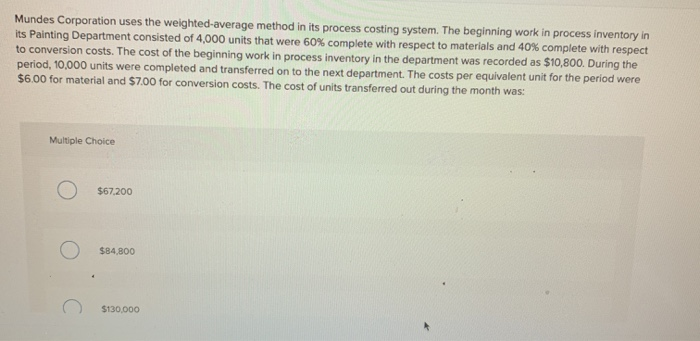

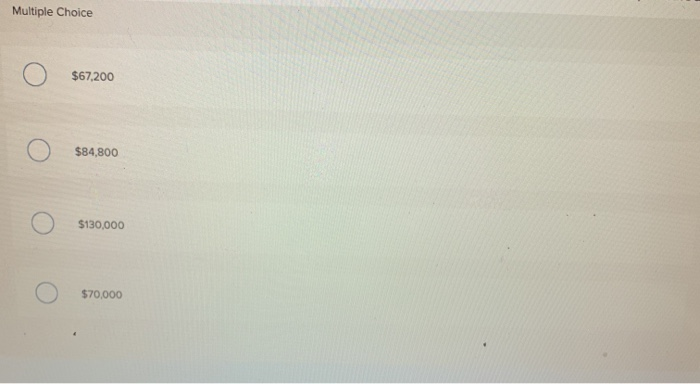

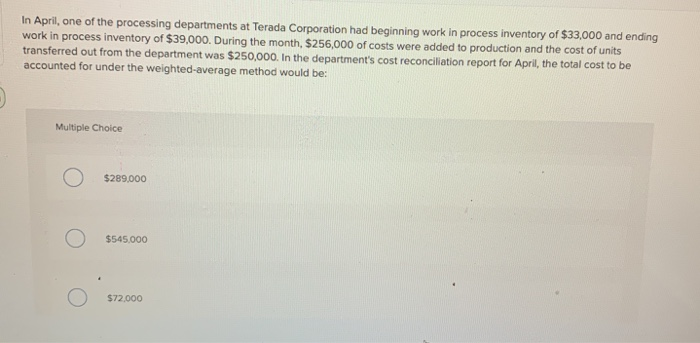

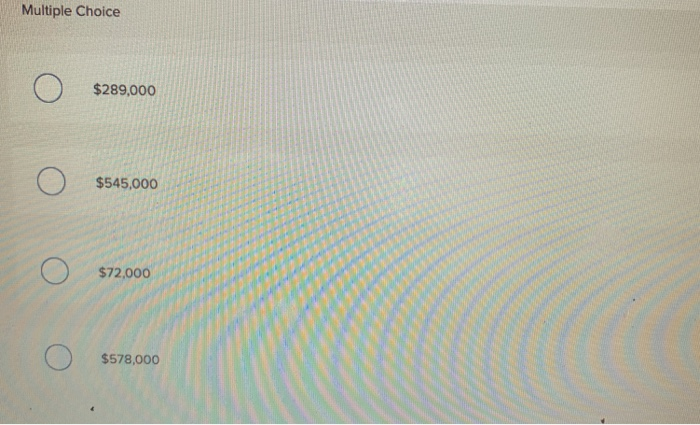

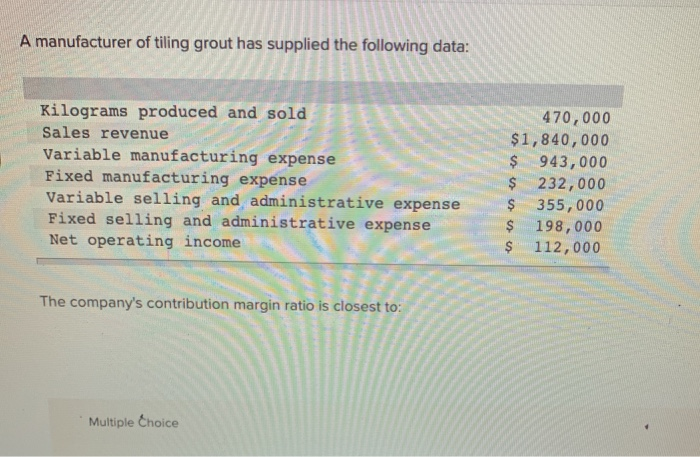

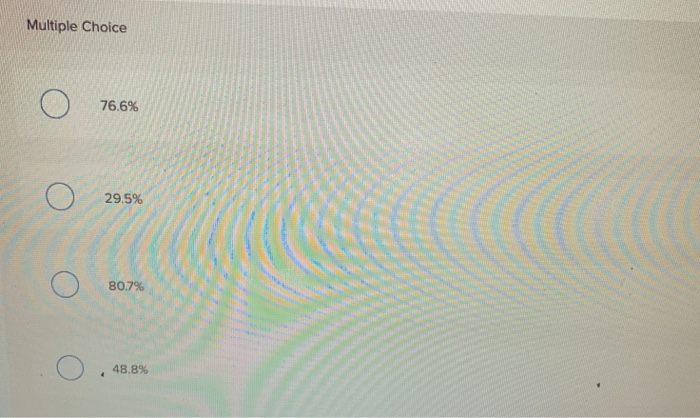

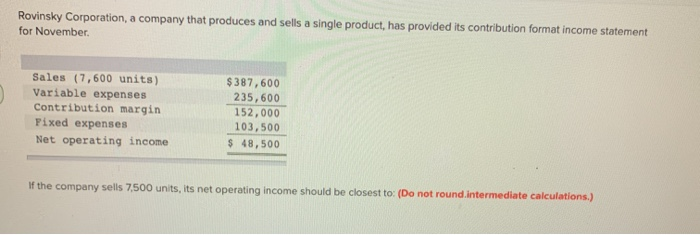

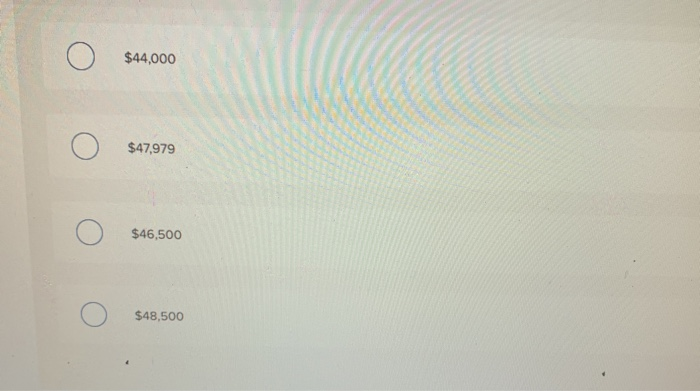

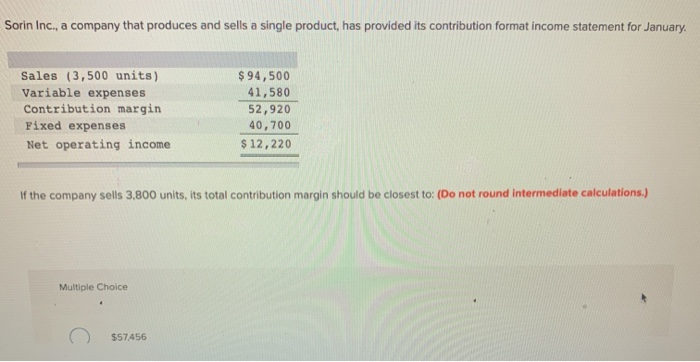

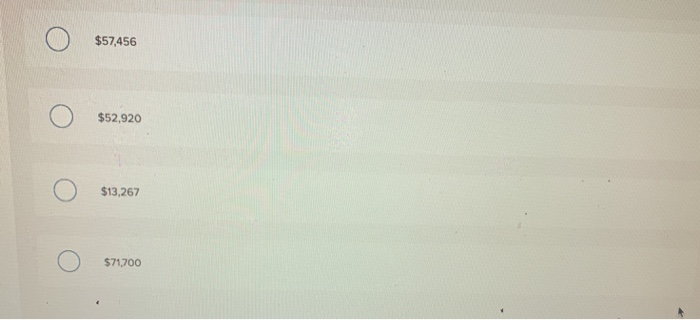

Mundes Corporation uses the weighted average method in its process costing system. The beginning work in process inventory in its Painting Department consisted of 4,000 units that were 60% complete with respect to materials and 40% complete with respect to conversion costs. The cost of the beginning work in process inventory in the department was recorded as $10,800. During the period, 10,000 units were completed and transferred on to the next department. The costs per equivalent unit for the period were $6.00 for material and $7.00 for conversion costs. The cost of units transferred out during the month was: Multiple Choice $67,200 $84,800 $130.000 Multiple Choice $67,200 $84,800 $130,000 $70,000 In April, one of the processing departments at Terada Corporation had beginning work in process inventory of $33,000 and ending work in process inventory of $39,000. During the month, $256,000 of costs were added to production and the cost of units transferred out from the department was $250,000. In the department's cost reconciliation report for April, the total cost to be accounted for under the weighted average method would be: Multiple Choice $289.000 $545.000 $72,000 Multiple Choice $289,000 $545,000 $72,000 $578,000 A manufacturer of tiling grout has supplied the following data: Kilograms produced and sold Sales revenue Variable manufacturing expense Fixed manufacturing expense Variable selling and administrative expense Fixed selling and administrative expense Net operating income 470,000 $1,840,000 $ 943,000 $ 232,000 $ 355,000 $ 198,000 $ 112,000 The company's contribution margin ratio is closest to: Multiple Choice Multiple Choice 76.6% 29.5% O 80.7% 48.8% Rovinsky Corporation, a company that produces and sells a single product, has provided its contribution format income statement for November Sales (7,600 units) Variable expenses Contribution margin Fixed expenses Net operating income $387,600 235,600 152,000 103,500 $ 48,500 If the company sells 7,500 units, its net operating income should be closest to: (Do not round.intermediate calculations.) $44,000 $47,979 $46,500 $48,500 Sorin Inc., a company that produces and sells a single product, has provided its contribution format income statement for January Sales (3,500 units) Variable expenses Contribution margin Fixed expenses Net operating income $ 94,500 41,580 52,920 40,700 $12,220 If the company sells 3,800 units, its total contribution margin should be closest to: (Do not round intermediate calculations.) Multiple Choice $57456 $57.456 $52,920 $13,267 H706