Answered step by step

Verified Expert Solution

Question

1 Approved Answer

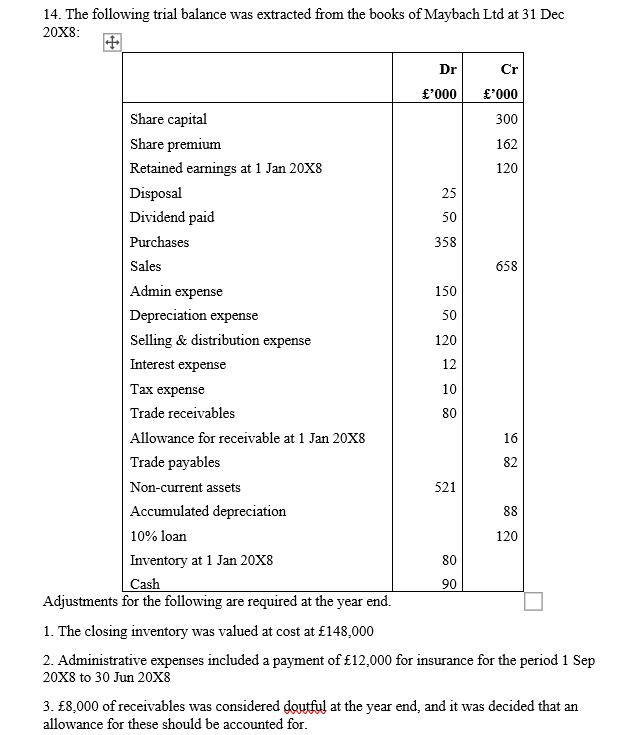

14. The following trial balance was extracted from the books of Maybach Ltd at 31 Dec 20X8: Share capital Share premium Retained earnings at

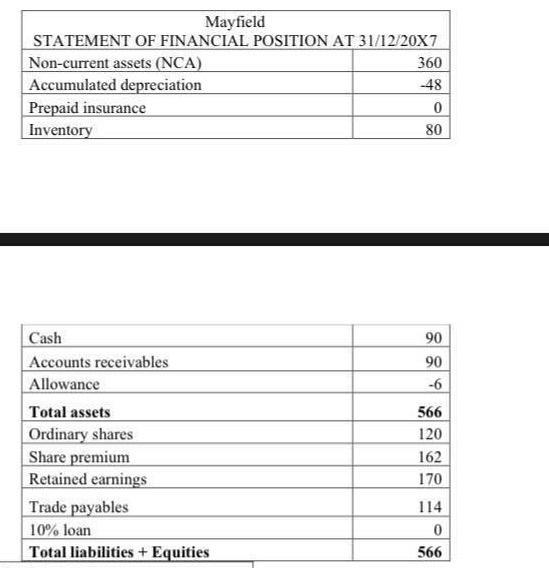

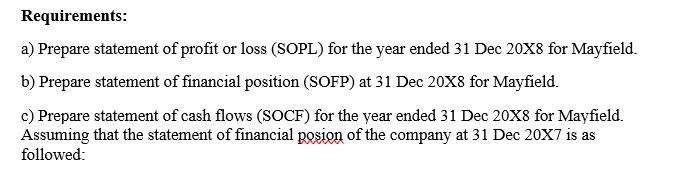

14. The following trial balance was extracted from the books of Maybach Ltd at 31 Dec 20X8: Share capital Share premium Retained earnings at 1 Jan 20X8 Disposal Dividend paid Purchases Sales Admin expense Depreciation expense Selling & distribution expense Interest expense Tax expense Trade receivables Allowance for receivable at 1 Jan 20X8 Trade payables Non-current assets Accumulated depreciation 10% loan Dr '000 25 50 358 150 50 120 12 10 80 521 Cr '000 300 162 120 80 90 658 16 82 88 120 Inventory at 1 Jan 20X8 Cash Adjustments for the following are required at the year end. 1. The closing inventory was valued at cost at 148,000 2. Administrative expenses included a payment of 12,000 for insurance for the period 1 Sep 20X8 to 30 Jun 20X8 3. 8,000 of receivables was considered doutful at the year end, and it was decided that an allowance for these should be accounted for. Mayfield STATEMENT OF FINANCIAL POSITION AT 31/12/20X7 Non-current assets (NCA) Accumulated depreciation Prepaid insurance Inventory Cash Accounts receivables Allowance Total assets Ordinary shares Share premium Retained earnings Trade payables 10% loan Total liabilities + Equities 360 -48 0 80 90 90 -6 566 120 162 170 114 0 566 Requirements: a) Prepare statement of profit or loss (SOPL) for the year ended 31 Dec 20X8 for Mayfield. b) Prepare statement of financial position (SOFP) at 31 Dec 20X8 for Mayfield. c) Prepare statement of cash flows (SOCF) for the year ended 31 Dec 20X8 for Mayfield. Assuming that the statement of financial posion of the company at 31 Dec 20X7 is as followed:

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a MAYFIELD STATEMENT OF PROFIT LOSS FOR PERIOD ENDED 31ST DECEMBER 20X8 000 000 Sales 65800 Cost of sales Opening stock 8000 Add Purchases 35800 cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started