Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Music Mart, Inc. Robert Antony Balance sheet of Music Mart on January 4 t h is shown in Exhibit 1 . Transactions subsequently entered into

Music Mart, Inc.

Robert Antony

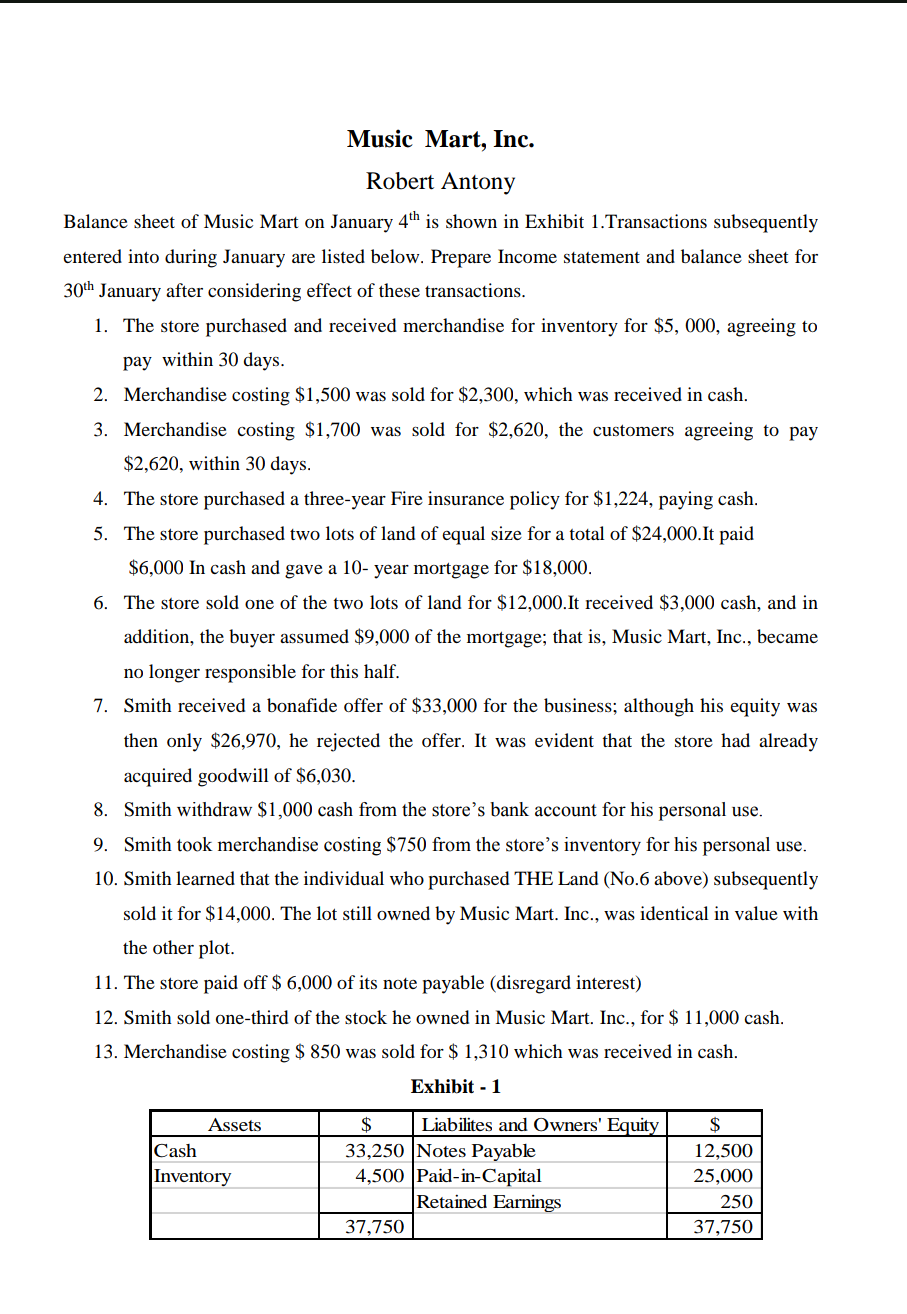

Balance sheet of Music Mart on January is shown in Exhibit Transactions subsequently entered into during January are listed below. Prepare Income statement and balance sheet for January after considering effect of these transactions.

The store purchased and received merchandise for inventory for $ agreeing to pay within days.

Merchandise costing $ was sold for $ which was received in cash.

Merchandise costing $ was sold for $ the customers agreeing to pay $ within days.

The store purchased a threeyear Fire insurance policy for $ paying cash.

The store purchased two lots of land of equal size for a total of $ It paid $ In cash and gave a year mortgage for $

The store sold one of the two lots of land for $It received $ cash, and in addition, the buyer assumed $ of the mortgage; that is Music Mart, Inc., became no longer responsible for this half.

Smith received a bonafide offer of $ for the business; although his equity was then only $ he rejected the offer. It was evident that the store had already acquired goodwill of $

Smith withdraw $ cash from the store's bank account for his personal use.

Smith took merchandise costing $ from the store's inventory for his personal use.

Smith learned that the individual who purchased THE Land No above subsequently sold it for $ The lot still owned by Music Mart. Inc., was identical in value with the other plot.

The store paid off $ of its note payable disregard interest

Smith sold onethird of the stock he owned in Music Mart. Inc., for $ cash.

Merchandise costing $ was sold for $ which was received in cash.

Exhibit

tableAssets$Liabilites and Owners' Equity,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started