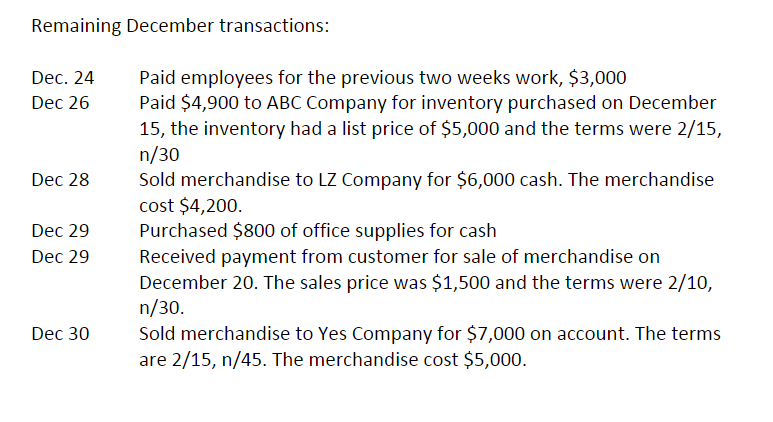

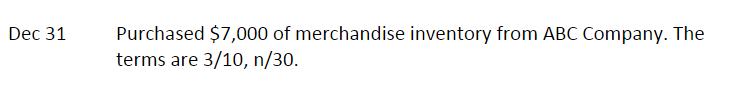

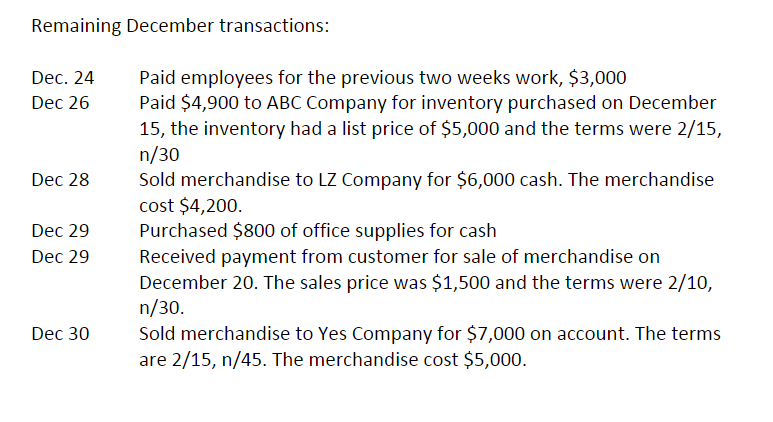

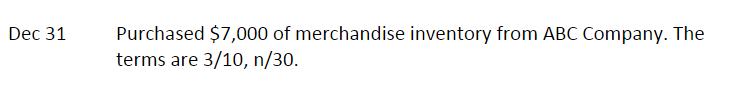

MWP Company is a sporting goods retailer with a December 31 year end. In the files section on Canvas there are files for the project ledger, project journal, the trial balance at December 23 along with templates for other trial balances and financial statements. Below you will be given the transactions for the last week of 2022 and the information for any required adjusting entries for 2022 . You are to do the following: - Journalize and post the remaining 2022 transactions Remaining December transactions: Dec. 24 Paid employees for the previous two weeks work, $3,000 Dec 26 Paid $4,900 to ABC Company for inventory purchased on December 15 , the inventory had a list price of $5,000 and the terms were 2/15, n/30 Dec 28 Sold merchandise to LZ Company for $6,000 cash. The merchandise cost $4,200. Dec 29 Purchased $800 of office supplies for cash Dec 29 Received payment from customer for sale of merchandise on December 20 . The sales price was $1,500 and the terms were 2/10, n/30 Dec 30 Sold merchandise to Yes Company for $7,000 on account. The terms are 2/15,n/45. The merchandise cost $5,000. c 31 Purchased $7,000 of merchandise inventory from ABC Company. The terms are 3/10,n/30. MWP Company is a sporting goods retailer with a December 31 year end. In the files section on Canvas there are files for the project ledger, project journal, the trial balance at December 23 along with templates for other trial balances and financial statements. Below you will be given the transactions for the last week of 2022 and the information for any required adjusting entries for 2022 . You are to do the following: - Journalize and post the remaining 2022 transactions Remaining December transactions: Dec. 24 Paid employees for the previous two weeks work, $3,000 Dec 26 Paid $4,900 to ABC Company for inventory purchased on December 15 , the inventory had a list price of $5,000 and the terms were 2/15, n/30 Dec 28 Sold merchandise to LZ Company for $6,000 cash. The merchandise cost $4,200. Dec 29 Purchased $800 of office supplies for cash Dec 29 Received payment from customer for sale of merchandise on December 20 . The sales price was $1,500 and the terms were 2/10, n/30 Dec 30 Sold merchandise to Yes Company for $7,000 on account. The terms are 2/15,n/45. The merchandise cost $5,000. c 31 Purchased $7,000 of merchandise inventory from ABC Company. The terms are 3/10,n/30