Answered step by step

Verified Expert Solution

Question

1 Approved Answer

my answer is wrong pleasw find the right answer for part a and part b You have been paying off a mortgage in quarterly payments

my answer is wrong pleasw find the right answer for part a and part b

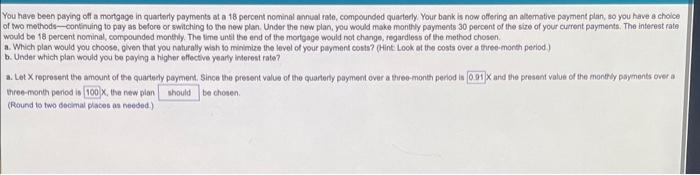

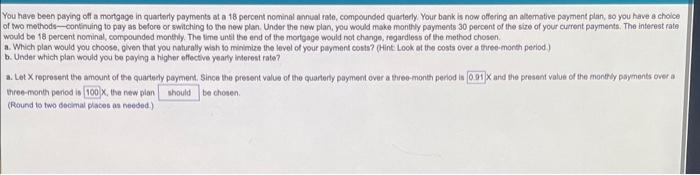

You have been paying off a mortgage in quarterly payments at a 18 percent nominal annual rale, compounded quarterly. Your bank is now offering an altemative payment plan, so you have a chaice of two methods - continuing to pay as before or switching to the new plan. Under the new plan, you would make monthly payments 30 percent of the size of your current payments, The interest rate would be 18 percent nominal, compounded monthly. The lime unti the end of the mortgage would not change, regardless of the mothod chosen. a. Which plan would you choose, olven that you naturally wish so minimize the level of your payment costs? (Hint Look at the costs over a three-month petiod) b. Under which plan would you be paying a higher effective yearfy interest rate? a. Let X represent the amount of the quartedy payment, Since the present value of the cuarterfy payment over a three-month period is Cand the present value of the montrily payments over a three-month period is , the new plan (Round to two decinal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started