must show all work done please

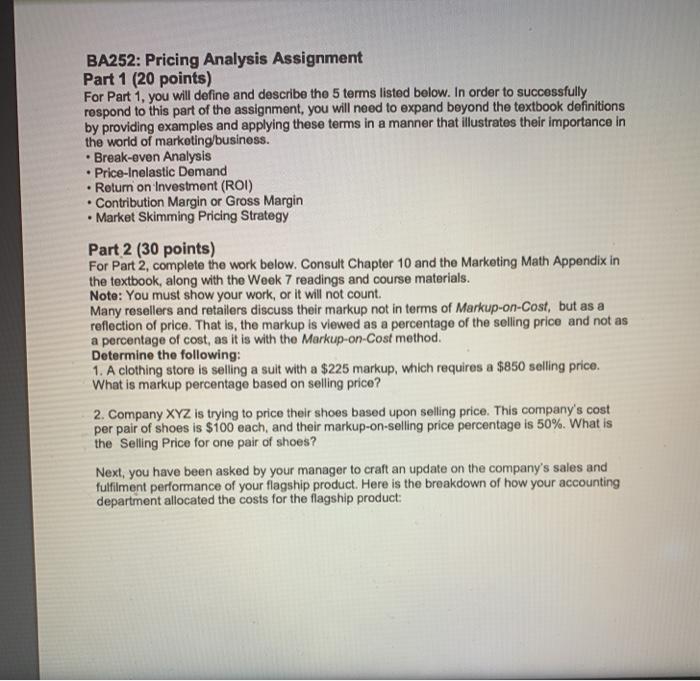

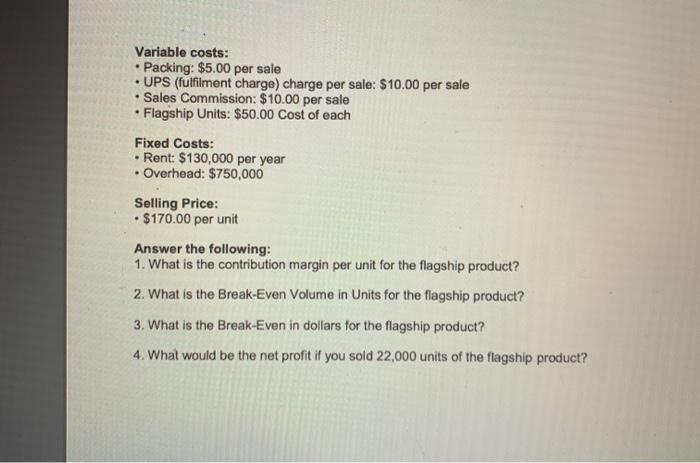

BA252: Pricing Analysis Assignment Part 1 (20 points) For Part 1, you will define and describe the 5 terms listed below. In order to successfully respond to this part of the assignment, you will need to expand beyond the textbook definitions by providing examples and applying these terms in a manner that illustrates their importance in the world of marketing/business. Break-even Analysis Price-Inelastic Demand Return on Investment (ROI) Contribution Margin or Gross Margin Market Skimming Pricing Strategy Part 2 (30 points) For Part 2, complete the work below. Consult Chapter 10 and the Marketing Math Appendix in the textbook, along with the Week 7 readings and course materials. Note: You must show your work, or it will not count. Many resellers and retailers discuss their markup not in terms of Markup-on-Cost, but as a reflection of price. That is, the markup is viewed as a percentage of the selling price and not as a percentage of cost, as it is with the Markup-on-Cost method. Determine the following: 1. A clothing store is selling a suit with a $225 markup, which requires a $850 selling price. What is markup percentage based on selling price? 2. Company XYZ is trying to price their shoes based upon selling price. This company's cost per pair of shoes is $100 each, and their markup-on-selling price percentage is 50%. What is the Selling Price for one pair of shoes? Next, you have been asked by your manager to craft an update on the company's sales and fulfilment performance of your flagship product. Here is the breakdown of how your accounting department allocated the costs for the flagship product: . Variable costs: Packing: $5.00 per sale UPS (fulfilment charge) charge per sale: $10.00 per sale Sales Commission: $10.00 per sale Flagship Units: $50.00 Cost of each Fixed Costs: Rent: $130,000 per year Overhead: $750,000 . . Selling Price: $170.00 per unit Answer the following: 1. What is the contribution margin per unit for the flagship product? 2. What is the Break-Even Volume in Units for the flagship product? 3. What is the Break-Even in dollars for the flagship product? 4. What would be the net profit if you sold 22,000 units of the flagship product? BA252: Pricing Analysis Assignment Part 1 (20 points) For Part 1, you will define and describe the 5 terms listed below. In order to successfully respond to this part of the assignment, you will need to expand beyond the textbook definitions by providing examples and applying these terms in a manner that illustrates their importance in the world of marketing/business. Break-even Analysis Price-Inelastic Demand Return on Investment (ROI) Contribution Margin or Gross Margin Market Skimming Pricing Strategy Part 2 (30 points) For Part 2, complete the work below. Consult Chapter 10 and the Marketing Math Appendix in the textbook, along with the Week 7 readings and course materials. Note: You must show your work, or it will not count. Many resellers and retailers discuss their markup not in terms of Markup-on-Cost, but as a reflection of price. That is, the markup is viewed as a percentage of the selling price and not as a percentage of cost, as it is with the Markup-on-Cost method. Determine the following: 1. A clothing store is selling a suit with a $225 markup, which requires a $850 selling price. What is markup percentage based on selling price? 2. Company XYZ is trying to price their shoes based upon selling price. This company's cost per pair of shoes is $100 each, and their markup-on-selling price percentage is 50%. What is the Selling Price for one pair of shoes? Next, you have been asked by your manager to craft an update on the company's sales and fulfilment performance of your flagship product. Here is the breakdown of how your accounting department allocated the costs for the flagship product: . Variable costs: Packing: $5.00 per sale UPS (fulfilment charge) charge per sale: $10.00 per sale Sales Commission: $10.00 per sale Flagship Units: $50.00 Cost of each Fixed Costs: Rent: $130,000 per year Overhead: $750,000 . . Selling Price: $170.00 per unit Answer the following: 1. What is the contribution margin per unit for the flagship product? 2. What is the Break-Even Volume in Units for the flagship product? 3. What is the Break-Even in dollars for the flagship product? 4. What would be the net profit if you sold 22,000 units of the flagship product