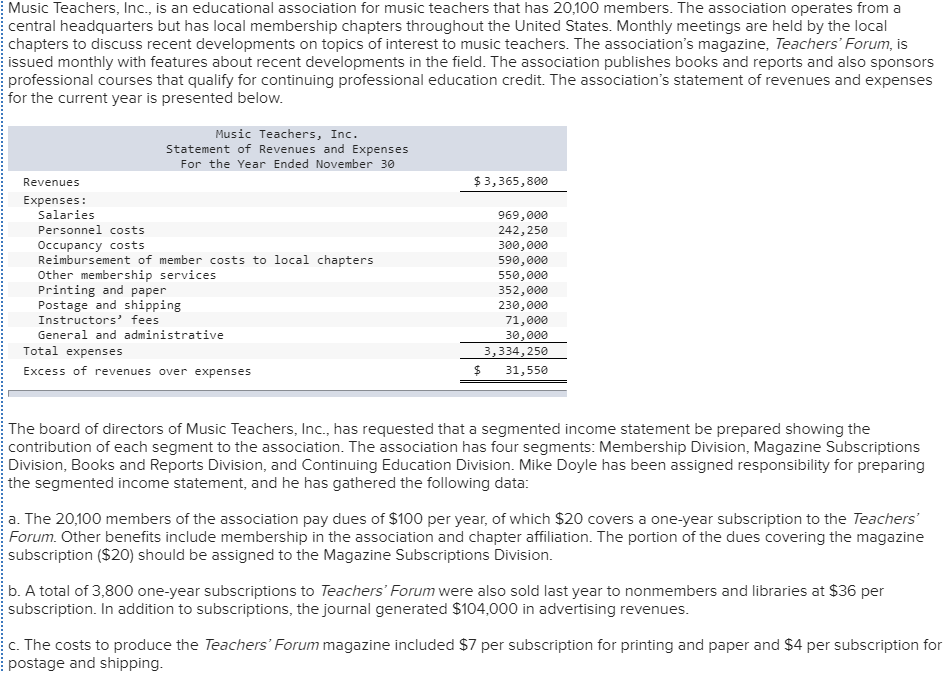

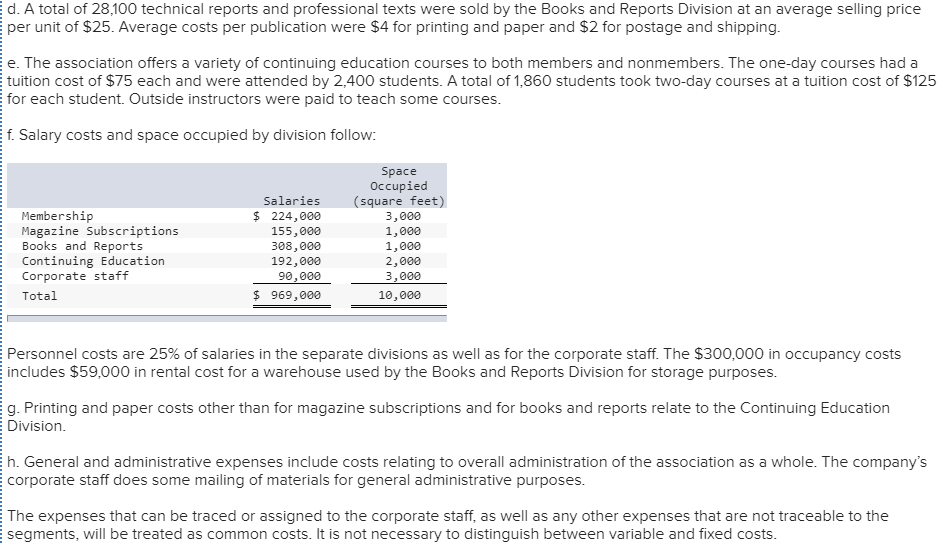

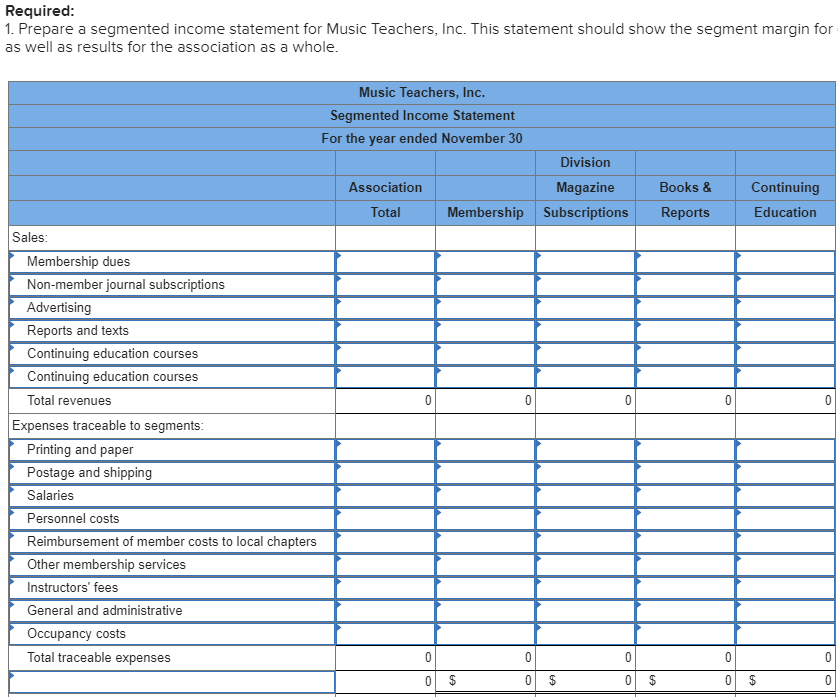

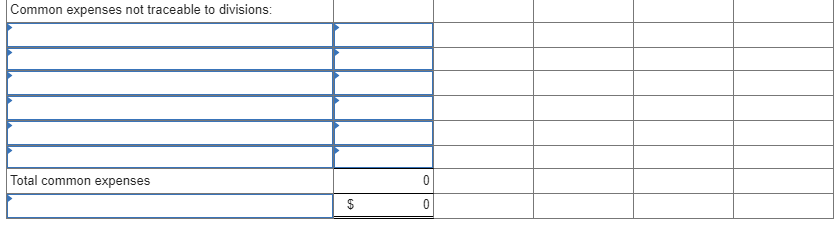

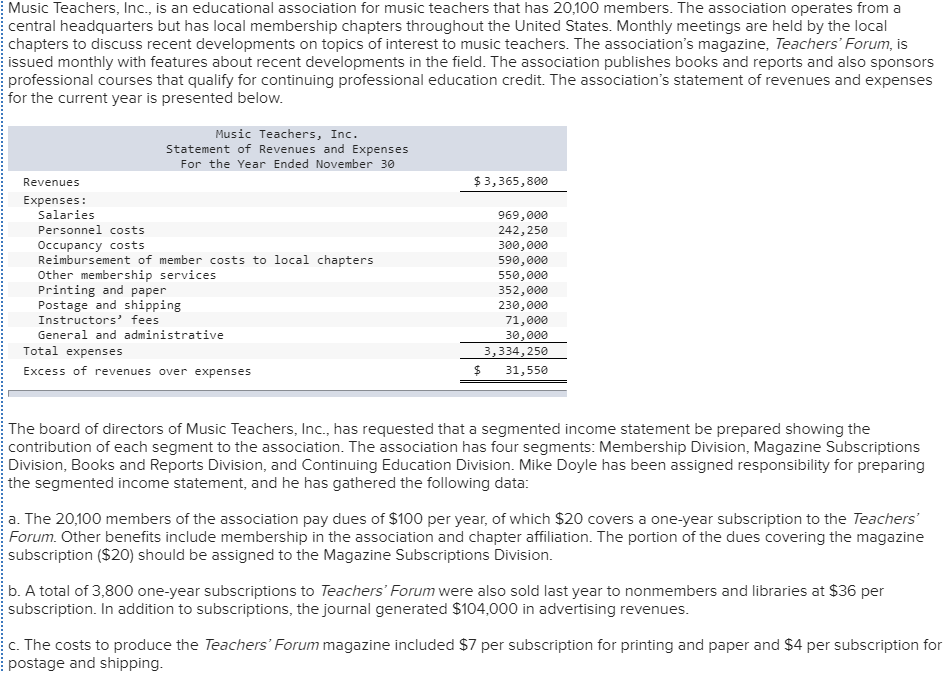

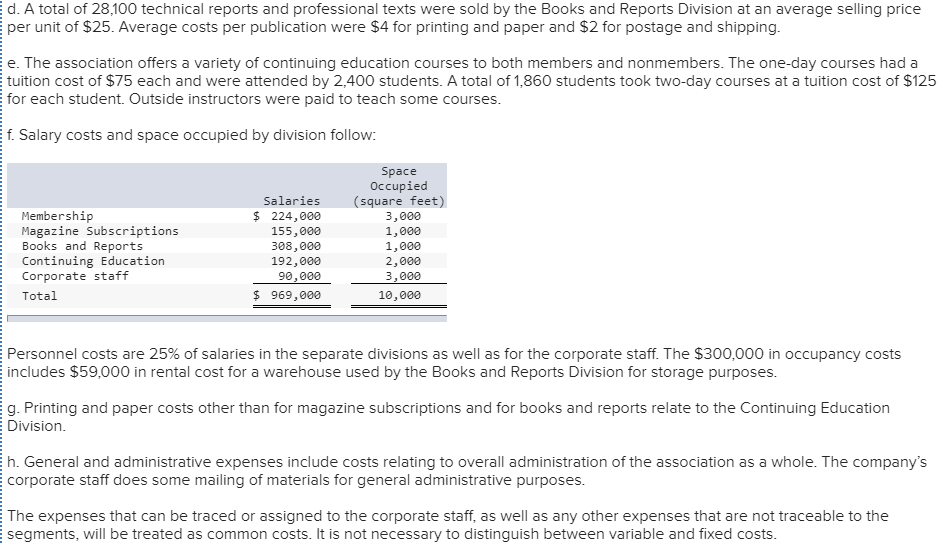

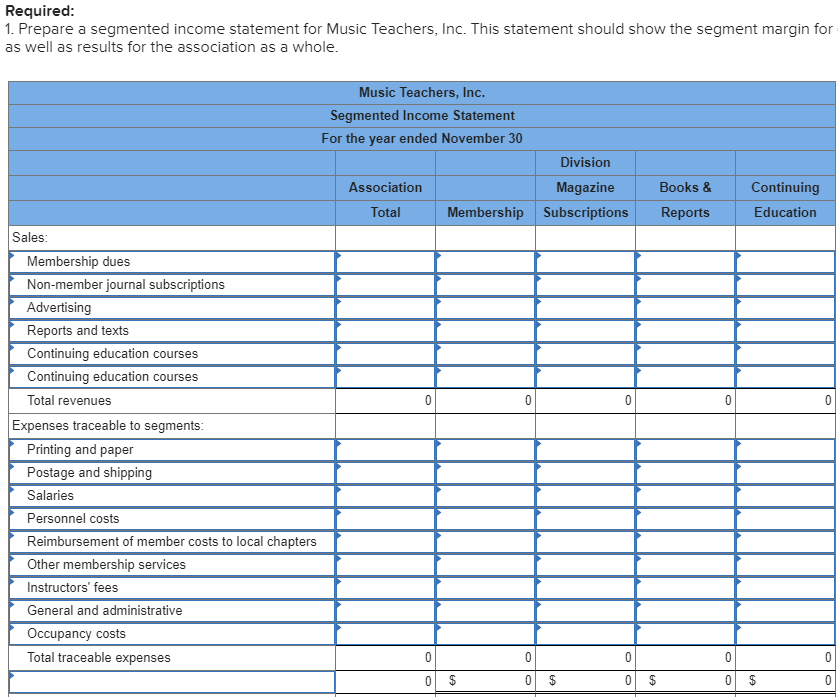

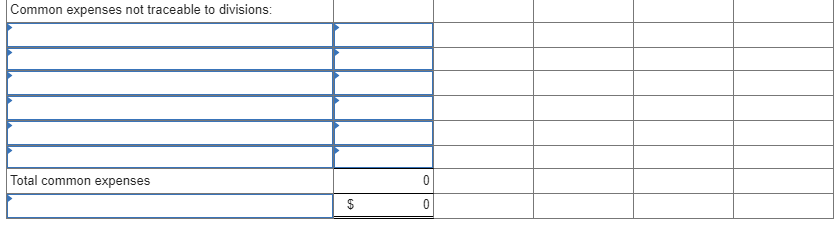

Music Teachers, Inc., is an educational association for music teachers that has 20,100 members. The association operates from a central headquarters but has local membership chapters throughout the United States. Monthly meetings are held by the local chapters to discuss recent developments on topics of interest to music teachers. The association's magazine, Teachers' Forum, is issued monthly with features about recent developments in the field. The association publishes books and reports and also sponsors professional courses that qualify for continuing professional education credit. The association's statement of revenues and expenses for the current year is presented below Music Teachers, Inc Statement of Revenues and Expenses For the Year Ended November 30 Revenues $3, 365,800 Expenses: Salaries Personnel costs Occupancy costs Reimbursement of member costs to local chapters Other membership services Printing and paper Postage and shipping Instructors' fees 969,000 242, 2560 300,000 590,000 550,000e 352,000 230,000 71,000 30,000 3, 334,250 $31, 550 neral and administrative Total expenses Excess of revenues over expenses The board of directors of Music Teachers, Inc., has requested that a segmented income statement be prepared showing the contribution of each segment to the association. The association has four segments: Membership Division, Magazine Subscriptions Division, Books and Reports Division, and Continuing Education Division. Mike Doyle has been assigned responsibility for preparing the segmented income statement, and he has gathered the following data a. The 20,100 members of the association pay dues of $100 per year, of which $20 covers a one-year subscription to the Teachers Forum. Other benefits include membership in the association and chapter affiliation. The portion of the dues covering the magazine subscription ($20) should be assigned to the Magazine Subscriptions Division. b. A total of 3,800 one-year subscriptions to Teachers' Forum were also sold last year to nonmembers and libraries at $36 per subscription. In addition to subscriptions, the journal generated $104,000 in advertising revenues c. The costs to produce the Teachers' Forum magazine included $7 per subscription for printing and paper and $4 per subscription for postage and shipping